WiseTech tries to move on with life without Richard White

In comparison to MinRes, the WiseTech board has managed to engineer the transition of a dominant CEO into a new consulting role. But investors are still feeling the shock.

WiseTech’s executive search firm Russell Reynolds is up and running, with a sharp focus on potential Silicon Valley names and other global tech executives who could step up to run the $46bn logistics software player.

Internal names are also being considered, but outsiders have the frontrunning as WiseTech starts on path of gently moving on from its founder, biggest shareholder and long-serving chief executive.

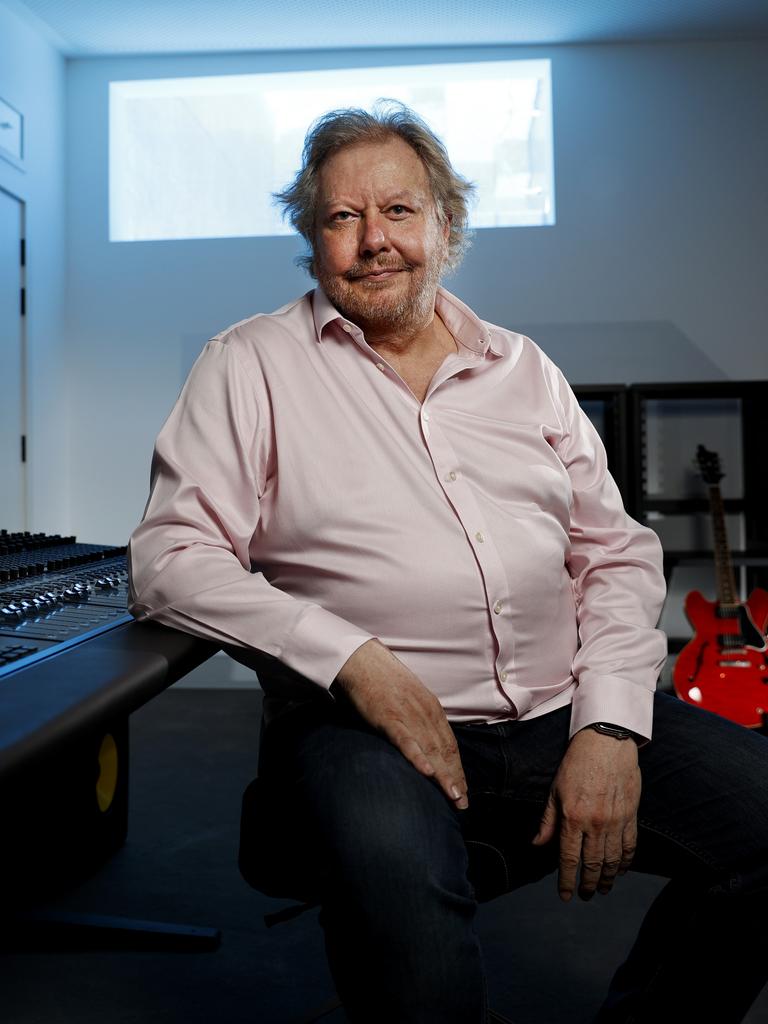

Even after all the high drama surrounding last month’s sudden exit of Richard White, WiseTech is reverting to business as usual, coming off a year of record profit and passing the $1bn revenue mark. The tech company’s shares hit a record high this week and unlike Mineral Resources, another founder-led company facing intense pressure, WiseTech is expected to avoid being hit with a protest vote at Friday’s annual meeting.

WiseTech, too, has quietly put the emphasis on White’s new role as “consultant to the board” over the planned job title of “founding CEO”.

This shift should help smooth over any governance confusion when a new chief executive is eventually appointed – a process still many months away.

However, with an acting CEO firmly in place, it increasingly looks like Richard Dammery has so far managed to engineer the delicate transition of a founder from the role of CEO to a position that still has meaningful input into the company’s future. The first phase of the transition – the exit of a dominant founder – is often the most risky.

