Woodside joins Origin and Fortescue in scaling back green hydrogen project

Woodside Energy has joined Origin and Fortescue in rolling back the Albanese government’s ambitions to make Australia a global leader in green hydrogen.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Woodside Energy has joined Origin and Fortescue in rolling back the Albanese government’s ambitions to make Australia a global leader in green hydrogen.

The energy giant confirmed it has pulled out of green hydrogen projects in Tasmania and New Zealand but stressed it was still going ahead with plans for plants in the US and Perth.

Origin announced this week it was exiting the $207m Hunter Valley Hydrogen Hub project because of uncertainty around the “pace and timing of development of the hydrogen market” and the risks associated with capital-intensive infrastructure.

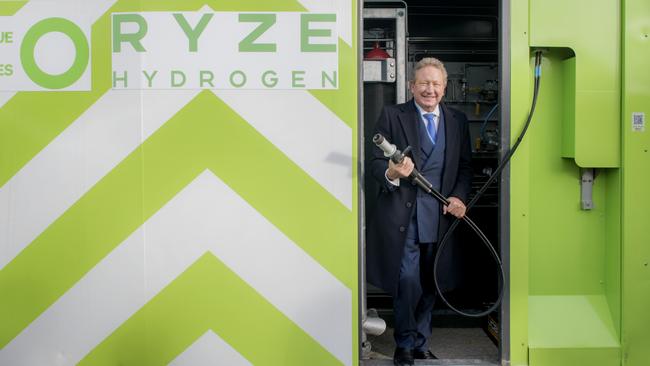

Billionaire Andrew Forrest earlier this year scaled back his green hydrogen targets in a backdown that coincided with the loss of 700 jobs at Fortescue.

Woodside’s proposed H2TAS renewable ammonia and hydrogen production facility in Tasmania has been put on the backburner after the withdrawal of environmental applications. Woodside said it would “continue to assess the viability of this potential opportunity”.

In New Zealand, Woodside has ceased discussions with Meridian Energy, Mitsui & Co and Murihiku Regeneration about developing the Southern Green Hydrogen Project. Woodside also has changed its planned H2Perth project from ammonia and hydrogen production to liquid hydrogen only, following feedback from customers.

ANZ head of institutional banking Mark Whelan expects the energy transition to be challenging as different technologies evolve.

“With hydrogen and green hydrogen you’ve got to wait for the technology to catch up with the thinking. But I think it eventually will,” he said. “There’s a lot on with that and there’s a lot going on with sustainable aviation fuel or green fuel.”

Still, more energy companies are expected to jettison costly green hydrogen projects, according to Hazer chief executive Glenn Corrie. Mr Corrie, whose company is developing so-called turquoise hydrogen derived from gas, said he was in discussions with one major company that had walked away from green hydrogen because of the prohibitive costs.

“I certainly expect more green hydrogen projects to fall over,” Mr Corrie said. “Origin is just the latest high profile project to not get anywhere near the finish line because of the cost. ‘They have got to get away from green hydrogen and look at other forms. The hard truth about the costs of green hydrogen are starting to come out and the writing is on the wall.”

Geo Science Australia said there remained significant interest in Australia’s future hydrogen production, with over $200bn in the investment pipeline for hydrogen and derivatives. But there was a decrease in the total number of hydrogen projects from 110 in 2022 to 104 in 2023 due to the reclassification or rescoping of projects.

The number of projects that were operational or under construction increased from 22 to 31 over that period, but projects were still small, with the largest operational project, Hydrogen Park South Australia, producing 175 tonnes per year from electrolysis using renewable energy.

The global hydrogen market has been forecast to reach $US1.4 trillion by 2050.

The Department of Climate Change, Energy, the Environment and Water says Australia has a range of comparative advantages in this market. Hydrogen hub projects around Australia continue to be developed, including the Edify Green Hydrogen Project in partnership with Siemens Energy Global, supporting a green hydrogen hub in Townsville; Stanwell and Idemitsu’s project in Gladstone; and HIF Global in Bell Bay.

Mr Corrie said his company’s technology converted natural gas and similar feedstocks into hydrogen and graphite, using iron ore as a process catalyst. That produced ‘‘clean’’ hydrogen with significantly lower carbon dioxide emissions, enabling it to be used in a range of developing clean energy applications, as well as in large existing chemical processing industries. “We can produce energy at a fifth of the cost of green hydrogen,” he said.

Earlier this year, Hazer signed a memorandum of understanding with Korea’s Posco Steel about integrating its technology into low-carbon steel production.

The Opposition has called for the possible development of “pink hydrogen” derived from nuclear power, accusing the government of putting all its eggs in one basket in its pursuit of green hydrogen.

‘When it comes to hydrogen, they have insisted that it can only be green hydrogen,” said opposition spokesman on climate change and energy, Ted O’Brien.

“It can only be hydrogen that comes from wind or solar technology as the energy source,” he said. “They ignore the possibility of hydrogen, which can be generated through gas with carbon capture and storage. They ignore even pink hydrogen as a potential, which is zero emissions nuclear.”

Mr O’Brien said the Coalition had “always been very technology-agnostic, positive about hydrogen’s potential. “We have to stop Labor from sort of selling these fantastical dreams that really are ending in closures or basically companies like Origin withdrawing from making final investment decisions,” he said.

Additional reporting: Joyce Moullakis

More Coverage

Originally published as Woodside joins Origin and Fortescue in scaling back green hydrogen project