Australian Securities and Investments Commission (ASIC) issues investor warning about GS Partners

Investors have been warned against a multi-level-marketing platform being spruiked by a number of ‘influencers’ on the Gold Coast.

Gold Coast

Don't miss out on the headlines from Gold Coast. Followed categories will be added to My News.

Australia’s corporate regulator has warned investors against a multi-level-marketing (MLM) platform being spruiked by a number of ‘influencers’ on the Gold Coast.

The Australian Securities and Investments Commission (ASIC) issued an investor warning about GS Partners, adding the group to its ‘investor alert list’.

The alert tells investors that the business is “likely to be offering financial services to Australian consumers”, while “not hold(ing) an Australian financial services licence or Australian credit licence from ASIC” and said investors should “be wary of dealing with this business”.

It’s just one of multiple warnings against GSPartners, with the group receiving regulatory enforcement actions from New Zealand, the US, Canada and South Africa.

Regulatory fraud warnings against GSPartners and GSPro have been issued by a number of US states including California, Washington, Mississippi, Alabama, Texas, Arizona, New Hampshire, Arkansas, Wisconsin and Kentucky.

Civil and criminal suits have been filed in Alabama, while GSP owner Josip Heit and US promoter Michael Lynn “El” Dalcoe were fined $500,000 by the state of Georgia.

The fine was handed down as part of an emergency cease and desist, issued by Georgia’s Commissioner of Securities on January 22, 2024.

The state of California has also taken specific action against Mr Heit, as well as executive Dirc Zahlmann, who visited the Gold Coast last year to promote the concept.

After regulatory action was taken against GS Partners in the US, the company rebooted as GS Pro in late 2023. Since then, GS Pro has geo-blocked US and Canadian investors from accessing their accounts.

US states including Arizona have since issued specific warnings against GS Pro. The Arizona Corporation Commission said it was concerned that GS Partners was ‘an alleged crypto scheme that is exploiting investors … (and) may be offering the same unregistered and fraudulent investments opportunities through a new entity called “GSPRO” and/or “GS Digital Partners, LLC’.

New Zealand’s Financial Markets Authority issued a warning just weeks ago: “GS Partners (is) subject to numerous warnings and regulatory actions issued by international regulators for: operating a multi-level-marketing scheme; providing financial services or products while unauthorised in the respective jurisdictions; offering unrealistic returns to its investors; and making false and misleading statements and presentations.”

