‘He took control of everything’: Women suffer as financial abuse reaches epidemic levels

Female victims of financial abuse are reaching out to counsellors as their dominating partners control bank accounts and money, set up loans in their lover’s name and run up debts. SEE HOW YOU CAN GET HELP

Money

Don't miss out on the headlines from Money. Followed categories will be added to My News.

Exclusive: Financial abuse experienced by partners is at epidemic levels in Australia as more people look to seek help from counsellors, experts say.

Dominating partners who have complete control of bank accounts and money, set up loans in their lover’s name and run up debts or tax liabilities are some of the most common issues victims have reported.

Financial Counselling Australia's chief executive officer Fiona Guthrie said financial abuse was a widespread issue and resulted in counsellors across the country having to undergo specialised training to combat the problem.

This include domestic violence courses — a problem that often goes hand-in-hand with financial abuse.

“We know domestic violence and economic abuse are directly correlated,” Ms Guthrie said.

“We have been training financial counsellors to more clearly identify signs of economic abuse and ask people more about their situation and respond to it.”

Latest data from the collaborate network Thriving Communities Partnership found 80 per cent of women seeking family violence services had experienced financial abuse.

Ms Guthrie said some victims had gone to extremes to torment their partners and control their expenditure down to the last dollar.

“I’ve heard horrific stories of people having their money really closely monitored and they save just $5 a week for years until they have enough and they can try and leave,” she said.

Experts say one of the biggest frustrations was dealing with government departments including Centrelink and Australian Taxation Office on dealing with the financial abusive situations.

Family violence financial counsellor at social and community health organisation Each,

Michelle Ludwig, said the fallout from the financial services’ Royal Commission had put the spotlight on issues including financial abuse but there was still a long way to go to help combat the problem.

“The courts’ system is a diabolic mess and quite often favours the perpetrator and allows the abuse to continue for an extended period of time,” she said.

“There’s very limited access to pro bono or low-cost lawyers to protect the low-income or vulnerable in property law matters.”

MORE NEWS

Home loan interest rates you should pay

Big Four bank’s surprise home loan change

What divorce means for mortgages

Ms Guthrie said one of the newest trends in recent years was financial abuse happening in the privacy of a couple’s home including partners being forced to unwillingly sign up to loans in their name.

“The ability to get a loan in the privacy of your home and be forced to do it in your name is scary,” she said.

“It’s not healthy when a person uses economic resources to control another.”

Ms Guthrie said other common problems included having all bills held in the victim’s name and one partner divvying up a partner an allowance, while also forcing them to account for every penny spent.

She warned people not to take out a loan where they don’t get a benefit and to also consider a silent bank account, which can be kept hidden from another person.

RUTH* — ‘He took control of everything’

Age: 45.

Marital status: Single, was in a de facto relationship from 2009-2014.

Income: Works casually as a gaming manager, earns $50,000 annually.

I’d been through a divorce and afterwards I received more than $300,000 from a property settlement.

I then met my new partner and we fell in love.

He was a uni student and knew I had a large sum of money.

