How much money Aussies need to earn in order to feel rich has been revealed

An Aussie father-of-three earning $230,000 a year took to an online forum to reveal he was struggling just to get by - and his grim admission struck a chord.

Work

Don't miss out on the headlines from Work. Followed categories will be added to My News.

New research has revealed exactly how much money Australians need to make before they feel rich – and it’s no small sum.

Financial comparison website finder.com.au conducted a survey that determined people would need a salary of $345,819 before they felt affluent.

Unfortunately, that’s considerably more than the average personal income of $72,000, according to Australian Bureau of Statistics data.

“Only a small percentage of the population earns anywhere near $346,000,” finder.com.au money expert Rebecca Pike said.

“That said, it’s been an incredibly tough couple of years for many, with household budgets pushed to the limit.

“With everything from soaring property prices to expensive energy bills, the average person now feels they need to earn a whole lot more to be wealthy.”

The reality of living expenses on a high income was a topic of discussion on Reddit yesterday, where a man posted to a finance forum that his family was “living paycheque to paycheque” despite raking in $230,000 per year gross.

The man and his wife have three children, all aged under six, and own a property worth $1.3 million with a mortgage balance of $750,000, he explained.

“I’m feeling a little lost, as we are – relatively speaking – earning a decent household income, but I can’t seem to really knock off that mortgage as aggressively as I’d like,” he wrote.

“It’s almost as if we are living month to month, with very little extra to spare.”

When his wife returns to work from maternity leave, he said the household’s income will increase again by about $3000 per month.

Commenters were sympathetic, with one describing the situation as “a s*** sandwich”.

“Earn enough to lose out on most government benefits and get taxed like a millionaire but don’t earn enough to cover it,” they wrote.

Another noted: “It is a poor reflection of what Australia has become if you are month-to-month on $230,000 a year.”

One noted that even when the man’s wife returns to work, it won’t make a material difference to their struggling scenario.

“Her working part time will help but also consider that you’re not winning that much on her part time salary,” they wrote.

“Two high performing 25-year-olds can reasonably obtain a 100,000 salary each. So right now, you’re a bit better than that young couple (who don’t have the expense of dependants).

“The simple problem is wife’s lack of income. Your salary is great for one person but once it supports a whole family you don’t really have much, plus a lot on presuming is going to tax too.”

Another pointed out that the mortgage on the family home is “was three mortgages 15 years ago”.

And one comment painted a bleak picture of the realities of modern life in Australia: “You have made huge investment in children, which will be having a substantial impact on your bottom line for quite some time. They can be very expensive. Hopefully, that investment will pay off for you in the future.”

Everything costs more

Over the past few years, red-hot inflation has sparked a cost-of-living crisis and millions of Australian families are struggling to afford the cost of essentials.

By the start of 2023, the consumer price index – a measure of the price of a fixed basket of goods and services – was running at 7.8 per cent, which is blisteringly high.

To put that into perspective, the Reserve Bank’s target for inflation is between two and three per cent.

The last time inflation was that high in Australia was at the start of the 1990s when the country was plunged into recession.

Rapid interest rate rises by the RBA have helped to lower inflation, but not as quickly as the central bank had hoped, and the impact on mortgage holders has been significant.

John Hawkins, a senior lecturer in economics at the Canberra School of Politics at the University of Canberra, said some prices rise “fairly smoothly” in line with inflation.

“Others, such as petrol and fresh food, are much more volatile,” Mr Hawkins noted in an article for The Conversation.

Inflation on its own isn’t the only thing hurting Aussies.

Mr Hawkins noted that cost-of-living becomes a growing problem with incomes fail to keep pace with it – and that’s been the case for many years now.

“Over long periods of time, wages tend to grow faster than prices. The economy becomes more productive over time and the gains flow to both workers and companies.”

The latest Wage Price Index released by the ABS in September showed a four per cent increase over the year, but a quarterly growth rate of 1.3 per cent.

While that represented the biggest three-month uplift in the 26 years of the WPI measure, it’s much lower than inflation.

And for the decade prior, wages growth was flat.

The wide gap between income and expenses is forcing more Australians into precarious financial positions, welfare groups have warned.

About a million households technically living in poverty based on standard measures are ones earning salaries.

That’s raised serious concerns about the growing trend of ‘the working poor’ – that is, the worsening sign that having a job isn’t a protection against financial despair for many Aussies.

And where you live make a huge difference to your bottom line.

Australia’s most expensive city

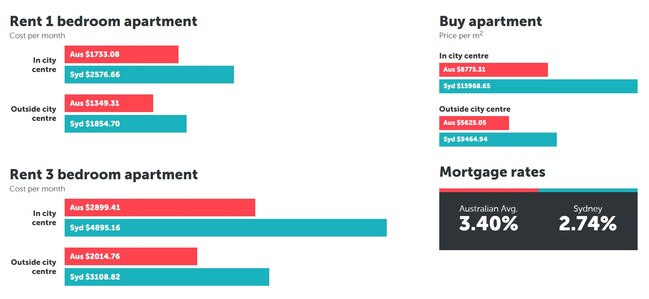

Living somewhere in Greater Sydney will see you pay more on a majority of expenses than elsewhere in the country, various measures show.

Housing is the biggest factor making it such an expensive place to live.

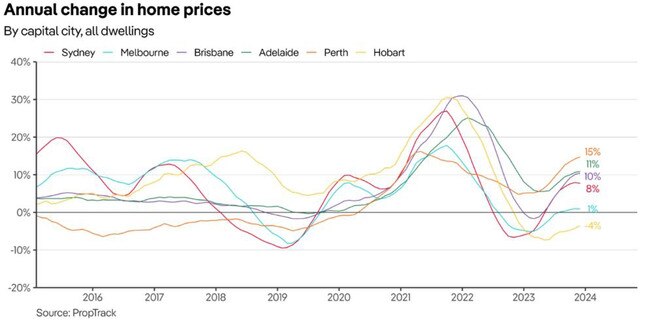

When it comes to buying a home, analysis by research house CoreLogic found a staggering gap between the price of a standard dwelling in Sydney and Melbourne of $345,000.

The median dwelling value in Sydney is $1.46 million and surged by 8.9 per cent last year, SQM Research data shows, while in Melbourne, the median home price is $1.04 million, up 4.3 per cent year-on-year.

For those on an average income, it would take more than 12 years to save a 20 per cent house deposit in the Harbour City – almost three years longer than in the Victorian capital.

Sydney simply isn’t building enough new homes to keep pace with demand thanks to planning restrictions and inefficiencies and a lack of available land due to the city’s geography.

With the ocean to the east, mountains to the west and large swatches of national parks in the north and south, the chances to expand out are limited.

Melbourne doesn’t have that problem and so huge levels of new supply have been generated on the fringes of the city.

The rental market in Sydney is just as dire, with median weekly prices rising by 14 per cent across 2024, according to SQM Research, on the back of a severe supply shortage and soaring demand.

CoreLogic data shows the average rent in Sydney is sitting at about $740 per week, while in Melbourne it’s considerably lower at $560 per week.

At a national level, rental prices in the New South Wales capital are about 55 per cent higher than the Australian average, according to analysis by Budget Direct.

Modelling by the Grattan Institute shows Sydneysiders pay 20 to 30 per cent more for electricity thank their counterparts in Melbourne.

Motorists there also cop fewer road tolls when driving around, while fuel also tends to be marginally cheaper. Public transport is more expensive than in most other major capitals.

Overall consumer prices are about six per cent higher in Sydney than the national average while locals pay as much as 2.2 per cent more for groceries than elsewhere in the country, Budget Direct found.

Leisure and recreation activities also cost more – a monthly gym membership is almost $20 more in Sydney than elsewhere in the country, movie tickets typically cost $2 more, and hiring a tennis court to whack a few balls on the weekend is more than three dollars higher, Budget Direct noted.

Age impacts income expectations

Perhaps unsurprisingly, a person’s age impacts how much money they need to earn in order to feel financially well-off.

Finder.com.au’s research on what salary would deliver financial security found Millennials who earn less need the most to feel affluent – a staggering $418,000 per year.

Generation X, likely battling high mortgage repayments and family costs but earning more money already, said they’d need $307,000 per year.

Baby Boomers, many of whom tend to be financially secure with a mortgage-free home, solid superannuation balances and other investments, would need $273,000 per year to feel rich.

“If you feel like your pay isn’t stretching far enough, take stock of where your money is going,” Ms Pike said.

“Cut spending on anything you aren’t using or no longer need, and don’t pay too much for what you do need.

“From energy to insurance to your mobile provider, compare your options to ensure you’re getting the best bang for your buck. If you haven’t switched any of these in the past six to 12 months, you’re probably paying too much.

“Work on habits like setting aside a regular portion of your income straight into a high interest savings account and let it grow.”

Earlier this week, news.com.au released comprehensive analysis showing how many Aussies could quickly save thousands of dollars in expenses.

More needs to be done

Prime Minister Anthony Albanese is facing mounting criticism that he’s not doing enough to help struggling Australians cope with the cost-of-living crisis.

The government’s Mid-Year Economic and Fiscal Outlook (MYEFO) released in December shows the next federal budget will post $9.8 billion in savings, resulting in a relatively thin deficient – and potentially a surplus by May.

Treasurer Jim Chalmers has embraced “responsible economic management” in cutting spending, identifying savings, and boosting coffers for a rainy day.

That will eventually have flow-on effects for households struggling with higher costs, Dr Chalmers insisted.

“Through our spending restraint and by returning the vast majority of revenue upgrades to the budget, our fiscal strategy is working alongside monetary policy to reduce inflationary pressures in the economy,” he said in December.

But the Australian Council of Social Services said cost savings should be diverted to meaningful support measures for those on the bread line – and those living significantly below it.

“The skyrocketing cost of rent and energy has created a tsunami of financial distress that is pushing people on the lowest incomes to the absolute brink,” ACOSS acting chief executive Edwina MacDonald said.

“Community services are at a breaking point, unable to keep up with the demand from people in desperate need of support. The government’s projections today show at least 100,000 more people will be unemployed next year.

“More of the same in the MYEFO does not cut it when people on low incomes are forced to choose between feeding themselves, paying their rent, or turning the lights on.”

Ms MacDonald said it’s “disturbing” that the treasurer’s mid-year update revealed expectations of almost no real spending growth by the government “when we know we need to do more”.

ACOSS has called on the government to urgently increase income support payments, scrap the “wasteful and inflationary” stage three tax cuts “that will put money in the pockets of people who need it least”, and provide further energy relief for those on low incomes.

“If the government is serious about easing financial distress, we need bold, sensible, and urgent action that will restore fairness to the budget,” Ms MacDonald said.

Originally published as How much money Aussies need to earn in order to feel rich has been revealed