Auditors from Big 4 financial services firms lash working conditions at Deloitte, PwC and EY

Ex employees from Australia’s largest financial services firms have lashed the company’s “ingrained” work culture after a woman was found dead at her Sydney office.

Work

Don't miss out on the headlines from Work. Followed categories will be added to My News.

WARNING: Confronting

Former employees at the ‘Big 4’ financial services firms have lashed the ingrained unhealthy culture of work and pressures auditors are subjected to, with 80-hour work weeks, poor remuneration, and chronic stress and burnout among the main concerns.

In Australia these top firms include Ernst and Young (EY), Deloitte, PricewaterhouseCoopers (PwC) and KPMG.

Former employee at Deloitte, Sarah* joined the firm as a graduate in its financial statement audit division. She says it was an “unspoken rule” that busy periods would see her working up to 70-hour weeks across six days.

Despite this, she remembers her salary as a graduate was just $55,000 not including superannuation.

“I would say I was severely underpaid for the hours. I think someone working at McDonalds would have been earning more than me on a per-hour basis,” she told news.com.au.

“If I were to divide it, I probably wouldn’t have been getting more than $15 an hour.”

Want to stream your news? Flash lets you stream 25+ news channels in 1 place. New to Flash? Try 1 month free. Offer ends 31 October, 2022 >

Lachlan*, who’s worked at PwC and EY described the culture at the Big 4 firms as an “iron man contest”. He also believes it would take years to break the “ingrained” company culture.

“You survive or leave,” he told news.com.au.

“Each level punishes the next level down. They see it as: ‘If I had to do it, then you have to do it’ and it propagates the same kind of bad behaviour.

“In saying that there are fantastic partners that care for their staff. However the good ones end up leaving because they’re punished as they treat staff well and aren’t as profitable as a result.”

The complaints were triggered by the tragic suspected suicide of a 33-year-old Ernst and Young (EY) employee, after her body was discovered at the firm’s Sydney CBD offices in the early hours of Saturday morning.

News.com.au is not suggesting the work culture at EY contributed to the employee’s death and the employee’s identity and role within the company has not been disclosed.

On Wednesday, the accounting firm confirmed the woman had left its George St offices at 7.30pm on Friday and returned just after midnight. This was about 20 minutes before police were notified of a “mental welfare report”.

Previously it was believed that the woman had returned to EY building at 7.30pm, after attending an event planned by the company held at The Ivy - a prominent Sydney bar and club.

The woman’s death has triggered widespread discussions of work culture and the pressure placed on employees among the Big 4 financial services company.

‘Near-impossible engagement targets’

Since Tuesday, news.com.au has received several complaints from former auditors across all the Big 4 firms, which cited 70 to 80 hour work weeks as the norm. Despite this, getting paid overtime is not.

While total working hours nearly double the normal 40-hour work week are common, KPMG, EY and PwC maintained employees averaged works days of 7.5 to 8.4 hours a day, representatives told a parliamentary inquiry in 2020.

At the time, PwC said records from the financial services firm place the average hours worked per week between 40 to 42 hours.

“That includes the peaks, time off and all of that,” the representative said.

Similarly, EY said while there was “sometimes work outside of the standard 7.5 hours”, this didn’t occur “throughout the whole year”.

KPMG, however, said it was “very hard to give an average” working hours recorded by staff.

However, former employee Lachlan told news.com.au auditors are actively dissuaded from recording the total amount of hours worked on each client. The total number of billable hours an auditor has spent on one case is recorded, but Lachlan said workers were advised to put in time well beyond their billable figures.

“They claim that staff only work hours slightly above normal hours but what they don’t say is that they set unrealistic budgets that force staff to not charge time,” he said.

“If you put too much down on your time sheet then you get questioned about it because it has to be accountable somewhere.

If staff did go above the budgeted time on a client, they risked being placed on performance review.

“When staff went to HR for advice the partners were informed and it generally resulted in the staff being put on a list for redundancy or performance reviews,” he said.

Emeritus Professor of Macquarie University’s Department of Accounting and Corporate Governance James Guthrie said junior staff members are the most affected by these expectations.

“They give graduates and younger employees $25 to $30 an hour and charge them out at $150,” he told news.com.au.

“What they have to put in place is a rule where they should only work the number of hours required on their contract.”

Peak auditing periods

The auditing industry is currently in its peak period. This comes as ASX-listed companies prepare to release their annual reports by September 30. The period between January and March is another busy period for companies who end their financial year on December 31.

Sarah said it was expected employees would stay back every day except for Friday during these periods. However during non-peak periods she said she would be in the office from 9am to 6pm.

“During the busy seasons, I would get there are 8.30am and leave around 11pm and get home at 12am and do the same thing all over again from Monday to Thursday. On Fridays we’d leave at a more reasonable time,” Sarah said.

“If you did work on the weekend, you’d be working together as a team, which would maybe be an extra full day in the office.

“I would say my worst week was about 70 hours.”

‘No amount of money is worth it’

Another former PwC senior associate Sebastian* said that he was paid around $67,000, once superannuation contributions were removed from his total salary of $74,400.

“It’s a tough slog, and they sell you on ‘what it does to your CV’ and ‘you can make partner …’. The former I agree with the latter, well, yes, if you sell your soul to the firm and agree on no life outside of it,” he told news.com.au.

