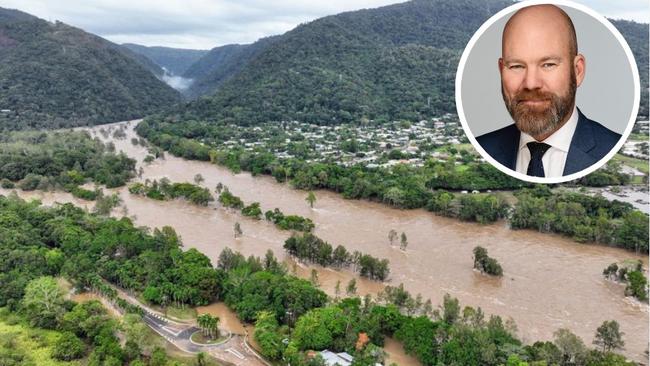

Insurance Council of Australia CEO Andrew Hall’s plan to lower insurance premiums for Qld customers

From stamp duty reforms and supporting government buyback schemes, the Insurance Council of Australia has revealed 86 industry recommendations to help improve Queensland home insurance.

Cairns

Don't miss out on the headlines from Cairns. Followed categories will be added to My News.

From stamp duty reforms and strengthening homes to backing government buyback schemes, the Insurance Council of Australia has revealed 86 industry recommendations to help improve Queensland home insurance ahead of the severe weather season.

ISC chief executive Andrew Hall, who presented the findings in a keynote speech at the Advance Cairns Catastrophe Resilience event last week, said the organisation identified how insurance companies could better support their clients.

“We engaged with Advance Cairns and the assistant treasurer at the start of the year, and have been back (to the Far North) a number of times running community forums to help people through the claims process,” Mr Hall said.

“What we identified, is that we need to be addressing risk such as extreme weather events.”

Mr Hall said more work needed to be done to improve existing infrastructure to make it durable for climate conditions in the Far North.

“Particularly around the tropical north coast, (buildings) need not only provide a survivable shelter for occupants, but withstand the likelihood of strong cyclonic winds,” he said.

“When it comes to flooding, it’s one of the country’s biggest challenges and the most expensive peril when it comes to calculating insurance premiums for a property because it’s a predictable risk.

“You don’t know where a storm or cyclone will hit, but you do know where floods happen and the potential frequency of a flood.”

Mr Hall said the ISC was in active negotiations with state and federal governments to decrease insurance premiums driven by flood risk.

“We’re in an active conversation at state and federal levels about what we can do to help people facing high insurance premiums driven by flood risk and how do we prevent the problems repeating moving forward?” he said.

“So not developing on floodplain areas and if homes are built, mitigation needs to be put in place from levies, see if there are options to build on raised land and the like and then the national construction code needs to be updated to include resilience as a key objective.”

Mr Hall said the ISC was also arguing for the abolition or reformation of stamp duty, support for government buyback schemes for homes built in floodplains, and investment into building resilience and mitigation.

“If we can lower the risks, we can lower premiums across the state,” he said.

More Coverage

Originally published as Insurance Council of Australia CEO Andrew Hall’s plan to lower insurance premiums for Qld customers