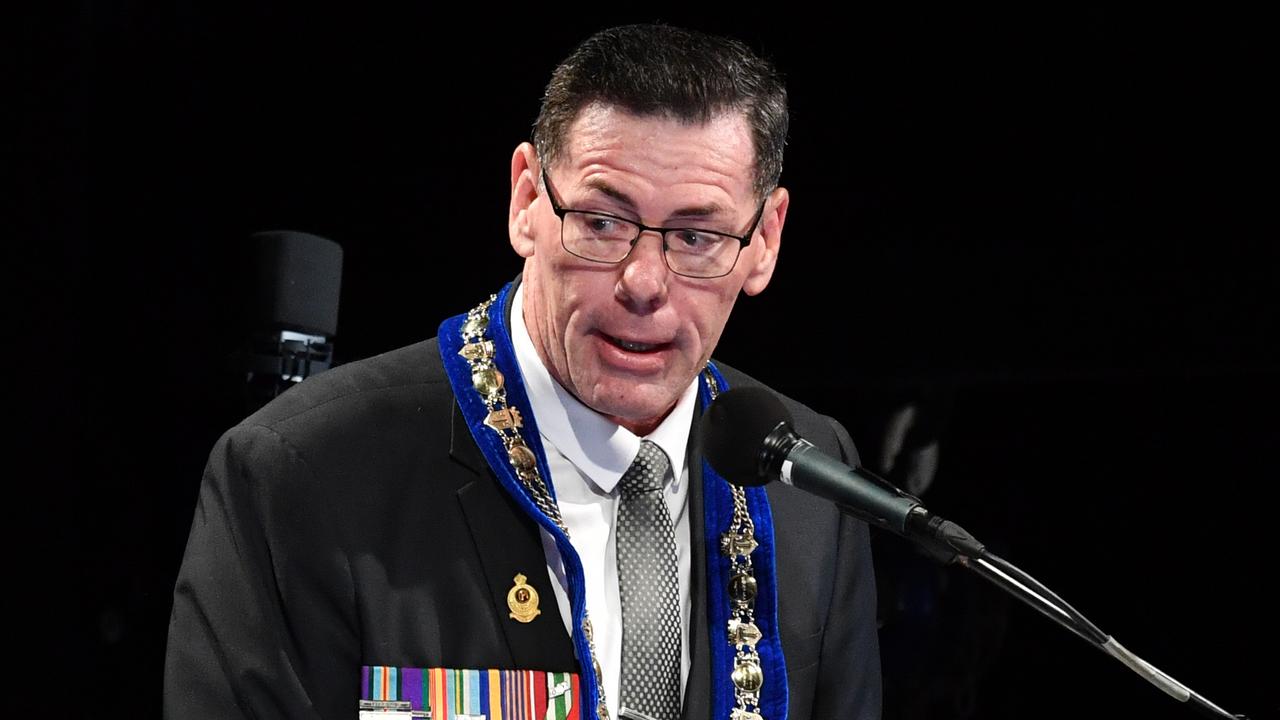

Federal Member for Herbert Phillip Thompson says Townsville residents struggling with insurance price hikes

Given quotes for home insurance ranging from $2000 to $14,000, a Garbutt homeowner says he will risk going without it if his current provider increases his premiums, saying he simply won’t be able to afford it.

News

Don't miss out on the headlines from News. Followed categories will be added to My News.

Given quotes for home insurance ranging from $2000 to $14,000, Garbutt homeowner Neville Macklan says he will risk going without it if his current provider increases his premiums, saying he simply won’t be able to afford it.

Joining hundreds from the North Queensland community who are calling out the “unfair discrepancies” in the insurance industry Mr Macklan said some companies won’t even give him a quote when entering his postcode, with the company saying they cannot provide insurance for that area.

“They won’t let you go any further. There are so many, I just want to take insurance out like most people,” he said.

Having lived in his home since 2016 the aged-pensioner said his house has never flooded despite being in a ‘flood-zone’, with flood waters not coming into his home or yard.

“No matter whatever rain, it just stays at a certain level and doesn’t get close to my house. The only thing that happened during the last event in Townsville is that the toilets wouldn’t flush,” he said.

“I’ve lived in Townsville for 50 years. I have photographs of the 2019 flood level when the trees were small at the time, it’s all low-lying but I am safe. If the water rose anymore it would start spreading out to the salt pans and around the airport.”

Mr Macklan said the only risk he considers for his home would be a fire and has never taken a claim out on his house.

“I wouldn’t have built here if we knew we were going to be classified as a flood area, that only came up six years ago,” he said.

Hearing the issue of costly insurance from dozens of Townsville residents who contact him each day, Federal Member for Herbert Phillip Thompson has written a letter to the chair of the Government’s Australian Reinsurance Pool Corporation Julie-Anne Schafer, as he says the “Pool is not working as per its original intention”.

He noted the experience of one resident who said their insurance increased to $12,000, after 30 years of being with the same insurance company.

After looking into the finer details of the Cyclone Reinsurance Pool they discovered it “doesn’t apply to most of the claims made”, with the cyclone pool covering claims for cyclone and flood related damage arising during a cyclone event from the time a cyclone begins until 48 hours after the cyclone ends.

“So immediately that makes no-one in NQ eligible for flooding from cyclones,” they said in the letter.

The Australian Reinsurance Pool is a public financial corporation started in 2003, with the Cyclone Reinsurance Pool commencing on July 1 2022, as a “longer-term vision is to support insurers to deliver affordable terrorism and cyclone insurance in Australia.”

Mr Thompson noted the Australian Competition and Consumer Commission’s Insurance Monitoring Report from September 24 which states; “while it is widely expected that insurers should pass through the eternity of any cost savings to consumers, the legislation underpinning the pool does not require this and insurers have discretion to decide whether and how they do so.”

“There was a Reinsurance Pool that was set up and this Government has failed to make sure these insurers have had their feet held to the fire and we’ve got insurance companies making the decision on how much, if any, of the savings that they are given through the Reinsurance Pool will be passed on,” he said.

“It’s heartbreaking to hear the stories and it is so disappointing that the government has allowed this to just kick down the road.”

Mr Thompson has outlined a list of “urgent actions” he wants to see undertaken and has invited the ARPC board to Townsville to “hear first-hand from locals about the crippling impact high insurance premiums are having on lives and livelihood.”

The actions include an urgent review of how the pool works to deliver mandatory compliance of meaningful cost savings, the implementation of a real-time data dashboard that shows what cost savings are being passed on by each insurer and more easy to access information for consumers, with Mr Thompson labelling the current 94-page report on the insurance pool “simply unfeasible” for consumers to understand.

The Australian Reinsurance Pool Corporation said they are currently in caretaker mode ahead of the election, but said “legislative aspects of the cyclone pool will be examined as part of the scheduled legislative review commencing later this year.”

“This review will provide an opportunity to evaluate the current frameworks of the cyclone reinsurance pool and consider any additional feedback from stakeholders,” they said.

More Coverage

Originally published as Federal Member for Herbert Phillip Thompson says Townsville residents struggling with insurance price hikes