Interest rates: what the RBA’s rise means for December and beyond

Borrowers and retailers have been bashed by the latest interest rate rise, and fear more, although history delivers a ray of hope.

National

Don't miss out on the headlines from National. Followed categories will be added to My News.

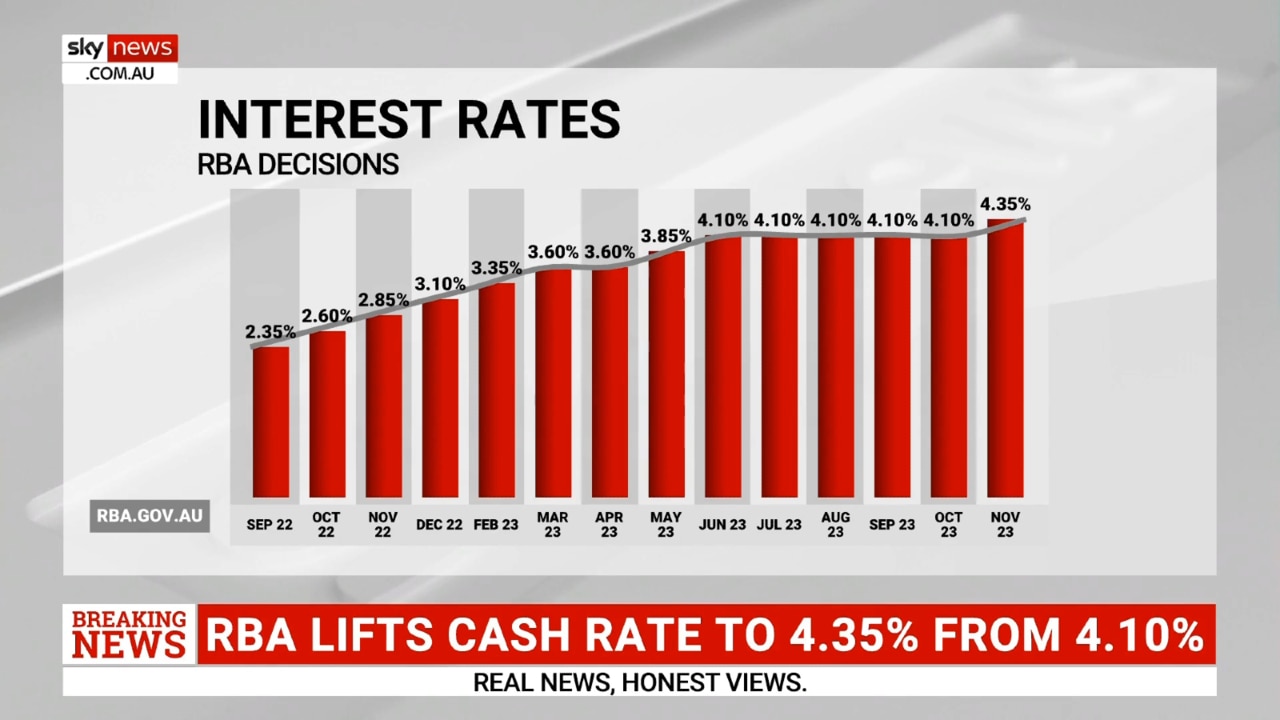

Rate rise number 13 by the Reserve Bank of Australia could be its most painful one yet.

It’s not because of its size, even though the 0.25 of a percentage point rise adds $76 a month to repayments on a typical $500,000 mortgage.

And not because it was unnecessary: recent economic data on inflation, retail sales, population growth and employment hinted at an increasing likelihood of a rise, while financial markets had priced in a 70 per cent chance of the increase.

It’s because of the timing. The RBA has become a Christmas Scrooge by hitting home loan borrowers and businesses with another hammer blow right before the biggest shopping and spending period of the year, and ending four months of relative calm and hopes that the rate-rise cycle was over.

We can’t blame new RBA governor Michele Bullock for lifting again. She has been talking tough about getting inflation back within a 2-3 target range in a timely fashion, and her statement on Tuesday said fresh information received since August “suggests that the risk of inflation remaining higher for longer has increased”.

The latest rise – and potentially another next month – puts a big brake on Christmas spending plans, including the Black Friday sales later this month, and raises the risk of a recession.

The big question is did the RBA’S official cash rate rise, from 4.1 per cent to 4.35 per cent, just kill Christmas?

For some people, probably yes. And also probably yes for many retailers already battling a sales slump because millions of Australians are suffering from previous rate rises and the broader cost-of-living surge across energy, fuel, groceries, insurance and other key household bills.

However, many Australians have weathered the rate rise storm of the past 18 months, and the breakdown of home ownership in this country helps explain it.

Households are roughly divided into one third renters, one-third owner-occupiers who no longer have a mortgage, and one-third owner-occupiers who are paying off a home loan.

Of that one-third who have a home loan, it’s likely that at least half are longer-term borrowers who perhaps have built up plenty of equity in their property and have a mortgages a lot smaller than the $500,000-plus most newer borrowers face today.

This housing breakdown suggests that only 15 per cent of Australians – or fewer – are really struggling from RBA rate rises, while the rest of the population is free to keep spending and potentially push up inflation and interest rates further.

Borrowers with big mortgages – usually young families and first homebuyers – are understandably stressed about what comes next. Another rate rise in December? Or more when the RBA board returns from its Christmas break in early February?

Financial markets had priced in one or two more RBA rate rises for Australia by early 2024, putting us at odds with the US, Britain, Canada and Europe where official interest rates appear to have peaked.

More rises will depend on the economic data we see in the coming weeks and months. The next monthly Consumer Price Index release from the Bureau of Statistics comes on November 29, less than a week before the RBA’s next board meeting on December 5. If inflation is not falling fast enough, expect the RBA to pull the trigger again.

A small ray of light for borrowers lies in the history of the RBA’s previous rate-rise cycle, which ended in 2010. Back then there was a five-month pause before a single final rate rise – also in November – and then that was it for more than a decade. Fingers are crossed that history repeats.

More Coverage

Originally published as Interest rates: what the RBA’s rise means for December and beyond