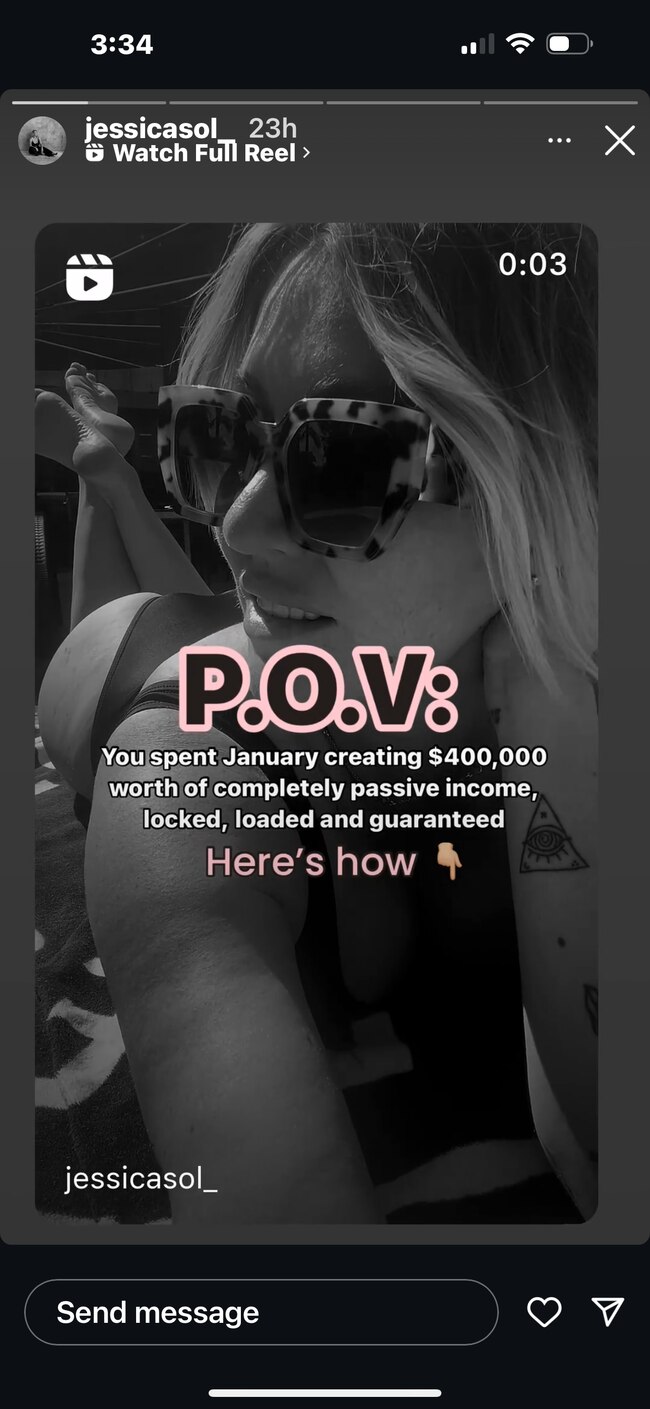

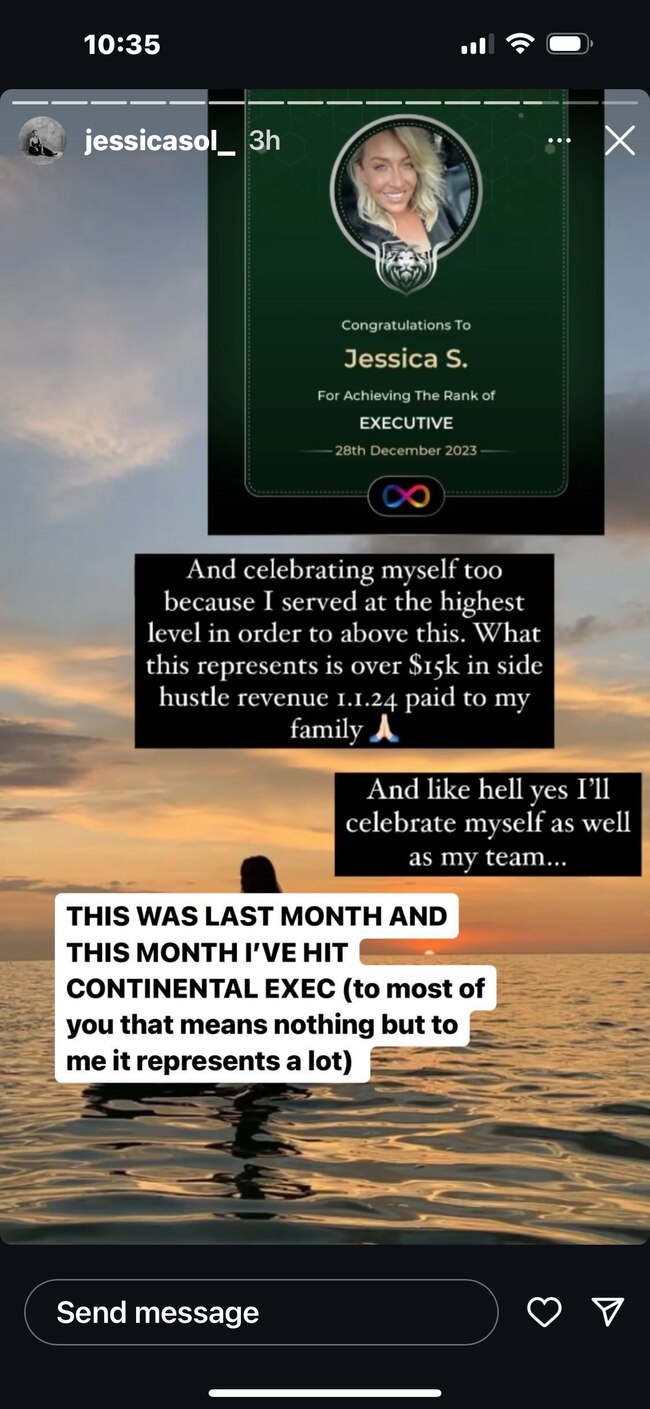

GS Partners/GS Pro has been promoted on the Gold Coast with Gold Coast and Brisbane-based GSP continental executive director Jessica Schembri, also known as Jessica Sol, holding forums online as well as a ‘VIP client day’ at the Langham Hotel in Surfers Paradise. Ms Schembri has been contacted for comment but refused.

Ms Schembri’s social media features a photo of GSP executive Dirc Zahlmann, also known as ‘MetaLion’, who is the subject of regulatory action in the US.

Ms Schembri branded herself as a ‘life architect, mentor, mama bear’ on her website jessicasol.com. The website offered life coaching packages as well as a free masterclass called ‘Solutions Outside the System’.

The masterclass linked to a YouTube video, posted in late December, in which Ms Schembri promoted GSP.

“I’ve been between the Gold Coast and Brisbane in the last 10 years or so but working from home and supporting my family. I’ve been working with GSP now for around seven months and to say that it’s changed my life would be an extreme understatement,” she said.

“This has quickly turned into something that is providing my family with a multi five-figure-a-month income so it’s becoming extremely abundant for us.

“I couldn’t be more happy to share this opportunity. If it’s not for you, then it’s not for you … it is not for people that are going to look for problems, it is not for people that are going to be unresourceful.”

Ms Schembri then described how investors could purchase ‘Metaverse certificates’, adding ‘loads’, and earning at least a ‘five percent weekly payback’.

Her pitch appeared to mirror the warning description provided by California’s Department of Financial Protection and Innovation:

