Labor makes $10bn promise to unlock 100,000 new homes strictly for first home buyers

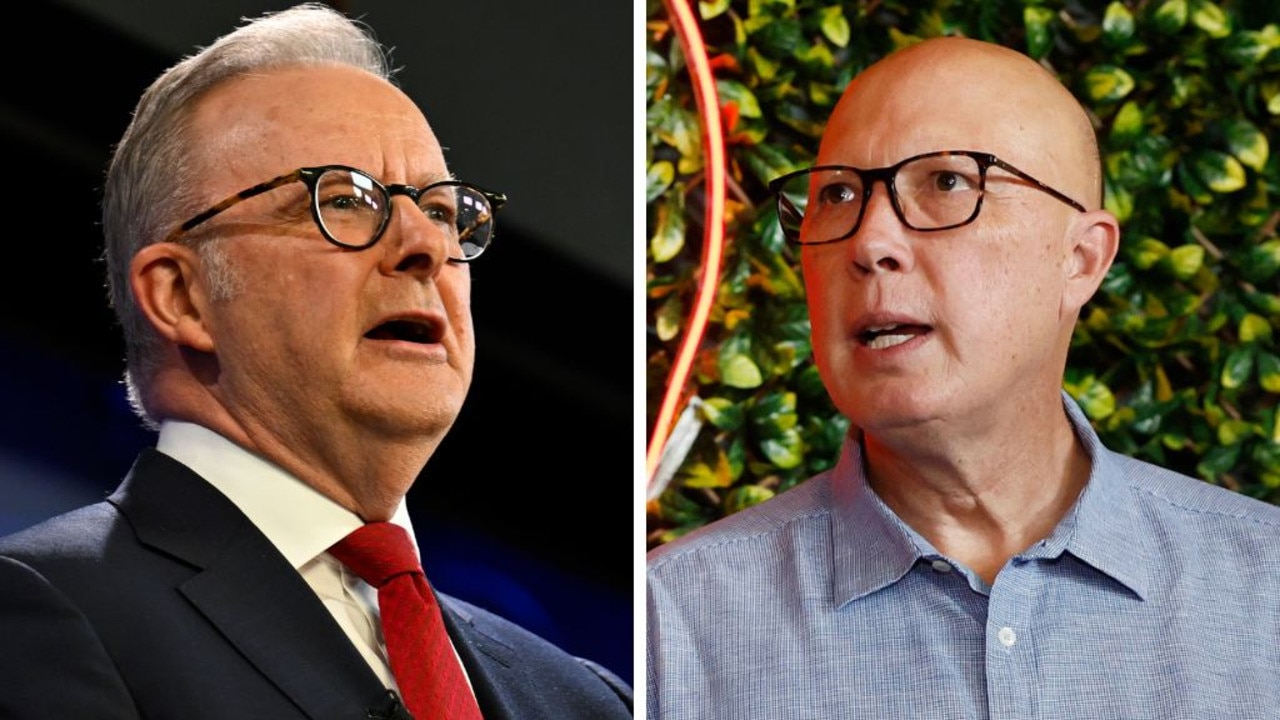

First home buyers’ hopes of getting onto the property ladder faster will get a boost under plans to be unveiled by Anthony Albanese at Labor’s campaign launch. See what’s on offer.

Federal Election

Don't miss out on the headlines from Federal Election. Followed categories will be added to My News.

All Australian first home buyers will be able to buy a house with a deposit as low as 5 per cent without having to use the bank of mum and dad under a significant expansion of a government scheme.

And in an effort to boost supply, Labor has also made a $10bn promise to unlock 100,000 new homes strictly for first homeowners.

Labor’s marquee housing policy of the federal election will be announced by Prime Minister Anthony Albanese at the party’s launch in Western Australia as he attempts to win over younger voters increasingly locked out of the housing market.

“I want to help young people and first home buyers achieve the dream of home ownership,” Mr Albanese said.

“This will help people buy their first home faster, without paying the burden of Lenders Mortgage Insurance.”

The policy involves expanding the First Home Guarantee — where the federal government acts as guarantor on up to 15 per cent of a loan for prospective home buyers, allowing them to buy a house with a deposit as low as 5 per cent and avoid paying lender’s mortgage insurance.

From 2026 the scheme would be open to every first homebuyer, up from a cap of 50,000 applicants a year. Treasury estimates this change will attract 80,000 applicants a year.

There will be no limit on how much a first homebuyer accessing the scheme earns, as long as they can meet the usual home loan eligibility requirements.

Labor would also increase the allowed property price limit by $300,000 in some areas. The upper limit in Sydney, Melbourne, Brisbane, Adelaide and Hobart will be $1.5m, $950,000, $1m, $900,000 and $700,000 respectively.

It also means first home buyers won’t have to lean on the bank of mum and dad to help them with a deposit, in a practice that has become more prevalent as the generational wealth gap grows.

It would also take less time saving for a deposit — about 5.6 years on an average income — though a smaller deposit means higher loan repayments.

Labor will also announce $10bn to boost new housing supply, in a promise it says will unlock 100,000 homes for first time buyers.

Under this plan there would be $2bn worth of grants and $8bn in zero-interest loans or equity investments largely to states and territories. State and territory governments will be required to collectively match the $2bn grant contribution.

Based on the population split, this would mean NSW may need to chip in $620m, Victoria $500m, Queensland $400m and South Australia $136m.

The cash is designed to close the feasibility gap hindering new housing projects from going ahead — such as a lack of basic infrastructure like roads, water, and sewerage.

Labor would work with jurisdictions and industry players to identify suitable projects, including the use of vacant or underused government land.

Mr Albanese, campaigning in Perth on Saturday, was able to show off Labor’s dominance in Western Australia as he seeks to hold the four seats that flipped in 2022 to deliver him a majority government.

Walking down a wharf to take a ferry from South Perth to Elizabeth Quay, a man affectionately yelled out “Albooo! Chicken nuggey!”, in a rugby league reference Mr Albanese responded with “Go the Bunnies!”.

Peter Dutton, also in Perth, was welcomed largely positively though one woman yelled out “I hate you” from a moving car.

More Coverage

Originally published as Labor makes $10bn promise to unlock 100,000 new homes strictly for first home buyers