Tax cuts promised by both major parties are a con, family groups say

Both major parties are offering families tax cuts worth $2160 before polling day, but family groups say they are nothing more than a con job.

Federal Election

Don't miss out on the headlines from Federal Election. Followed categories will be added to My News.

Exclusive: Almost half a million families have been stripped of their family tax benefit, reducing their incomes by around $2,000 a year.

A News Corp Australia investigation into cutbacks to family benefits made by both sides of politics has found only one in three families with children now receive the benefits, down from over 50 per cent in 2011.

For a family with two children the financial losses from the cutbacks are about the same size as the $2160 tax cut now being offered by Labor and the Coalition as an election sweetener.

And family groups say it means the tax cuts are nothing more than a con job.

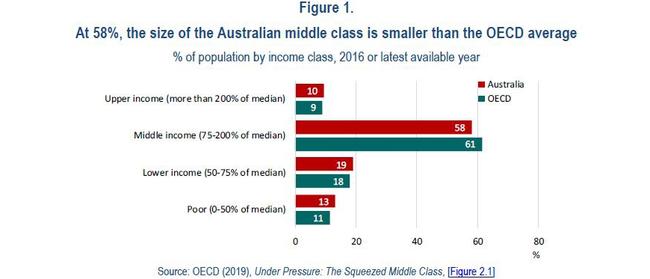

It comes as a recent OECD report found Australia’s middle class is shrinking as stagnant wages, cuts to family tax benefits, rising housing, electricity, education and health and childcare costs put the squeeze on working families.

Monash University’s Population Research Institute has found nearly six million Australians live in households that experienced an income decline between 2011 and 2016.

MORE FAMILY ELECTION STORIES:

Working mums taxed 120 per cent

Aussie preschools risk falling behind the world

Push for big fines and ad bans over junk food

News Corp has found the cost of the essential components of a middle class lifestyle have risen well above inflation or wage rises in recent years:

* Private school fees have jumped by up to three times the inflation rate with two thirds of the nation’s private schools charging over $5000 a year in fees and some over $40,000 a year;

* Health fund premiums have soared by over 52 per cent since 2010 and now cost $4000 for families while government subsidies have been cut back and Medicare rebates have been frozen;

* The cost of owning a home has increased from 3.3 times the average income in 1981 to 6.8 times the average income and the proportion of Australians who own their own home has declined from 71.4 per cent to 65 per cent.

* Childcare fees have risen by 80 per cent in the last a decade with some up 10 per cent this year. They are now a crushing $93 to $200 a day. On average it costs over $20,000 a year to have a child in full time care;

* Electricity prices have soared over 117 per cent since 2008, four times the inflation rate;

* Wages are growing at just 2.3 per cent a year barely compensating for inflation of 1.9 per cent.

These cost of living increases have been borne by families at the same time as their family tax benefits have been slashed.

In 2010, there were 1.8 million families receiving the payment but in December last year that had shrunk to 1.39 million families.

More than 420,000 families — nearly one in four — who qualified for the Family Tax Benefit Part A and Family Tax Benefit Part B were booted off the benefits after the Gillard Government and Abbott Governments slashed the amount of money they could earn and still qualify for the payments.

More recently the Coalition stopped families earning over $80,000 from getting the $737.30 per child end of year supplement.

The Parenthood’s Executive Director, Alys Gagnon said politicians promising tax cuts were selling families a “pup”.

“The government is giving with one hand but taking away with the other hand,” she said.

“This feels very dishonest to be telling families you are getting a tax cut but at the end of the day your cost of living is going up and the cuts to family tax benefit are greater than your tax cuts,” she said.

She added that families would not appreciate a tax cut if it meant essential services like Medicare and childcare subsidies were cut to pay for it.

The Australian Council of Social Services says ultimately people on middle and low incomes end up paying the price for tax cuts in the form of funding cuts to essential services.

“This is not the time for a tax cut ‘auction’. In the recent past, we have seen how eight successive income tax cuts created pressure for harsh cutbacks in essential services and social security payments in the 2014 budget,” ACOSS CEO Cassandra Goldie said.

“People often ask why they are paying more for the doctor, aged care, child care and other essential services. One of the main reasons is that we don’t have the revenue base we need to meet the costs of services in an ageing population. We are the 8th lowest taxed country in the OECD, ” she said.

Originally published as Tax cuts promised by both major parties are a con, family groups say