Concerns over companies vying for court recording, transcripts job

Is the Queensland Government about to preside over another costly IT bungle? That’s the fear of some parties as they keep tabs on the process to pick a new court reporting contractor.

QLD Business

Don't miss out on the headlines from QLD Business. Followed categories will be added to My News.

Is the Queensland Government about to preside over another costly IT bungle?

That’s the fear of some parties as they keep tabs on the process to pick a new provider for the state’s court recording and transcription services.

Just last week the current contractor, Auscript, and four rival companies vying for the lucrative deal rocked up for an initial tender briefing about the complex, technology-focused job.

But eyebrows have been raised about the track record and suitability of some of the Auscript competitors, which include a US outfit, a French mob and a small Victorian player.

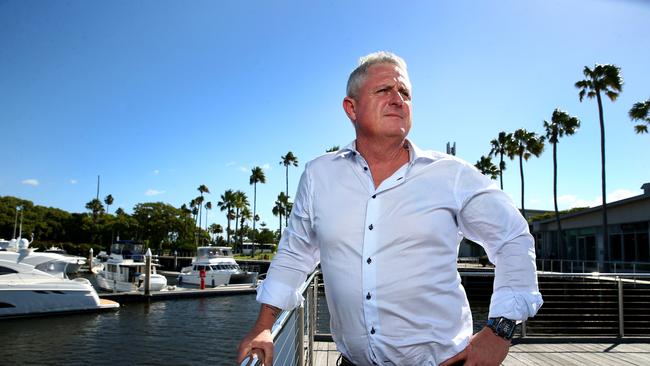

Brisbane-based Auscript, headed by Peter Wyatt, snared the job in controversial circumstances in 2013 after the Newman government privatised the service, laying off nearly 200 public servants in the State Reporting Bureau and promising $6 million a year in savings.

Under the contract, Auscript reaped $54.5 million over six years, with a further four-year option taking that to $100 million. It helped cement the company’s position as a national and global leader in the industry.

But the then-Opposition repeatedly questioned the outsourcing of the service and, once in power, Premier Annastacia Palaszczuk described the privatisation as “a great debacle’’.

NEW MODEL

Fuelling Palaszczuk’s argument has been legal sector complaints about fees charged by Auscript and some delays in service.

A report by the Auditor-General in 2016 found the privatised model cost the state less money but the savings were far short of the $6 million promised annually. Still, over the life of the contract, the saving were tipped to reach nearly $20 million.

Presumably keen to keep costs low, Attorney-General Yvette D’Ath announced earlier this year that the service will continue to be outsourced after the current contract ends in March 2021.

D’Ath flagged a “new model’’ for the service without elaborating. But there’s well-informed speculation that the government will move the technology back in-house while doling out the transcription work to a panel of providers, a change one source described as “a recipe for chaos”.

Given the alleged limitations of Auscript’s rival bidders, one source close to the company predicted a “looming debacle’’ if it lost the contract. “You’d think it would be a no-brainer, particularly given the government’s buy local strategy,’’ he told City Beat.

Intensifying concern is the government’s woeful record on IT cost over runs.

Just this month a contract to streamline debt recovery blew out by $24 million and who can forget the $1.2 billion health payroll debacle a few years ago?

BATTLE OVER

It looks like the battle for control of Port Hinchinbrook’s marina and commercial areas is over, giving long-suffering residents hope the cyclone-smashed area can finally be revived.

Two rival camps, Oakland Investment Group and Sino-Resource Import & Export Company, had each claimed to be the rightful mortgagee over the common areas in the far north Queensland community at Cardwell.

When a Cairns Supreme Court ruled in favour of Sino in May last year, Oakland appealed the decision. This week the Court of Appeal court threw out the case, paving the way for Sino to assert control.

“Hopefully it’s a path forward, given that the LNP committed $1.5 million for dredging if they won,’’ one homeowner told us yesterday.

Oakland and Sino had clashed over the site since an entity known as The Passage Holdings collapsed in mid-2017 owing $13.7 million.

Passage, which was closely associated with disgraced bizoid Craig Gore, had acquired the property for nearly $3 million and flagged a grandiose $450 million redevelopment.

Sino is comprised of five American investors whose venture capital group is registered in the British Virgin Islands. It had tipped in $6.8 million to the project and alleged that Oakland’s touted $4.15 million loan to secure a top-ranking mortgage never went ahead.