Staff, patients impacted by collapse of Felicity Cohen’s Weight Loss Solutions Australia companies

Debts of almost $3 million have been unearthed by liquidators of two companies behind Gold Coast business Weight Loss Solutions Australia, and former staff and patients have revealed the scale of the damage. Read their stories

Gold Coast

Don't miss out on the headlines from Gold Coast. Followed categories will be added to My News.

Debts of almost $3 million have been unearthed by liquidators of two companies behind Gold Coast business Weight Loss Solutions Australia.

Many creditors are former employees and suppliers of the companies, while clients of the business also claim they are owed money.

Even the company’s accountant – who spent untold hours on the phone and email with unhappy suppliers, patients and staff – is listed as a creditor, with a five-figure debt.

The company’s CEO Felicity Cohen, who is still running the business from its Varsity Lakes headquarters, told a liquidator she “owes $1.98 million to the company in relation to a loan account”.

Ms Cohen has since denied owing the money.

In the meantime, patients, clients and suppliers can only wait to see if the liquidations result in any of their funds being recovered.

The patient

Toowoomba mum Vicki Collins booked a gastric bypass procedure in September last year, handing over more than $4800 to WLSA, with fees to the surgeon and hospital taking the cost to more than $23,000.

When health issues forced her to cancel, she was aware she would be liable for a $700 cancellation fee from WLSA – but Ms Collins said the business had kept all of her money.

“My daughter and best friend got gastric bypass and I was going to do it myself,” she said.

“But you read other people’s stories and I’d had a heart attack 12 months earlier so I was a bit worried. I was going to do it and then decided against it.”

While the surgeon and hospital refunded her money Ms Collins, she said WLSA did not return a single cent of the $4800.

The Toowoomba resident said she’d contacted the company almost every week since, trying to get her money back as she was suffering severe financial hardship due to her health.

“I was ringing them every day. I’ve been off work with no sick pay and they just didn’t care.

“They think it’s OK to keep someone else’s hard-earned money.

“I feel disgusted. How can a big business like that think it’s OK to rip people off?

“Especially these days when everyone’s struggling.

“It is disgraceful that a company can do this and people are supposed to trust them.”

The Gold Coast Bulletin has seen receipts, emails and bank transfers confirming Ms Collins’ dealings with WLSA and its related healthcare providers.

Responding to questions to Ms Cohen by the Gold Coast Bulletin, lawyer Callum Viel of Hickey Lawyers said his client was “not familiar with this patient’s story”.

“Our client intends to comply with any legal obligation that she has,” he wrote.

Ms Collins’ story is not the only case of alleged poor patient experience.

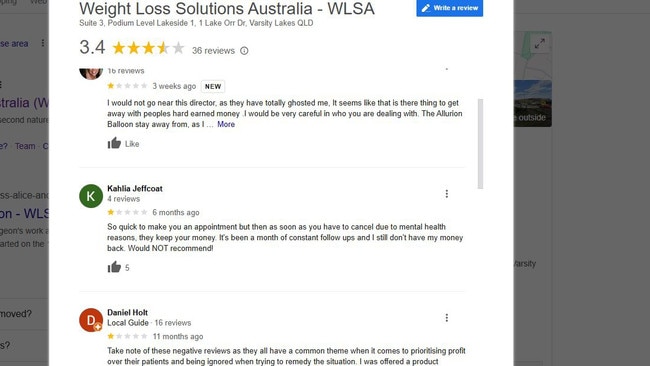

Online reviews for Weight Loss Solutions are peppered with accounts of people claiming not to have received refunds, often losing thousands.

Some patient reviews claim their surgeries simply didn’t work.

Mr Viel’s letter said Ms Cohen refuted the reviews and denied allegations the business has failed to refund patients’ money when required.

“Each and every patient is different, and each procedure is different,” the response said.

“If a patient fails to achieve successful weight loss, there are a number of different complex medical and psychosocial reasons that could lead to this outcome.

