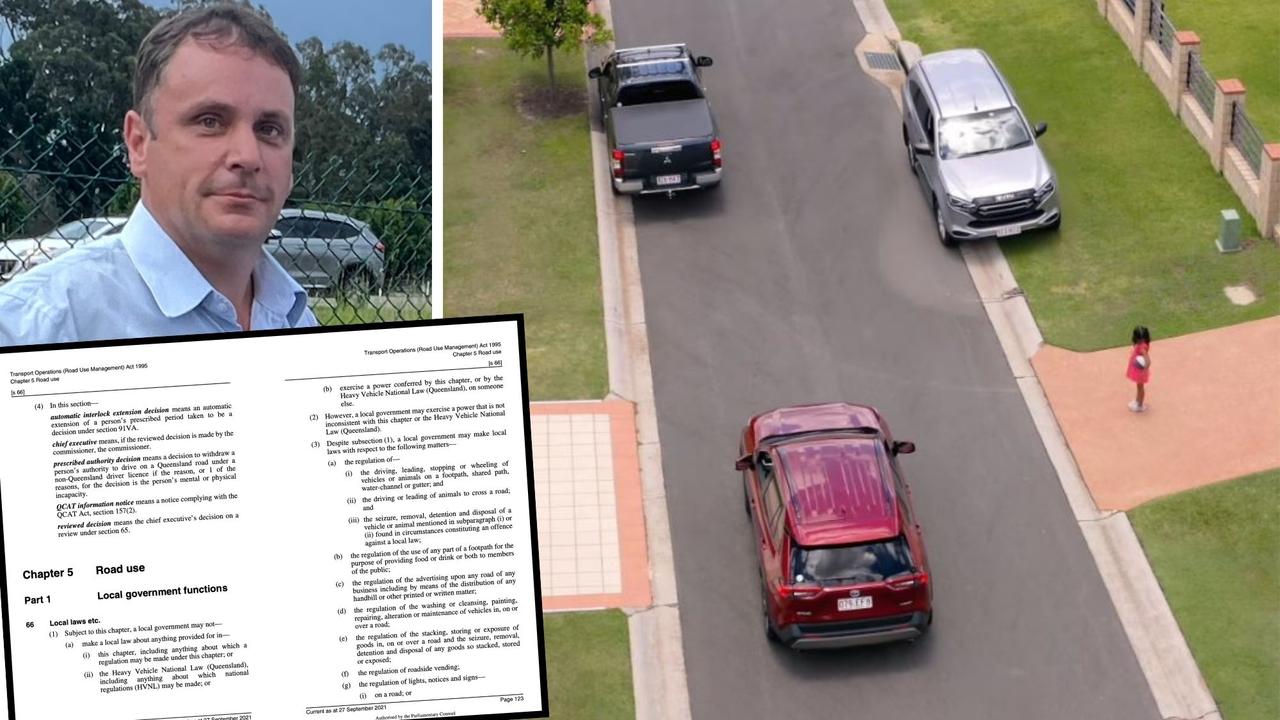

Paradise Motor Homes director Shannon Burford facing ban as liquidator reveals hefty payrise

New details have emerged about the behaviour of the boss of failed Paradise Motor Homes, amid revelations police were called in over the $20m collapse. Here’s what it means for creditors

Gold Coast

Don't miss out on the headlines from Gold Coast. Followed categories will be added to My News.

The boss of the failed Paradise Motor Homes group gave himself a six-figure payrise in the months before it collapsed, and police have been notified of potential “criminal activity” within the company, a new liquidator’s report has revealed.

In his statutory report into Paradise Motor Homes (Qld) and PMH Manufacturing, liquidator Jason Tang of Cor Cordis said corporate regulator ASIC had asked him to prepare a more detailed report into the affairs of the group and the conduct of its director Shannon Burford.

The report confirmed the worst for customers of the failed enterprise – there will be no money left over from the sale of the motorhome business for unsecured creditors.

The retirement dreams of Paradise customers were dashed when its three companies went into administration with debts topping $20m in October. Some were owed as much as $400,000 each for motorhomes they never received.

Despite paying hundreds of thousands of dollars for the motorhomes, customers have been told they did not own them as they were considered assets of the collapsed group.

The new owners of the business, JB Caravans, have restarted operations at Yatala and gone on a hiring spree.

As well as customers of Paradise, the liquidation’s unsecured creditors include tradies owed more than $2.7m.

