Green is good: How to join the ethical investment boom

Ethical investment is surging as Australians chase a warm and fuzzy feeling when parking their spare cash or life savings. Here’s how to do it.

Ethical investment is surging as Australians chase a warm and fuzzy feeling when parking their spare cash or life savings.

Also known as responsible investing or sustainable investing, the market grew 17 per cent last year to $1.15 trillion – almost 40 per cent of all professionally-managed assets.

And people who invest responsibly don’t have to make a trade-off of poorer financial returns.

Data from the Responsible Investment Association Australasia (RIAA) shows responsible funds delivered higher investment returns than traditional funds over almost every time period in the past 10 years.

Getting started is not difficult, with separate RIAA research finding more than half of Australia’s 50 biggest superannuation funds now have a responsible investment option.

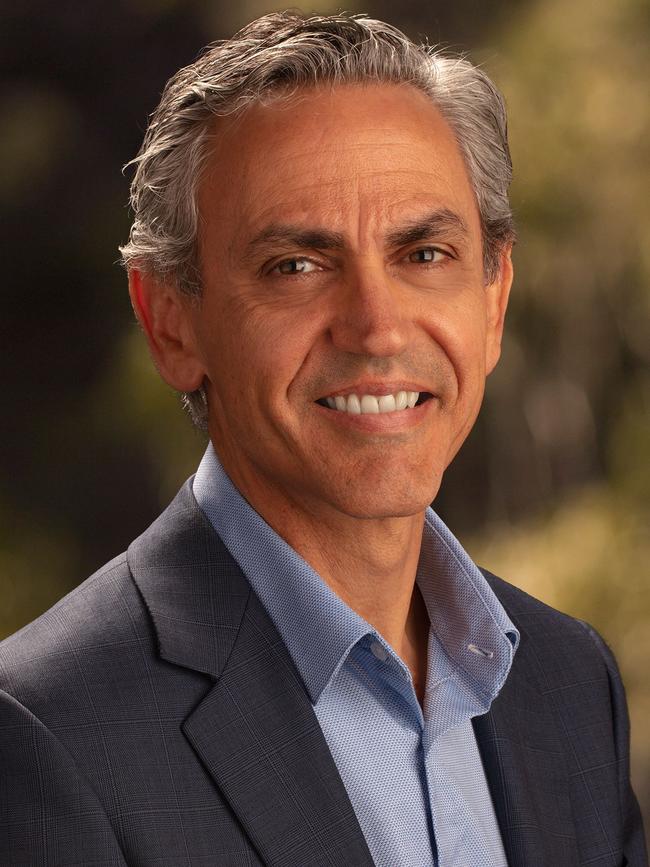

“Most banks and super funds have information on their website if they are engaged in responsible investing, and if they don’t, you should contact them and ask,” says RIAA CEO Simon O’Connor.

Responsible investment specialist and Novo Wealth director Paul Garner says start with your existing super fund.

“If you can, find out where you can get a list of companies that the fund invests in, or whether they have an ethical, socially responsible or sustainable option,” he says.

“If you don’t want to or don’t have the means to do the research, question your existing adviser or find an adviser who specialises in that area.”

Investors don’t have to choose individual investments: there’s a growing number of exchange traded funds – which spread money across a wide variety of stocks – with a responsible focus, including three from BetaShares.

Garner says there’s “a lot under the bonnet” of responsible investment funds, which are often measured in different shades of green and may adopt negative screening – weeding out undesirable companies – or positive screening, where they specifically target companies that are doing good things.

“These are the companies of the future so that is where the revenue is going to come from,” he says.

“From a long-term point of view you want to be invested in these companies.

“In the early days it was purely based on avoidance – you avoided tobacco, armaments and gambling. Now funds have become more sophisticated.”

Garner says it’s not just environmentally-minded young people leading the push into ethical investments.

“At the moment I’m dealing with a lot of 50-plus people,” he says.

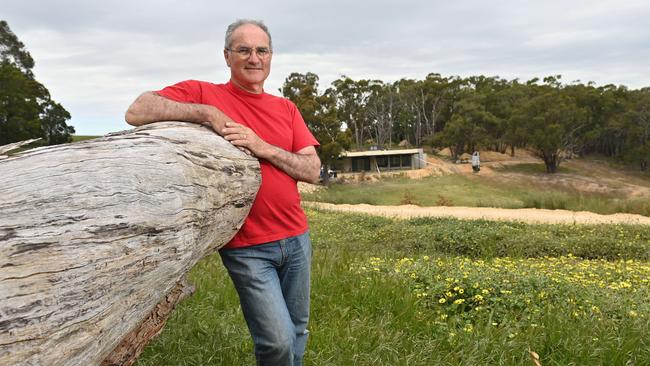

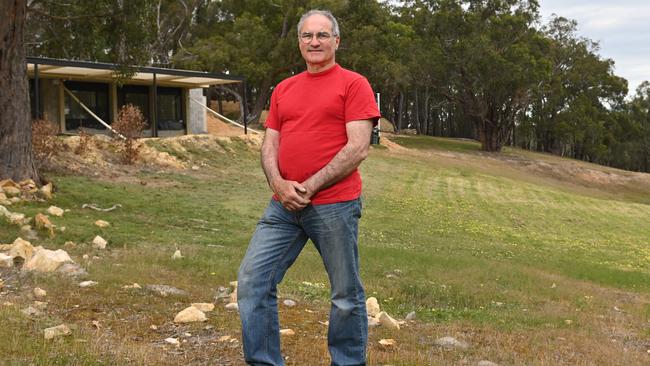

Among them is Peter Hardy, 65, who invests ethically across his diversified portfolio both inside and outside of superannuation.

“It initiated out of wanting to fix some of the wrongs that my generation has done,” he says.

“Burning fossil fuels – we can’t keep doing that.”

Hardy, who is currently building a green off-grid home, says his responsible investment portfolio has matched and in some cases beaten returns from conventional investments.

The RIAA has an online tool, Responsible Returns, that details products and can help people match their values with an investment, and also a responsible investment adviser directory.

O’Connor say you should first work out what’s important to you.

“For some people it’s climate change, for others poverty, human rights abuses or companies that don’t pay their fair share of tax,” he says.

“Many financial advisers are skilling themselves up around responsible investing.

“It may take some homework but ultimately these are some of the biggest financial decisions you’ll make in your life so it’s worth getting it right.””

GREEN IS GOOD

Return on 10 year investments:

Australian shares responsible 9%

Australian shares overall 7.8%

International responsible funds 11.9%

International funds overall 10.9%

Multi-sector responsible 8.2%

Multi-sector overall 6.9%

Source: Responsible Investment Association Australasia

MORE NEWS

Huge savings for mobile customers