“There are medical governing bodies who are able to assist in dealing with any patient complaint.

“There are a significant number of satisfied patients who have achieved incredible

health and wellbeing outcomes.”

The staff

Staff of WLSA are owed more than $360,000 in unpaid superannuation and entitlements.

The Gold Coast Bulletin has spoken to multiple former employees of the business, who wished to remain anonymous for fear their comments would hamper future job prospects.

One former staffer, a respected healthcare professional owed thousands in entitlements and superannuation, said she and other WLSA employees often had to “beg” just to get paid.

“After being paid regularly and promptly for a year, suddenly my pay was regularly late or I wasn’t paid enough,” she said.

“After a few weeks of this, I checked my super, and realised I hadn’t been paid any super for over a year.”

The ex-employee said she was given various different excuses for why she hadn’t been paid properly.

“I would be told the wage payment was made but would be processed over the weekend, but days or even a week later I never received the money,” she said.

“Sometimes when I did receive it, the amount given was completely random — a flat $500 for example, when owed much more than that.

“One major problem was that the pay slips, when issued, were always perfect, suggesting we were paid in full, on the correct day.

“Collectively, the wage payments became so mixed up, it became impossible to know what week the money was for, and was very hard to keep track of exactly what I was owed.”

The former employee said she learned about the pending wind-up of WLSA in late 2023.

“Felicity was cavalier about it, saying it had no impact on the business at all and was all a misunderstanding,” the former employee said.

WLSA company company Bariatric Patient Management Australia was wound up by the Supreme Court of Brisbane on April 9, 2024, but the WLSA business kept operating, with Ms Cohen still at the helm as CEO.

In the letter from Mr Viel, Ms Cohen blamed her patients for the business’s cash shortfalls.

“Our client says that sometimes the business was late in paying its employees, however, late payments to employees were not a frequent event,” the letter said.

“Any occasion in which payments to employees were late was due to a cash shortfall

as a result of patients not making payments until after the due date.”

The letter said Ms Cohen “denies that she misled or provided inaccurate information to her

employees in relation to payments”.

“Our client received advice from external financial advisors to employ more health professionals, rather than using consultants,” it said.

“Our client relied on that advice and added considerable cost to the business model and resulted in health professionals demanding exorbitant pay increases.

“In circumstances where health professionals were dissatisfied, they voluntarily

terminated their employment.”

The response denied Ms Cohen was “cavalier” about the windup of WLSA.

“The liquidation of WLSA had minimal impact on BPMA as it was a non-trading entity and did not prevent the business from continuing,” it said.

“The decision to proceed with the wind up was based on detailed financial and restructuring advice, which has the aim of maintaining a successful business model and employment for all staff.”

Another long-term ex-employee said Ms Cohen “had fantastic people working there”, but “there were constant lies and promises that were never kept”.

“It’s a 12-month program so you form a relationship with the patient over that time, but I started to wonder, as new patients came in – paying a lot of money – if they were going to get what they’ve paid for,” she said.

“Then personally, you never knew if you were going to get paid. Some people had childcare or rent payments coming out.

“She promised everyone their super would be paid, that if they got through the tough times it would all be paid.

“The people she has burned are really great people, she had wonderful professionals there and it was a fantastic business, she just didn't manage it well.”

Mr Viel’s letter said Ms Cohen “worked hard to drive a positive culture for all staff”.

“Our client accommodated many single Mums by providing flexible working arrangements, which included bringing their kids to work during school holidays,” it said.

The business creditors

More than 20 businesses are listed among the creditors of Bariatric Patient Management Australia, owed amounts ranging from $79 to $115,000 each.

A supplier of nutritional products to WLSA, out of pocket tens of thousands of dollars, said Ms Cohen had a successful business model.

The supplier said they had initially tried to help Ms Cohen through her struggles by offering different payment methods.

“The industry is actually quite small and we wanted to help her,” they said.

More Coverage

Originally published as Staff, patients impacted by collapse of Felicity Cohen’s Weight Loss Solutions Australia companies