Covid-19 vaccine: Insurers introduce benefits for serious side effects

Some insurance policies now allow customers to claim up to $50,000 if they suffer a serious side effect from a Covid vaccine.

Coronavirus

Don't miss out on the headlines from Coronavirus. Followed categories will be added to My News.

Insurance companies have moved to provide Covid-19 vaccination protection, allowing customers to access benefits of up to $50,000 if they suffer a serious side effect.

Zurich and OnePath Life announced on Firday that consumers who hold life insurance policies with them will be able to make a claim if they suffer a serious adverse reaction to an approved jab.

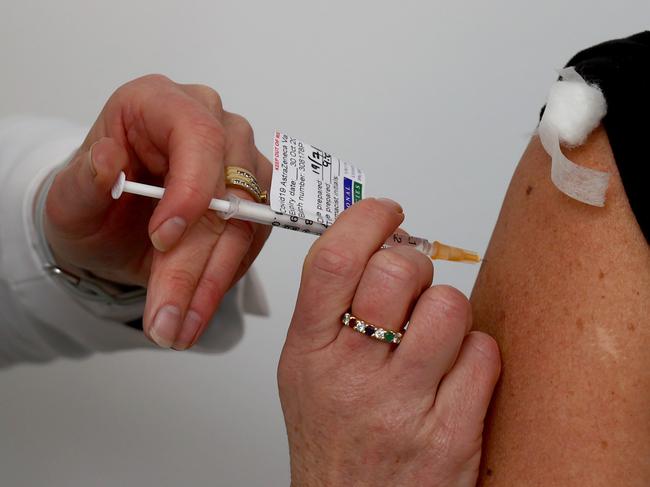

There are three Covid-19 vaccines approved for use in Australia: Pfizer, AstraZeneca, and Moderna.

Pfizer and AstraZeneca are currently being used in the national vaccine rollout. While some adverse reactions have been reported — particularly with AstraZeneca which has been linked to blood clots — medical experts have stressed that serious side effects are extremely rare and the benefits of getting a Covid-19 jab far outweigh the risk.

Zurich and One Path Life offer life insurance for ANZ, HBF and ALI Group, and also via superannuation funds including BUSSQ; Energy Super; Legal Super; LUCRF; Club Plus; the ANZ Staff Superannuation Scheme; BOC Super; and Virgin Money Super, among others.

Under the policy revamp, customers or their beneficiaries will be eligible for a one-off payment of up to $50,000 on top of their death or total and permanent disability benefit if they die or become permanently disabled because of the vaccine.

The offer is available from September 1 to December 31, and eligible customers must have an in-force police during this period and at the time they are vaccinated.

Death or disability must occur within 90 days of receiving a Covid-19 jab, and an individual will only be able to make an income protection claim, also capped at $50,000, if they have been hospitalised for three days or more as a result of a Covid-19 jab.

Claims must be lodged by December 31, 2022.

Chief product and proposition officer a Zurich LiveWell, Dr Sally Phillips, said the policy change was to offer Australians peace-of-mind as they “weigh up the benefits and risks” of getting a jab.

“While medical evidence indicates the likelihood of vaccine complications is extremely low, we understand that some people are concerned about the risk of a serious adverse reaction,” Dr Phillips said.

TAL — which offers live insurance policies through NIB, Allianz, NRMA and AAMI, among others — said it also offers the benefit.

A TAL spokesperson said just four of its 4.5 million customers had made a claim as a result of an adverse reaction from a Covid-19 vaccine.

“All life insurance policies including those provided by TAL already fully cover any side effects from any vaccine that would result in serious disablement or death,” the spokesperson said.

“However, all the medical evidence and advice is that the chances of any serious adverse side effects are extremely low.”

Medibank, Allianz, and AIA Group have been contacted for comment.

Originally published as Covid-19 vaccine: Insurers introduce benefits for serious side effects