Behind the smart pricing machine being built by JB Hi-Fi

The electronic goods giant is in the early stages of building a digital platform to keep shoppers coming back and big global brands in its corner.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Behind JB Hi-Fi’s low fidelity shopfronts, the nation’s biggest electronics good retailer is building a sophisticated pricing machine designed to keep customers coming back and big global brands in its corner.

Since November, JB Hi-Fi has been quietly trialling a loyalty program JB Perks, offering member discounts, access to coming sales and even birthday greetings. In the three months since launching, it’s now up to 405,000 members and growing. It has been launched in a crowded market, but Australians have shown they are willing to sign on for a good loyalty program.

The big guns of Australian loyalty include Qantas Frequent Flyer with more than 13 million members, Virgin Velocity on 10 million, Woolworths has more than 12.5 million while Priceline Sister Club, now owned by Wesfarmers, has more than 7 million.

JB Hi-Fi chief executive Terry Smart says the program is designed to help the retailer to “join the dots” between the customers who are purchasing online and the customer shopping in-store. This means they can target in-store shoppers in different ways, for example if they are an Apple user verses a Samsung user, and start providing pricing benefits through the program. The ultimate strength of JB Perks will come as it gets more momentum and suppliers will start looking to fund promotions into the program given it promises “laser like” targeting of customers. This will ultimately help drive JB’s top line sales growth.

“Suppliers will really step up and support this program as it continues to roll out and grow in numbers,” Smart says. Currently 15 per cent of JB’s total sales are generated online.

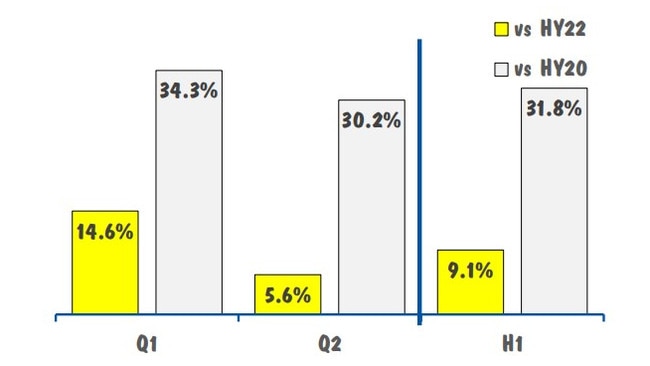

The CEO was talking as the JB Hi-Fi machine rolled on, delivering an 8.6 per cent jump in first half sales to $5.3bn. Net profit for the half jumped 14.6 per cent to $330m. One sore spot is the near record levels of inventories, which are now pushing $1.2bn. Signs of cooling consumer demand as the economy slows is starting to spook investors, sending JB’s shares down more than 5 per cent on the session.

With more than $9bn in annualised sales JB is now getting into the big leagues of global electronic goods retailers, which in term becomes an important distribution point for global suppliers.

Smart points out JB’s younger and tech-savvy customer skew makes them early adopters and is important to suppliers looking to maximise sales for their new products. At the same time, The Good Guys has a lock on established and first-time homeowners.

Those other secret to JB Hi-Fi is its ruthless focus on costs and sales productivity. It has a flat management structure where the CEO often answers the phone. And one of the reasons the stores feel cramped or busy is due to having highly productive floor space as it seeks to squeeze every ounce of sales per square metre. This relentless cost focus, including a large causal workforce that can be scaled up or down allows JB Hi-Fi to respond to market swings or compete against new competitors.

Endeavour, the owner of Dan Murphy’s and BWS, is using loyalty in a different way. With alcohol a more frequent buying experience, the My Dan’s loyalty scheme is now pushing five million active members, an increase of 9 per cent on the same time last year.

Here the program is also being used as a pricing scheme to make sure the retailer is competitive. Endeavour says more than 900,000 prices were matched or beaten against competitors using the membership pricing. The Dan Murphy’s app has 890,000 average monthly users and the new Dan’s Daily website, which is different to the digital store, has so far seen 2.2m visits.

Customers are returning to the Dan Murphy’s stores following Covid, while nearly two-thirds of online shoppers are opting to pick-up in store. Over the past three years Endeavour boss Steve Donohue has seen compound digital growth of 15 per cent across online sales.

Consumer fightback

The message from business is consumers are holding their ground, even after taking a pummelling from surging prices. But it’s anyone’s guess how long they can keep taking the blows.

From JB Hi-Fi, