The $50bn strategic bet that’s set to change BHP forever

The BHP of the future will be less reliant on Australia and even less about iron ore as CEO Mike Henry reshapes the miner. Is it the right strategy?

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

BHP is entering one of those generational inflection points, with chief executive Mike Henry throwing everything at securing a long-term future in copper as he hitches himself to a new kind of commodities super cycle.

The shift will change the look and feel of BHP just as it has major implications for Australia, with the miner set to rely less on its home country as a driver of earnings and by consequence means less investment will be made here than BHP has been doing over the past two decades.

BHP has entered 2025 taking a big step forward on its strategy of locking down future facing commodities like copper and potash – a fertiliser that doesn’t need costly processing. Copper in particular is about to enter its own super-cycle, as iron ore stages a slower exit.

Henry has laid out an aspirational ambition for BHP to become a 2 million tonnes a year copper producer by mid-next decade. This bullish target won over market doubters over BHP’s solid, but uninspiring, December half numbers.

With the big copper deposits becoming rarer, Henry has been busy in the past two years staking out ground.

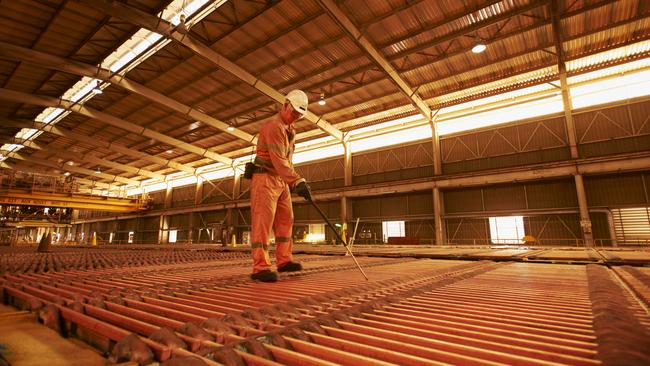

The recent buyout of Oz Minerals provide the starting point and was the missing piece for BHP to consolidate a string of existing and greenfield copper prospects based around its massive Olympic Dam mine in South Australia.

Henry last year made a high-stakes play for the copper rich but troubled UK miner Anglo American. He misjudged as Anglo rejected his advances, so to prove his copper determination, Henry instead signed on a long-term venture with Sweden’s Lundin Mining to develop a greenfield mines in Argentina’s Vicuña region. The entry ticket for Vicuña was $US4bn ($6.3bn) cash, and building a mine will require many billions more. BHP also has advanced plans to spend up big, stabilising output from the maturing giant Escondida mine in Chile.

Also up his sleeve is the giant resolution copper mine in Arizona he owns jointly with Rio Tinto. Donald Trump’s White House is expected to give new momentum to the mine that has stalled on legal challenges. However, Henry says technical testing and winning support from local landowners means progress on this mine is still years away.

On potash, Henry has already sanctioned more than $U15bn to be spent on developing the Jansen mine in Canada. The first stage of Jansen has been under construction for years, and BHP is now within reach of generating the first dollar of income from the ultra long life mine.

“One of the single biggest determinant of value for a company in our sector is the portfolio that it holds, and we have successfully reinvented ourselves over the 140 years,” Henry tells The Australian.

“The BHP in existence today is about recognising the economic trends that were unfolding around us. We wanted to deleverage ourselves from commodities that we saw thought had more downside risk over the long term,” he says in reference to the oil and gas exit three years ago.

“We wanted to up weight in future, facing commodities, and we specifically called out copper and potash,” he says. And while the mothballed Australian nickel remains under review, this low returning business is all but shelved for good given competing demands for investment across other parts of BHP’s portfolio.

Powering up

For years, Henry has been talking about the energy transition. Copper is used in all parts of the electricity supply chain, and he is convinced there will be a step change in demand over coming decades.

Increasing this conviction, energy intensive digitisation and AI has now been added to BHP’s like of thematic drivers of demand for its growth commodities, alongside population growth, urbanisation – themes that also feed into potash.

However, Henry will also be asking his investors to take a big leap of faith to get there – and much of this leap relies on China’s economy stabilising in the next few years. Henry is nonplussed about the impact of a global trade war, he also believes there are “green shoots” across China’s economy, that grew at 5 per cent last year.

The reason for his optimism is BHP will need all the cash it can possibly get as the next few years sees a sharp step-up in spending to build out new mines and expand existing ones. This will involve BHP committing around $US11bn a year over the next few years, compared to just over $US7.5bn over most of this decade.

That’s already starting to happen in the first half of 2025 with spending on track to hit $US10bn this financial year, before moving up again. Some 65 per cent of this spending will on copper and potash.

In the next three years Henry’s spending on copper and potash growth will run to $US20bn. Throw in the cost of buying Oz Minerals and Vicuña and that’s $US30bn, or nearly $50bn in local currency.

At the same time, a pullback in commodity prices, particularly iron ore, has weighed on BHP’s revenue and therefore earnings. BHP’s dividend is already feeling the squeeze at US50c a share, down from US72c and coming in at the lowest absolute level since 2017.

The miner too had to borrow to partially fund the dividend payment, pushing up its debt levels to almost $US12bn, from almost no net debt coming out of Covid. BHP has put investors on notice that it may need to “temporarily” move above its net debt target temporarily to back future investments such as Vicuña.

The new disciplined BHP is committed to a minimum 50 per cent dividend payout ratio as a bulwark against the miner’s long term habit of overspending in areas that delivered marginal returns.

Earnings shift

Underscoring the shift that BHP has underway, copper earnings hit the $US5bn mark during the December half, helped by a 10 per cent jump in output as well as prices received. Iron ore, by comparison, hit $US7.2bn, which was down 22 per cent as prices pulled back by around the same amount. Output for iron ore was up 1 per cent during the half.

Copper now represents a 39 per cent of BHP’s earnings mix, and is fast closing in on iron ore that now sits at 56 per cent. Five years ago, the equation was iron ore at 65 per cent and copper at just 19 per cent.

Henry’s not willing to make the call when copper overtakes iron ore. He says the West Australian iron ore operations will continue to be a “fantastic” business.

However, he does see a near future where there’s slower sustained growth taking place on iron ore and future prices for iron ore probably being lower than they are today.

This is in contrast to the higher growth in output to come for copper over the course of the next decade, as well as likely higher prices in future. That’s already evident now with the consensus forecasts for medium-term copper prices rising.

“The way I would paint it is we’ve had this portfolio with one dominant business being iron ore for a number of years now. In future, we will have, you know, three or three and a half equally placed significant businesses for BHP, being iron ore, copper, potash in the fullness of time – and then a very high-quality coal business,” he says.

“That’s the thing about the resilience of our business, it is improving over time, Henry says. “It will give us more growth optionality as well, because we’ll be spread more evenly across multiple commodities”.

The shift also means less Australia for BHP.

More Coverage

Originally published as The $50bn strategic bet that’s set to change BHP forever