How the rising risk of an ATO tax audit affects you

A TAX audit strikes fear into the heart of almost every Australian taxpayers. As the ATO uses technology to spot dodgy claims, this is how to avoid making a costly error.

Work

Don't miss out on the headlines from Work. Followed categories will be added to My News.

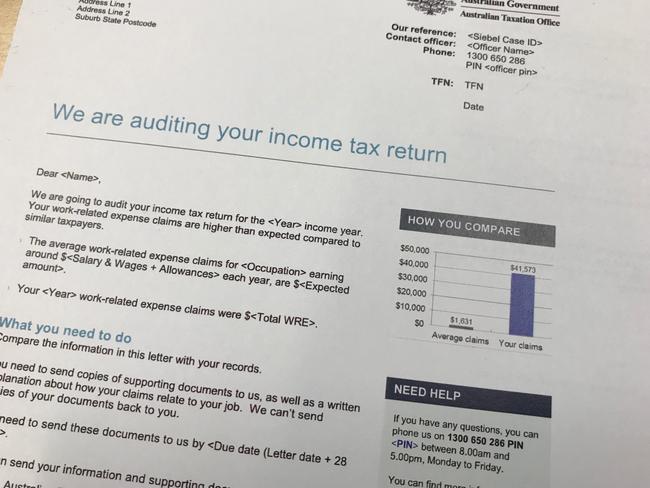

MILLIONS of Australians are at increased risk of an audit this year as the tax office takes a harder line on work-related expenses and other claims.

More than 360,000 audits and reviews will be conducted on individuals, while more than 1.3 million workers and two million real estate investors are being emailed.

Australian Taxation Office assistant commissioner Adam Kendrick said it had increased its resources to combat dodgy claims after finding widespread incorrect deductions for things such as mobile phones, uniforms and car expenses.

The ATO’s team of “data doctors” compares workers’ tax deductions with those with similar occupations and incomes, putting a spotlight on potential false claims and leading to a full-blown tax audit for up to 20,000.

“We are finding that we are amending seven out of every 10 tax returns that we audit,” Mr Kendrick said.

The idea of being audited by the ATO strikes fear into the hearts of most people, even if they have nothing to hide.

Deakin University associate professor Adrian Raftery said it was “a normal reaction to get nervous” and people often lowered their deductions after receiving generic warning letters from the ATO.

“The feeling they’re being watched means they try and stay well under the radar,” he said.

Dr Raftery said the ATO’s hi-tech data-matching systems were improving monthly.

TAX RULES: Tougher new laws for property investors

HLB Mann Judd tax partner Peter Bembrick said new reporting rules meant people who invested in Bitcoin or other cryptocurrencies could now be seen by the ATO when transactions exceeded $10,000.

Bitcoin is generally treated as an asset for tax purposes and attracts capital gains tax.

Mr Bembrick said the trend of government authorities sharing more information would continue. “People have to assume that the ATO will know a lot,” he said.

Anyone facing a tax audit should be forthcoming and back up their claims with records, Mr Bembrick said. “An audit is not something that anyone’s going to enjoy, particularly if it drags on.”

Most audits are finalised within 90 days. They usually start with a phone call, followed up in writing, and the ATO often speaks with banks and employers. “We also access third-party data. It might be immigration records, toll records, anything we can use to try and verify these claims,” Mr Kendrick said.

Penalties can include repayments at high interest rates, fines and prosecution.

Tax agents are targeted too, and Mr Kendrick said the ATO monitored people who shopped around for agents who delivered the highest deductions. DIY returns are watched closely, with messages about high claims sent in real-time.

“In myTax, we monitor taxpayers who change their claims multiple times as a result of the message we give them. We can see them moving through their return. We follow these people up — you can see they’re quite blatantly working out how to get around that message,” Mr Kendrick said.

THE ATO’S THREE GOLDEN RULES FOR WORK EXPENSES

1. You must have spent the money yourself and not been reimbursed

2. The expense must be directly related to earning your income

3. You must have a record to prove the purchase.

“We want people to claim what they’re entitled to — no more, no less.” - ATO assistant commissioner Adam Kendrick