How to get the best deal when buying a new car

Getting the best deal when purchasing a new car isn’t always easy, but experts reveal how it is possible to save thousands.

SmartDaily

Don't miss out on the headlines from SmartDaily. Followed categories will be added to My News.

Saving significant money on new vehicle purchases isn’t always easy but it is possible to come out ahead.

Demand for new cars is currently strong, as many people don’t want to jump on public transport for the return to work.

Here are our tips for driving home a bargain.

THE BEST TIME TO BUY

Timing is often key to financial success. Though new cars aren’t as volatile as shares or the real estate market, buyers can benefit from picking up a car on the right day. Shopping at the end of the month or quarter can work, as dealers have targets to hit – as can the end of the calendar and financial years when manufacturers report sales to head office.

The end of a model year is also a good time to buy. Dealer stock is switching from 2020-plate models to cars built early in 2021 no - ordinarily you might get a deal on remaining previous-year models before Easter, but low stock levels from strong demand make that less likely at the moment.

THE BEST WAY TO PAY

There are many different ways to get hold of a new car - dealer finance, bank loans, adding it to your mortgage, using a novated lease or paying cash.

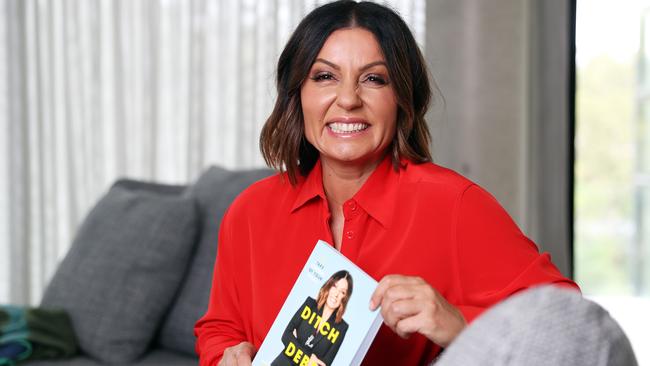

Effie Zahos, author of Ditch the Debt and Get Rich, says the three key options are loans, dealer finance, and novated leases.

“Car loans are a supersimple product,” Zahos says.

“You borrow a set amount, make repayments for a set term, then, at the end of the loan, you own the car outright with no more to pay.”

Many lenders offer car loans – and it isn’t hard to use websites such as Canstar.com.au to compare competitive loans.

Dealer finance is more complicated, and the specifics of a deal might not be available until you’re sitting across the table from a salesperson.

“Even then, the focus can be on how much you’ll pay each month rather than the interest rate involved,” Zahos says.

“Be prepared to ask what the rate is inclusive of upfront and ongoing fees.”

Balloon payments at the end of a loan or lease can reduce monthly repayments, but bring a nasty surprise at the end of the loan. It’s best to know all the fine print for a deal to understand the overall cost.

A novated lease uses pre-tax “salary sacrifice” pay to finance vehicles. It reduces your taxable income but requires customers to pay fringe benefit tax. You can lease a car for years without ever owning it – buyers need to pay for the car’s residual value at the end of the period to take it home, but many prefer to roll it into a new lease.

Zahos says “it can be a very tax-friendly way to pay for a car”, and that savvy buyers can come out in front when leasing, compared to a traditional loan.

“It’s worth chatting to an accountant if that’s the route you want to go down,” she says.

James Whitbourn, founder of vehicle broking service CarHelper.com.au, says customers should scrutinise sharp finance offers put forward by manufacturers.

“Dealer finance rates can be really low, but you have to look at their fees and charges and the total cost of the finance” he says.

“They have to make their money somewhere - you might get a good deal on finance but end up paying full price for the car.

“You’re better off going to a finance broker and arrange it before going to a dealership.”

KNOW WHAT YOU WANT

Most buyers have a good idea of what car they want to buy before setting foot in a dealership. There are dozens of independent reviews and comparison tests – including our car assessments published every Friday – motorists use to do their homework. It also pays to know the difference between model grades and option packages on short-listed models, so you know exactly what you’re looking for.

Shopping is easier if you know exactly the make, model, trim line and colour you prefer, which offers a chance to compare offers from different dealers.

But it can pay to be flexible. If your heart is set on an orange car, you won’t have many to choose from – and might have to pay more.

SHOP AROUND

You’ll get the best deal by cross-shopping multiple dealers to understand competitive pricing. Get three quotes and be honest with sales staff, letting them know that you’re ready to buy and will commit to the best one.

Some dealerships will be reluctant to give out prices on the phone or by email – you might need to visit in person to demonstrate commitment.

Car brokers can usually get a better price than retail buyers.

Whitbourn has bought hundreds of new cars for customers, and says folks in his line of work can get a great deal.

“You need competition and you need perspective – sometimes you need to talk to 10 dealers to actually find the car,” he says.

“Brokers deal with fleet departments rather than retail people. It’s a completely different business model.

“Fleet guys are focused on just another unit sold rather than retail margins. They’re not trying to squeeze the most out of you.”

DEMONSTRATOR MODELS

Sometimes brands push dealers hard to register stock as sold on their balance sheets, which can result in near-new demos on the forecourt.

While you can get a great deal, it’s best to make sure the new car warranty period hasn’t started – and to sharpen your pencil if the car’s manufacturer guarantee kicked off before you take it home.

Demonstrator models are easy to spot through online classifieds websites. You can refine searches to look for used cars built in the last year or so with less than 1000 kilometres on the dash.

RUN-OUT MODELS

The best time to buy a new car can be toward the end of its life, when a fresh version is just around the corner.

While you’ll get a great deal – and there is unlikely to be any trouble with well-proven models – you have to settle for having a slightly older-looking model that not have the latest features.

“Other than the ego issue of driving an older car there’s no downside to it,” Whitbourn says.

“Buying a new model in the first three months is a really bad time to buy.

“Dealers have more demand for brand new models, and likely not enough supply to meet demand.

“They don’t need to discount them.”

THE TRADE-IN

You will get more for your car by selling it privately than as a trade-in. But it will cost you time, effort, and the hassle of tyrekickers out to drive home their own bargain.

If you trade your vehicle in as part of a deal, be mindful to ask for the change-over price including what you pay for a new model.

If one dealership is offering a particularly generous sum for your old wheels, they might be making more money on the new machine.

It can pay to negotiate purchase and trade-in deals separately, ensuring you get the best price possible on both sides of the equation.

DRIVING A BARGAIN

It’s hard to know how hard to push for a new deal. Some cars – particularly cheaper entry-level models have very slim profit margins for dealers, who aren’t likely to budge much on advertised prices.

Sometimes a national drive-away deal is going to be as good as it gets.

But there can also be secret discounts, or “holdback” given to showrooms by head office to help move stock out the door.

Whitbourn says getting a good price can be down to your approach.

“Just be a straight shooter, motivated but not desperate,” he said.

“Make a low offer to the dealer with some commitment behind it, then go from there.

“There’s a possibility that approach wouldn’t work in the current market – some dealers have ore demand than supply.

“If they don’t have the cars to sell, you’re going to lose out a little bit.”

Originally published as How to get the best deal when buying a new car