Little Caesars pizza boss bankrupt, reveals why Australian chain failed

A year after the collapse of Australian pizza chain Little Caesars, the former director has pointed the finger at who was to blame.

NSW

Don't miss out on the headlines from NSW. Followed categories will be added to My News.

The man behind failed Australian pizza chain Little Caesars has laid the blame for its demise with both its US namesake and a besieged cryptocurrency company.

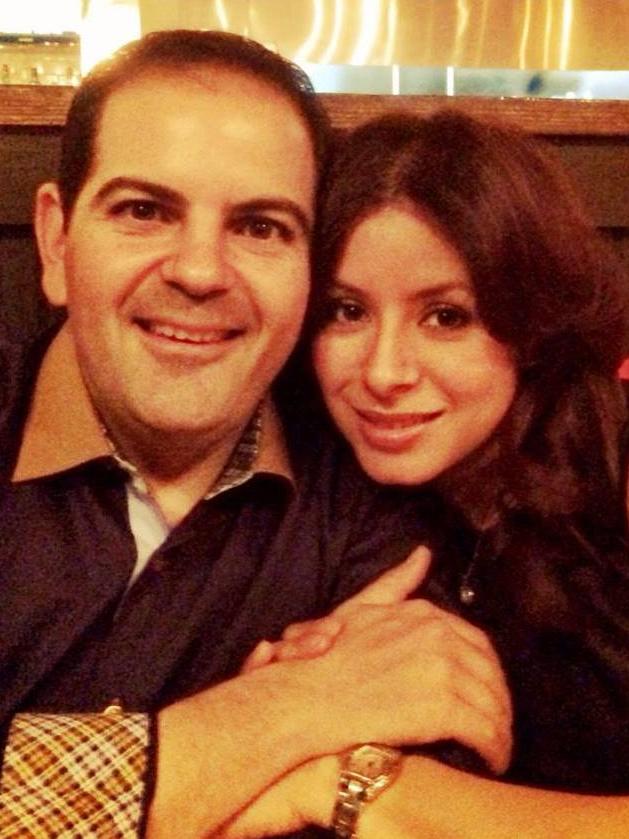

A year after the collapse led to the closure of all 14 NSW stores, Australian franchise director Ernest Koury pointed the finger at its main investor — cryptocurrency company Bitwealth — and US Little Caesars, the third-largest pizza chain in America.

The claim is found in his and wife Susan’s Chapter 11 debt reorganisation application to the US Bankruptcy Court for the Southern District of California, which lists under the section “other amounts someone owes you” the potential for making a claim against Bitwealth founders Matt Goettsche and Gavin Dickson, as well as a separate claim against US Little Caesars.

“Bitwealth was a partner in a business that the debtors operated in Australia,” the application, filed on the Kourys’ behalf, said.

“When the debtors resigned and moved back to the US, Bitwealth worked to undermine the other owners of the company by trying to move the assets of the debtor’s company into a new entity in order to eliminate the other partners’ ownership interests.

“While this was going on Matt G, the main owner of Bitwealth, was arrested by the Department of Justice in New Jersey … for being one of the (alleged) masterminds of a bitcoin Ponzi scheme. When he was arrested, the stores in Australia closed.”

In December 2019, Matthew Goettsche was charged with defrauding investors of nearly $1 billion in an alleged cryptocurrency scam. He has pleaded not guilty. Mr Dickson was not charged.

The bankruptcy application also flags a “possible claim” against US Little Caesars for “collusion with Bitwealth”.

The bankruptcy application lists 20 debts, including a potential $US1.9 million liability from a lawsuit brought by US Little Caesars.

The Kourys said their total liabilities were $US3.53 million ($4.8 million). Australian Little Caesars’ liquidator Andrew Spring said in a report to creditors that he would be reporting to corporate regulator ASIC that Mr Koury “may have breached” six sections of the Corporations Act, including insolvent trading and the director’s duty not to improperly use their position.

More Coverage

Originally published as Little Caesars pizza boss bankrupt, reveals why Australian chain failed