“GS Partners is a multi-level marketing platform that solicited investors to purchase securities called ‘MetaCertificates’. GSPartners represented that it would use investor funds to invest in real-world industry sectors and to trade in the forex market, which would sustainably generate lucrative returns for investors. GSPartners claimed that its ‘MetaCertificates’ paid investors fixed weekly returns ranging from 2.5 per cent to 5 per cent, in addition to monthly returns of 1.5 per cent. GS Partners also paid investors commissions to recruit new investors.”

Indeed, Ms Schembri said she also earned money by encouraging more people to invest and to sell the scheme.

“When we share this with people we are also given the opportunity to be remunerated. So, yes, this is a network marketing structure where if you recommend something to somebody else you will receive a commission off that recommendation.

“We’re not selling a product, what we’re doing is we’re just opening them up to an opportunity.”

A former member of a GSP group led by Ms Schembri said she lost money through her involvement in the scheme.

The former member said one participant in the group had invested $200,000.

“The initial joining fee to GSP or GSPro, whatever it is now, is $1000 non-refundable.

“Before you can proceed any further before you are made to provide a copy of your licence and or passport including a photo of you holding it, which must be verified and accepted.

“They receive their commissions on your investment. They must also sign a minimum of three members per month.

“You purchase certificates and invest as much or as little as you can, but they say to see real returns and earn commissions/rewards it’s not about the investment but signing up others.

“In my community (with GSP) there were approximately 40 members and one member invested $200K.

“I’m out now and I have serious concerns no one will see their money again, just like what’s happened to investors in the US and Canada.

“The warning signs are there that this scheme is collapsing.”

More Coverage

Originally published as Australian Securities and Investments Commission (ASIC) issues investor warning about GS Partners