Commonwealth Bank increases fees for customers

The nation’s biggest bank, the Commonwealth Bank, has jacked up charges for customers who try to cash a cheque or ask for help in the branch. SEE HOW THIS AFFECTS YOU.

- CommBank gives $50 to 150,000 customers

- ‘We’re sorry’: CBA blames mass outage on IT bungle

- ATMs, branches lost as Big Four banks slash costs

EXCLUSIVE

THE nation’s largest bank, the Commonwealth Bank, is slugging its customers more if they use cheques and ask for help to do transactions.

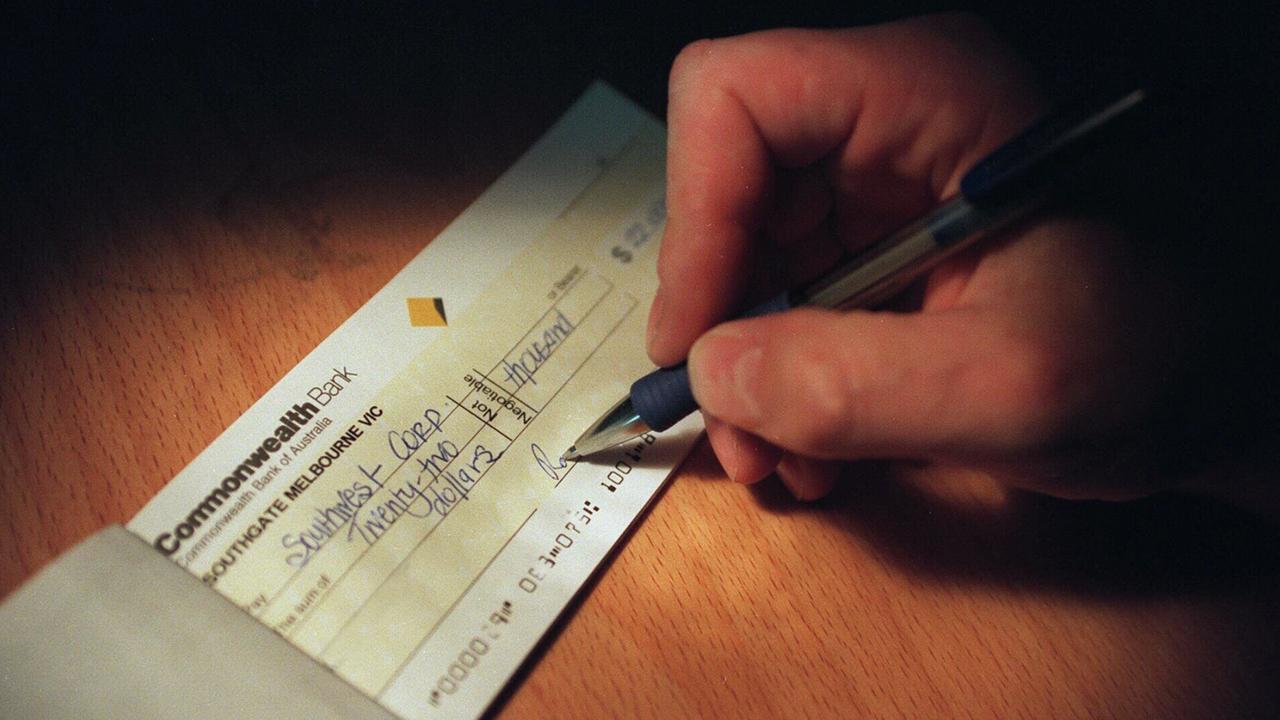

News Corp can reveal the banking giant on Friday doubled the cost for customers who write cheques from $1.50 to $3.

Cheques issued on a customer’s account and cashed inside a bank branch could also incur a withdrawal fee of $3 each.

And another charge jacked up is for customers who visit a CBA branch and have staff assist them with a transaction – this cost has increased from $2.50 to $3.

Some customers will be exempt from these charges including pensioners.

It comes just days after it was revealed the bank demanded 500 workers to repay bonuses they had received, but then backed down on asking for the cash amounts to be repaid.

This hit some of CBA’s lowest paid including staff in branches and back office staff.

And just last month a mass outage at the bank which prevented customers from receiving their salaries resulted in CBA crediting $50 to 150,000 customers nearly a week later with a description in their accounts stating, “sorry from CBA”.

Financial comparison website Mozo’s oman Kirsty Lamont said the hikes come when banks should be doing their utmost to keep customers.

“At a time when the big banks are under pressure to retain customers, this fee hike will not be welcome news for those older customers who have remained despite scandal after scandal,” she said.

“It’s likely to penalise older customers who value their bank’s branch services and cheque facilities.”

A CBA spokeswoman said despite the fee increases, “our customers have more options available to them than ever before”.

“We’re helping them save $415 million a year through fee-free account options, removing fees and charges, alerts to avoid fees along with mobile and online banking options.”

Late last month the bank’s chief executive officer Matt Comyn wrote to customers about changes they were making “to become a better bank”.

MORE:

CBA hands over bonuses to staff then demands them back

CBA gives $50 cashback to $150,000 customers

“We've made some big and small changes every week this year for the benefit of our customers,” he said.

He went on to boast about introducing Apple Pay, investing money in the bank’s app and strengthening security.

Mr Comyn also said CBA had retained the largest branch network nationally, despite shutting 39 branches and ripping out 208 ATMs in the 12 months to June 30.

The bank is holding a customer forum in Brisbane on Monday but put will tightly control the event – it provided customers with a pre-approved list of nine questions that could be asked at the event.

This included, “What new technology is coming soon to benefit customers?”

In-person attendance at the forum will be limited to 400 retail and business customers hand-picked by the CBA.

Originally published as Commonwealth Bank increases fees for customers