Director’s hefty payrise

The report said Mr Burford increased his salary in May 2021, when the business was already struggling financially.

The liquidator found the companies were likely insolvent from at least June 30, 2020, and remained that way until it went into administration.

“Based on the company’s management accounts, our calculations suggest the director received an additional $136,527 in remuneration for the 71-week period leading up to our appointment as administrators,” the report said.

Mr Burford’s explanation for the payrise was that it reflected “market rate”; had increased in line with “expansion of the role” and that it was agreed by shareholders.

The joint shareholders of Paradise’s parent company were Mr Burford, 47, and his wife Josephine.

The liquidator found it would not be commercially viable to pursue the parent company because it was unlikely to have the money to repay any funds.

According to the report, there are potential grounds for insolvent trading claims of $5.2m against Mr Burford, however liquidators cannot find any assets owned by him, so doubt his capacity to pay.

The director also personally guaranteed more than $1.5m in debts on behalf of the Paradise companies, which are unlikely to be recouped.

Mr Burford’s million-dollar Hope Island home is owned by Josephine Burford, the former general manager of Paradise Motor Homes who was paid a salary of $168,000 per year.

As well as Mr Burford’s payrise, liquidators found issue with $571,563 paid to another of Mr Burford’s companies, Clarity Valuations.

The director’s explanation of the payments was that they were “consulting fees” that formed part of his remuneration package.

Paradise also sold a $110,000 vehicle to Clarity Valuations, apparently at a $14,000 discount, for which the company “may not have received a commercial benefit” the report said.

The liquidator said it would be uncommercial to pursue Clarity Valuations.

Mr Burford also has an outstanding loan of $120,768 to PMH.

Customers’ fate confirmed

The report revealed the new owners of the business as JB Caravans and LPInvestments Gold Coast.

The new owners celebrated handover of their first motorhome earlier this month – giving the keys to original customers of Paradise whose vehicle was almost complete when the company went into administration in October.

Glenn and Annette Jarman had arrived on the Gold Coast from Sydney to collect their Spark motorhome, the same day Paradise collapsed, leaving their retirement dreams in tatters.

The couple had paid up to three quarters of the purchase amount, and had to make an additional payment to the new owners in order to secure it, but have now set off on their travels.

Other customers have not enjoyed such a happy ending, with liquidators confirming there would be no funds from the sale of the business remaining for unsecured creditors.

Michelle Keir told the Bulletin she’d already paid $380,000 towards a dream motorhome, and the new owners of the business had offered to sell it to her for $410,000.

She declined the offer.

The sting is made worse, Ms Weir said, by the knowledge the motorhome she paid for will likely end up sold to someone else while she’s left out of pocket.

Police called in, director ban on the cards

According to the liquidator’s report, “several creditors” had advised of “suspected criminal misconduct” within the company.

Mr Tang said he was reviewing the information, and may include it in his report to ASIC.

He said some creditors had taken the matter to police, alleging Paradise had obtained their property by deception.

“Based on the particular circumstances of that referral, the police have marked the investigation as a civil matter,” the liquidator said.

That leaves unsecured creditors with one option to chase their money – to lodge a claim in the liquidation, action which has proven futile.

Mr Tang said corporate regulator ASIC had identified Mr Burford as a candidate for being banned as a director and requested a more detailed report.

The liquidator said Mr Burford may have breached the Corporations Acts in multiple ways, including uncommercial forgiveness of related party debts; the director’s potentially “unreasonable” payrise; insolvent trading; improper use of position; uncommercial transactions and failing to show good faith, care and due diligence.

The liquidator also identified potential actions to avoid paying employee entitlements.

Who got paid thanks to business sale?

The $2.1m sale of the Paradise Luxury Motor Homes business did not result in any funds being available to unsecured creditors.

Three finance companies shared $252,000 from the sale proceeds, while another $189,252 was spent on costs related to the sale itself, including legal and agent’s fees and rent.

A lending company, Fifteen, had a secured loan of $910,000 to PMH, qualifying it as first-ranked creditor.

As such, the liquidator said it would be paid $450,000-$500,000, which is all available funds from the liquidation of PMH Manufacturing.

Creditors have approved payments to the liquidator of $75,000 for Paradise MotorHomes (Qld and the liquidator is seeking $281,039 payment for PMH Manufacturing.

A creditor meeting for PMH has been scheduled for March 9, where creditors will vote on the remuneration.

More Coverage

Originally published as Paradise Motor Homes director Shannon Burford facing ban as liquidator reveals hefty payrise