Sportsbet, Bet365 hit with money laundering audit

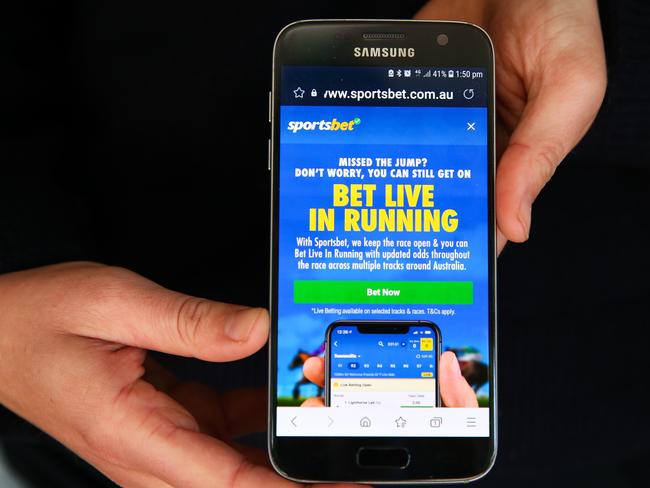

The popular betting apps have been ordered to appoint auditors after the nation’s financial crime watchdog revealed they’re being “extensively” monitored.

National

Don't miss out on the headlines from National. Followed categories will be added to My News.

Gambling agencies Sportsbet and Bet365 have been ordered to appoint auditors amid concerns they are allowing organised crime syndicates to launder money.

AUSTRAC – the nation’s financial crime watchdog – has revealed that it has been “extensively” monitoring the popular betting apps.

It comes after Austrac launched an investigation into Ladbrokes and Neds in September to ensure they were meeting anti-money laundering standards.

Australia’s online gambling market is worth $7 billion per year.

Organised crime syndicates have been looking for new avenues to launder money following crackdowns on Crown and Star casinos across the country.

“AUSTRAC has ordered the appointment of external auditors under section 162 of the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 (AML/CTF Act) to assess compliance of two corporate bookmakers, Sportsbet Pty Ltd (Sportsbet) and Hillside (Australia New Media) Pty Limited (Bet365),” the agency said on Thursday.

“The appointed external auditor will be authorised by AUSTRAC to assess Sportsbet’s and Bet365’s compliance with the AML/CTF Act and Anti-Money Laundering and Counter-Terrorism Financing Rules Instrument 2007 (No. 1) (AML/CTF Rules).”

Sportsbet and Bet365 have 180 days to check and report on whether they were tackling money laundering and terror financing risks.

They were also ordered to scour their books for suspected dodgy punters who may have criminal links.

Sports betting companies have sophisticated software that can monitor punters.

They have the power to block successful punters who win too much on their platforms, sometimes closing accounts.

AUSTRAC Chief Executive Officer Nicole Rose said the whole gaming industry was being put on notice.

“Sportsbet and Bet365 are among the largest operators in the corporate bookmaking sector. AUSTRAC is putting the whole industry on notice to lift their game,” she said.

“Ultimately, enforcing noncompliance is about protecting the community. Money laundering feeds organised crime and all the harm that comes with it. We need businesses at the front line to fully comply with the (anti-money laundering/counter terror financing) Act – to understand and mitigate their risks and report suspected crimes”.

Ladbrokes’ parent company Entain was fined $30 million for “anti-money laundering failures” at its UK businesses in August.

The breaches included allowing one punter to deposit $1.3 million over 14 months without appropriate checks.

Another punter, who lived in social housing, was allowed to deposit $334,000 with red flags being issued, the UK’s Gambling Commission reported.

Bet365 said in a statement it was “strongly committed to maintaining high levels of compliance with Australian law.

“Bet365 has robust policies and procedures in place to minimise risks associated with money-laundering and counter-terrorism financing,” the company said.

“The company is working co-operatively with AUSTRAC.”

stephen.drill@news.com.au

More Coverage

Originally published as Sportsbet, Bet365 hit with money laundering audit