“I know many partners across all the Big 4 firms and no amount of money is worth what they sacrifice.”

Working in consultancy and advisory, Sebastian said the work never stopped. He remembers regularly working 80 hours, including one year where a project required him to work throughout Christmas and New Years.

“I heard one of the vendors comment: ‘They’re consultants. They’re used to working around the clock,’” he said.

‘I saw it as an investment’

However, stints at Big 4 companies – particularly for graduates and junior staff can come with a silver lining.

While Sarah recalls being burnt during her five-year stint at Deloitte, she says having that accreditation did help her future employability.

“I saw it as an investment. There was a prestige to working with the Big Four and that is why people are drawn to it,” she said.

“I hated my life during that period and I was excited to get out but looking back, I can see that I learnt a lot from it.

“That’s why people always look for Big 4 recruits. There is the standard that we are driven to do work faster and in a shorter amount of time and under more pressure and stress.”

Apart for extending deadlines for auditors, Sarah says allocating more staff would also lessen the load for existing team members.

“The more team members, the less workload for each individual,” she says.

However, the industry is also currently in the midst of a worker shortage. According to CommBank Accounting’s May 2022 Market Pulse survey, at least 93 per cent of firms have experienced difficulties in finding quality of staff. A decline in overseas staff and migrant employees is a major issue.

“This becomes a problem of why aren’t the Big 4 recruiting more and putting in place systems and processes that support the new generation of accountants,” adds Prof Guthrie.

EY staff responds: ‘Aren’t addressing it at all’

Current EY employees hope the death of the recent employee will trigger a conversation around workplace culture and workload.

Some employees have criticised the firm’s response, in regards to the woman’s death.

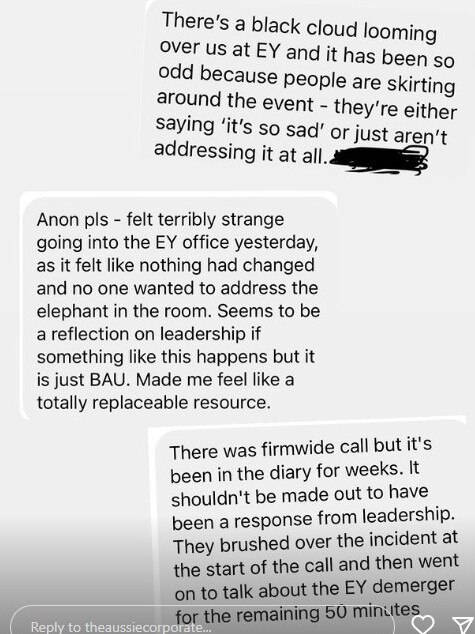

In comments shared by EY employees with Instagram account The Aussie Corporate, one current staffer said: “There’s a black cloud looming over us at EY and it was been so odd because people are skirting around the event. They’re either saying ‘it’s so sad’, or just aren’t addressing it at all.”

During a pre-planned firm-wide call on Wednesday, they said the death was “brushed over,” before leadership spoke about the demerge for the remaining 50 minutes.

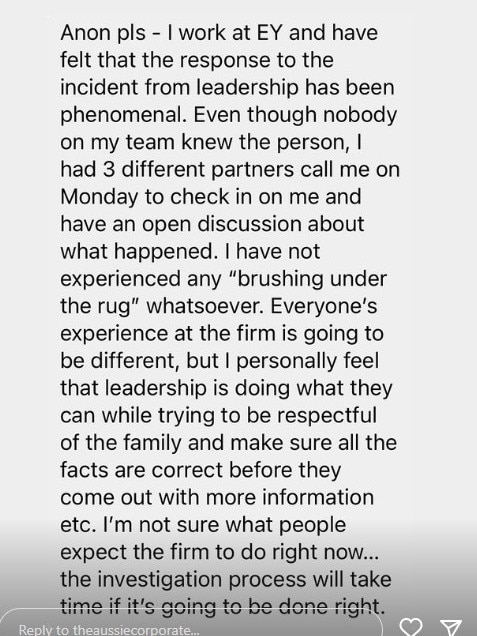

However, another EY worker said the leadership has appropriately navigated the situation.

“Even though nobody on my team knew the person, I had three different partners call me on Monday to check in on me and have an open discussion about what happened.”

As it stands, staff have been told of an “incident” which occurred over the weekend and resulted in the death of an employee. In an email seen by news.com.au, staff were notified on Monday morning that a “police investigation is ongoing we have been informed that there were no suspicious circumstances”.

“As a result of this tragedy, we are conducting a comprehensive and wide-ranging internal review that will include health and safety, security and social events,” the email read.

“Jono Nicholas, our Chief Mental Health Adviser will play an important role in helping guide and advise us as we move forward.”

In a comment to news.com.au, EY said a 24/7 Employee Assistance Program had been offered to all staff and their families, as well as onsite counselling services. Police investigations are continuing, although investigators believe there are no suspicious circumstances surrounding her death.

News.com.au has reached out to Deloitte, EY, PwC and KPMG, but did not receive a response prior to the publishing of the article.

*Names have been changed to protect the interviewers identity.

Originally published as Auditors from Big 4 financial services firms lash working conditions at Deloitte, PwC and EY