Vacancy blues hit office market as lockdowns start to bite towers

There is more empty space in office towers but landlords are confident that demand will recover as vaccines are rolled out, with small tenants to drive the comeback.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

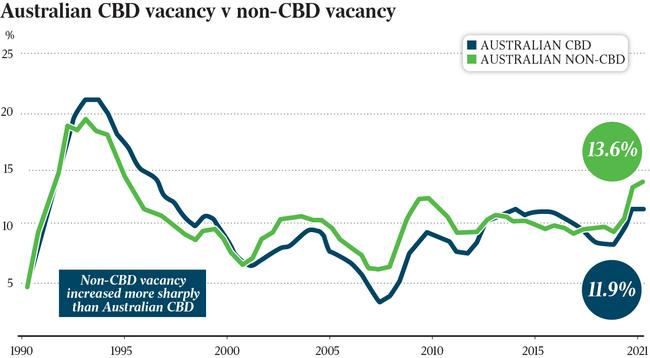

National office vacancy has hit a 25-year high as lockdowns bite across much of the country but landlords are hopeful the market will come back next year as vaccines are rolled out and workers return to their desks.

The Covid-19 pandemic and the tough restrictions introduced to quell its spread have driven up office vacancy to 11.9 per cent nationally as city markets deal with towers that were conceived of in boom times coming on line when conditions are still fragile, with Melbourne bearing the brunt of the problems.

The Property Council of Australia’s latest Office Market Report found office vacancy increased in the six months to July 2021 and landlords are now facing problems in Sydney as the city faces a prolonged lockdown despite its comeback in the first half of the year.

Vacant space is now at its highest since the pandemic began, on par with levels last seen in 1996, when the office market was in recovery from the recession of the early 1990s.

In a sign of the lasting impact of prolonged lockdowns, Melbourne’s office towers have proved much slower to recover. Vacancy in the capital city has risen 2 percentage points in the past six months to 10.4 per cent. Sydney was the only other capital to report a rise in the lettable space, up 0.8 percentage points to 9.2 per cent in the same period.

The worrying difference in the upward movement lies in the fall-off in demand for space in Melbourne, according to Property Council chief executive Ken Morrison.

Demand on a per-square-metre basis plummeted in Melbourne over the past six months, a symptom of extended lockdowns last year heavily impacting business. On the flip side, demand for space had strengthened in Sydney, with the city’s vacancy rising as a result of more stock coming online.

“There is a surprising resilience in office markets in the face of the pandemic … and if we take Melbourne out of the picture for a moment, in CBD markets demand has actually gone up overall,” Mr Morrison said.

“So there’s two stories: one is resilience, and then there is Melbourne.”

Melbourne’s office landscape has also changed dramatically over the past 24 months, moving from a city of undersupply pre-pandemic to one struggling under the weight of Covid-19. Over the next six months, more than half of supply promised to CBDs will be directed to the Victorian capital. At the same time, demand has contracted. Some of the most significant instances of this include big four bank NAB cutting their space by 35,000sq m at 800 Bourke Street and Origin Energy reducing its office space by 9600sq m at 321 Exhibition Street.

Mr Morrison believes it will take a strong revitalisation campaign to revitalise the city and restore it to its pre-pandemic glory.

“Melbourne spent most of last year in lockdown and has experienced this calendar year in and out of lockdown, albeit much shorter periods. That has had a significant impact on the tenant market there,” he said.

“Employers, employees and the community haven’t yet been able to re-embrace the Melbourne CBD like they have in Sydney or the other capitals. That’s going to need to be a big priority as we continue through this next phase, this vaccinated supported phase.

“More than any of Australia’s CBDs, Melbourne has an impressive ecosystem. It is more than our business capital … but its role as a capital of commerce underpins everything. That’s what is at risk: that the Melbourne CBD loses what’s great about it, all that vibrancy,” he said.

Elsewhere in the country, capital city vacancy rates shrank in the past six months. Canberra reported the tightest vacancy rate of 7.7 per cent, followed by Brisbane (13.5 per cent), Adelaide (15.7 per cent) and Perth (16.8 per cent).

Office space outside of the city centres reported a higher vacancy rate than the CBD as vacancy in the suburban and non-city markets hit 13.6 per cent, marginally higher than six months ago.

Sub-lease vacancy was largely on par in the CBD and outer-city markets. However, subleasing more than doubled over the past six months in Melbourne.

“We thought tenants were going to throw space out the window, get rid of it, get it off the books, and we‘re going to see this figure skyrocket,” Mr Morrison said. “What we saw was a significant moderation of expectations. So yes this number has gone up and might still go up into the future, but it certainly hasn’t skyrocketed over this last six month period as we feared it might.”

CBRE head of office leasing, Pacific, Mark Curtain, said that notwithstanding the recent NSW and Victorian lockdowns, the national leasing market had rebounded strongly through the first half.

The agency recorded more than 300,000sq m of new deals in assets of 1000sq m-plus in the first half of the year. This was down on pre-Covid levels of about 500,000sq m, but well up on the depths of the pandemic.

Sydney’s leasing inquiry levels rebounded strongly, topping 238,000sq m in the first half, but its performance in the wake of lockdown will be critical.

“Given the extent of the ongoing lockdown in NSW, we anticipate second half 2021 inquiry and deal volumes will be impacted, but to what degree is hard to determine at this point.

“We remain optimistic that the number of unforeseen lockdowns will diminish as vaccination rates reach targeted levels across the population, resulting in more stable conditions in late-2021 and moving into 2022,” Mr Curtain said.

JLL’s head of office leasing, Australia, Tim O’Connor, said the length of Sydney’s lockdown would determine the impact on office leasing activity. “But the encouraging sign is that there is far less uncertainty around office space decisions compared to last year’s lockdown,” he said.

Mr O’Connor said the negotiations that were active in Sydney prior to lockdown were progressing and a number of heads of agreement had been signed recently. “The momentum we saw in labour markets and leasing inquiry over the second quarter showed that organisations are planning for expansion in 2022 and beyond,“ he said.

Originally published as Vacancy blues hit office market as lockdowns start to bite towers