Federal budget 2020: First Home Loan Deposit Scheme extended by 10,000 spots

First home buyers and the building industry will get a much-needed boost under a plan to help young Australians move out of mum and dad’s place faster. SEE HOW TO ACCESS THE INCENTIVES

Federal Budget

Don't miss out on the headlines from Federal Budget. Followed categories will be added to My News.

- How Australia will climb out of record $1 trillion debt pile

- Calculate how new tax changes will affect you

Aspiring first home buyers can crack into the property market sooner as the federal government’s popular scheme is extended through until 2021.

It will see the rollout of an additional 10,000 spots available to entry-level buyers to purchase a newly-built home.

The First Home Loan Deposit Scheme started in January and has so far included two tranches of 10,000 spots for buyers who have just a five per cent deposit saved up.

Nearly all these spots have already been filled.

The additional 10,000 spots will be available from now through to June 30 next year and are only available for new builds.

Successful applicants require just a minimum five per cent deposit — the government acts as a guarantor for the remaining 15 per cent.

This means the purchasers avoid the hefty lenders’ mortgage insurance – a cost that protects the lender, not the borrower, if there is a default on the loan.

Business analyst Giovanni Fariselli, 38, saved up a five per cent deposit of $30,000 to buy his first property, a $600,000 two-bedroom unit in the inner Melbourne suburb of Richmond earlier this year using the scheme.

After saving for a couple of years he said it fast tracked his ability to buy his property where he now lives with girlfriend Chrysi Kroone, 28.

“My mortgage is $2200 per month and I was paying $2250 per month on rent beforehand,” he said.

“It was really helpful to get into the property sooner rather than later.”

Under the scheme eligible singles must have a taxable income in the 2019/20 financial year of less than $125,000, while couples must not earn more than $200,000.

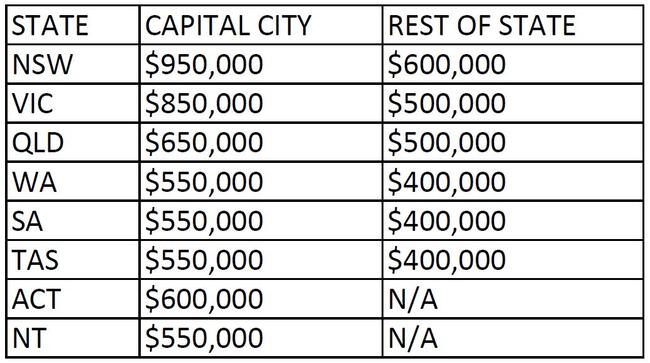

There are also thresholds for the purchase price of newly-built homes, which range from up to $950,000 for first-time buyers purchasing a new build in Sydney, down to thresholds of $400,000 in regional areas of WA, SA and Tasmania.

Bendigo Bank’s executive of consumer banking Richard Fennell said the scheme has frown popularity and he was pleased it could help aspiring buyers crack into the market earlier.

“It’s a significant helping hand particularly when you combine it with some state-based homeowner grants and stamp duty concessions on offer plus record-low interest rates,” he said.

MORE BUDGET NEWS

YOUR FIVE-MINUTE GUIDE TO THE BUDGET

OPINION: WHY TREASURER’S ADVICE WILL LEAVE YOU BROKE

PENSIONERS TO POCKET EXTRA $500 TAX-FREE PAYMENTS

“For those who haven’t been able to get a 20 per cent deposit to avoid having to pay lenders’ mortgage insurance this is a significant contributor to help them into the market.”

Aussie’s chief executive officer James Symond also said the additional support would provide entry-level buyers with a great chance of getting into the market.

“The Government’s First Home Loan Deposit Scheme has been a success so far as it has assisted first timers getting into the market with only a five per cent deposit,” he said.

The Federal Government has also provided eligible owner-occupiers, including first home buyers, with a tax-free grants of $25,000 to build a new home or rebuild an existing for contracts signed between June 4 and December 31 this year.

The Government will also provide a targeted capital gains tax exemption for granny flat arrangements where there is a formal agreement. It will apply to older Australians or the disabled.

EXTENDED FIRST HOME LOAN DEPOSIT SCHEME PRICE CAPS

MORE FEDERAL BUDGET NEWS

Barefoot Investor: Why Treasurer’s advice will leave you broke

$103m boost to build radioactive waste dumping ground

New plan to help Aussie diggers

New top cop squad and plan to catch spies, white collar crims

Stay at home Aussies can stay on parent’s health plan for longer

Virus-hit aged care sector gets $2bn boost

Private schools’ huge funding boost over public

Domestic violence victims left behind in 2020 budget

Hildebrand: What the Treasurer said, and what he really means

Tech giants in tax firing line

Winners and losers: Did you come out in front?

Originally published as Federal budget 2020: First Home Loan Deposit Scheme extended by 10,000 spots