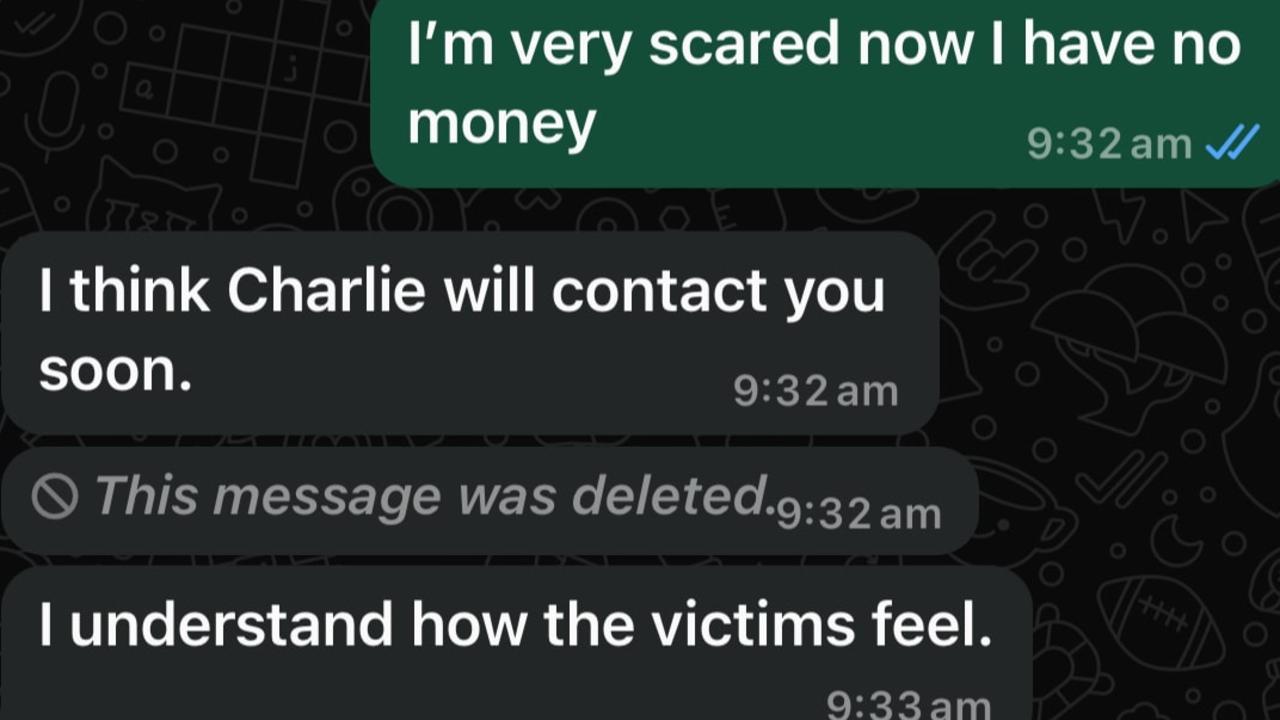

One year before we broke up he transferred money from my account to an account in Korea, where he was from and said it was for us to buy property together.

I thought it was a good idea because I’m from Korea and property over there is cheaper.

He said it was in our joint names but it actually wasn’t, it was just in his name.

He made me feel like I was no good at technology so he took control of everything and added himself as a joint account holder.

He also used my details to sign up to a credit card I had no idea about and he bought a $92,000 BMW with a loan he took out in my name.

I never even drove the car.

The car was also repossessed and I was left for a debt on it.

He assaulted me and I had a protection order taken out but I was under pressure to drop the charges.

I was unable to work because I was struggling with mental health issues, so I tried hard to keep up with the car repayments after the relationship ended.

He left Australia and me with a $100,000 debt and no savings.

I lost everything and my message to any other woman is just don’t give up.

*A pseudonym has been used to protect the woman’s identity.

KIARA* — ‘He monitored me on Snapchat’

Age: 24.

Marital status: Left her partner in 2018 and now has a new partner.

Income: Works full-time as a youth worker, $70,000 annually.

We broke up in 2018 after being together 18 months.

I ended up owing 13 creditors $15,000 and had 380 fines including tolls and speeding fines totalling $40,000.

Many of these fines he racked up under my name.

Everything started going downhill when he moved in with me about three months into our relationship.

He would call me every name under the sun and on weekends when he was drinking he would blow up. He was also using drugs.

He would even tackle me in the street and kick me in the head and stomp on me.

I didn’t call the police because I was scared.

He monitored me on Snapchat’s Snap Map to always see where I was.

I went from 99 per cent attendance to less than 34 per cent attendance, he would not allow me to leave his sight to go to work.

We fell behind in our rent so he could buy drugs.

I was running into debt, signing up to payday loans that he forced me to sign up to online while he watched.

He also damaged a lot of my property.

Once day I decided I had to get out, I just packed up my belongings and fled.

With the help of a financial counsellor most of my debts have been cleared, however my credit score still impacts my recovery.

I now have savings and one day hope to a house with my new partner.

*A pseudonym has been used to protect the woman’s identity.

MARY* — ‘My ex-partner had access to firearms’

Age: 47.

Children: Daughter, 16, and son, 12, live with their biological father. The perpetrator (ex-partner) has committed suicide.

Income: Works in the animal industry, receives some social welfare benefits.

I was in an abusive relationship, my ex-partner had access to firearms and he even shot at me.

I jumped behind a car and he missed getting me.

He’d even shot at the television and was making illegal firearms at home.

He established a trade business that was solely in my name and I didn’t know about this at the beginning.

When paperwork arrived he would throw it in the bin or in the fire.

He was always drinking and he took drugs too.

If something didn’t work out he would throw a tantrum like a child and destroy items around the house, he even damaged my car.

Any money from the business would go straight into his account but the business name was linked to my ABN.

He was giving me some money here and there and then sometimes I would get some money from Centrelink.

He was very aggressive, it didn’t take much for him to lose his temper.

The first I knew about the debt was when the police turned up at my house and said there was a warrant for my arrest for not turning up to court.

It was relating to a debt of $90,000 owed to the ATO.

He’s since ended his life and I’ve been left fighting with the ATO over the debt that’s linked to my ABN.

I can’t start my own business because of it.

My credit score is ruined and I can’t even get a loan to purchase a car.

*A pseudonym has been used to protect the woman’s identity.

GET SUPPORT

• 1800 RESPECT ON 1800 737 732, 24 hours, 7 days a week.

• Lifeline on 131 114.

• National Debt Helpline on 1800 007 007.

• Relationships Australia on 1300 364 277.

• Financial Abuse Legal Service NSW (free statewide service) 0481 730 344.

• Use Penda smartphone app for information.

• Safe Futures (Victoria only).

• Womenandmoney.org.au.

Originally published as ‘He took control of everything’: Women suffer as financial abuse reaches epidemic levels