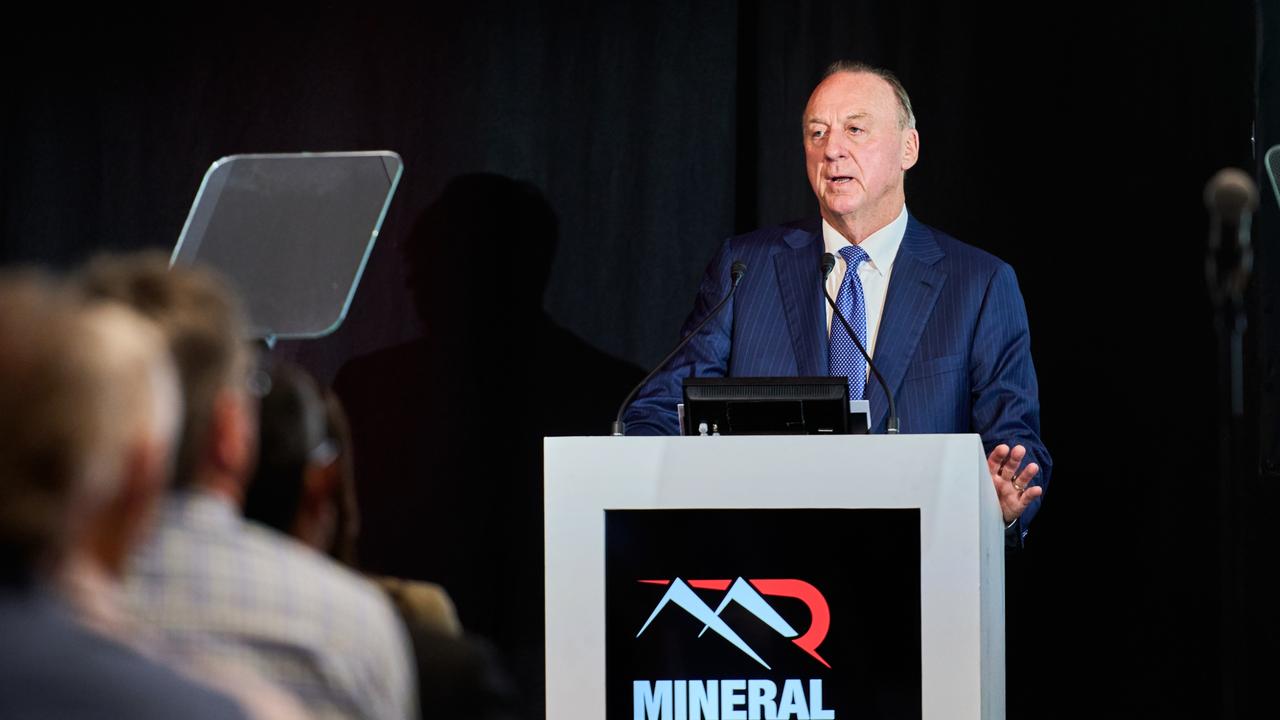

MinRes, by comparison, where governance issues around co-founder Chris Ellison emerged around the same time and potentially with more to come, was hit with a 75 per cent protect vote at Thursday’s annual meeting. Ellison says he will step down after 12 to 18 months, although he told shareholders “I hate what I’ve done”.

Still, there is a legitimate concern among some WiseTech investors that the internal focus of the board and White’s own major distractions have disrupted momentum around the planned launch of three keenly anticipated breakthrough software products.

Cargowise Next and Container Transport Optimisation were both planned for release before the end of this year and a third product, ComplianceWise, had also been slated for a soft launch in around the same time.

White, who turns 70 next month, had been deeply involved in the development of each of these products.

At Friday’s meeting Dammery conceded there would be a delay in one – Container Transport Optimisation which will impact revenue and earnings guidance. Confirmation of the delay sparked a share crash of as much as 20 per cent.

“I need to say that the Board is disappointed that the diversion of Richard White’s attention away from product development at a critical juncture has impacted the timing of the release of some of the three breakthrough products,” the chairman said in his prepared remarks.

White’s sudden exit last month followed mounting scandal around his private life and revelations about his relationship with several women outside the company. He had a lengthy relationship with one woman who later joined WiseTech. White had informed the board before she joined the company in May 2017, although he didn’t disclose he paid for her house.

Reputation hit

The billionaire had little choice to go, given his and WiseTech’s reputation were so deeply entwined and both were taking a hammering as a result of revelations coming out of a court case. As well as being co-founder, White is the single biggest shareholder in WiseTech with a more than 30 per cent of the company.

A board investigation is underway into any other past disclosures or governance issues, and it has law firm Herbert Smith Freehills and Seyfarth Shaw to lead the investigation.

But in a big win to the WiseTech board, each of the four big proxy advisers – ISS global, Ownership Matters, Glass Lewis and super fund-backed ACSI – have backed all the proposals tabled at the upcoming annual meeting, including supporting remuneration reports and the election of two new independent directors to the board – Lisa Brock and Fiona Pak-Poy. This is a big factor in avoiding a protest vote.

ISS, however, noted its concerns around previous governance oversight for the failure to disclose the remuneration package of chief growth officer Gail Williamson, who was paid $4.7m over two years between 2018 and 2019 that at the time would have made her the highest paid executive. This raises concerns regarding “transparency, accountability to shareholders and appropriate board and risk oversight,” ISS said.

Following a short overseas break, White has returned and is expected to attend the meeting in his new capacity as a consultant – a role locked in for the next decade and coming with a $1m a year annual salary. The meeting is online only, which has been the practice since the Covid pandemic, meaning it will avoid public clashes.

Dammery has met or spoken with nearly all of WiseTech’s major investors in the lead-up to the meeting. The feedback to the board had been an overwhelming desire to have White stay on in some form, but the question around the new consulting role is what it means in practice and what are the boundaries with an incoming CEO.

The message from Dammery during these meetings to investors was this was no ordinary corporate transition and it was not like flicking a switch and dropping in a new chief executive.

White has driven every part of the strategy for the past 30 years in building the business from the ground up and in the process of stepping back this will also involve the evolution of WiseTech.

The chairman has told investors WiseTech is on the path of “organisational maturity” from a company where everything evolved around the founder to one where power was distributed more evenly among executives.

The prospect of White staying on as a consultant and a figurehead isn’t expected to turn off future CEO candidates, with the arrangement quite common across Silicon Valley where founders stay on to have a “thought leadership” role.

Dammery recently met the boards of several US tech companies where similar arrangements around having the founder involved at arms-length is commonplace.

The next milestone for WiseTech to show it’s business as usual will be its investor day on December 3. While White played a big part in developing the strategy, the presentation will be led by acting CEO and former chief financial officer Andrew Cartledge.

With or without White running the day to day, inside WiseTech there is no backing away from the aspiration to hit the $5bn revenue over time.

Originally published as WiseTech tries to move on with life without Richard White