‘Failing’: Two-thirds of Australian retired renters live in poverty

Two-thirds of a massive Australian cohort are living in poverty, going without enough food or medicine to keep a roof over their head.

Breaking News

Don't miss out on the headlines from Breaking News. Followed categories will be added to My News.

More than half of retired Australians who rent a privately owned home are living in poverty, new research has found.

Grattan Institute analysis finds even after large increases to rent assistance payments, a single retiree living on just income support can afford 4 per cent of one-bedroom homes in Sydney, 13 per cent in Brisbane and 14 per cent in Melbourne.

The research finds two-thirds of retired renters (about 140,000 households) in the private market are living in poverty, including more than 75 per cent of women.

There are many different benchmarks for measuring poverty, and these Australians fall below all of them – not being able to buy things every Australian ought to be able to and having less than half the disposable income of the median Australian.

“These stark gaps can mean retirees struggling to feed themselves,” the researchers find.

“Researchers who interviewed 125 age pensioners in NSW about their housing experiences found that many of the older private renters interviewed were battling to purchase everyday necessities, and the high cost of their accommodation meant that some were running out of money for food before the next pension payout.”

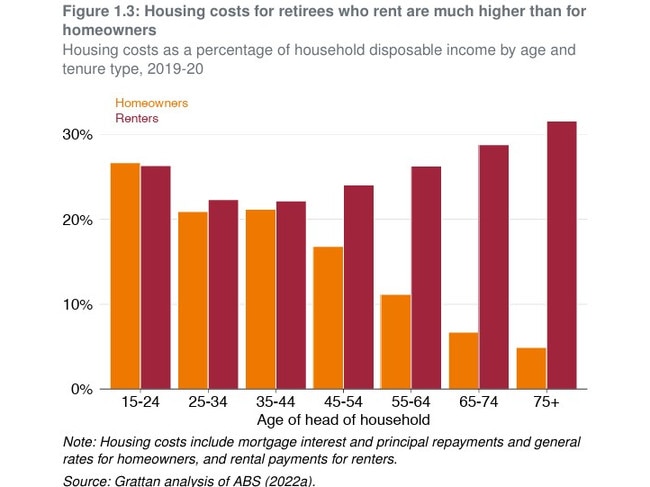

Crunching the numbers shows a huge gulf in the price of having somewhere to live for retired renters versus their homeowner peers.

When the average Australian hits 65, if they are paying off a mortgage, less than 10 per cent of their disposable income goes onto the mortgage payment. But for a 65-year-old renter, almost 30 per cent of disposable income goes on rent.

Report lead author Brendan Coates said only a further substantial boost to rent assistance could ensure all Australians got a dignified retirement.

“Australia is failing too many retirees who rent,” he said.

The Labor government has increased rent assistance 27 per cent in the past two budgets.

For the mid-year budget in September, the federal government also increased income limits for the Commonwealth Seniors Health Card for a second time. The increase in Labor’s first term meant an extra 32,000 older Australians qualified for a health card.

In Australia today, about 78 per cent of over-65s own their home. About 12 per cent rent and 10 per cent live rent-free or in residential care.

Originally published as ‘Failing’: Two-thirds of Australian retired renters live in poverty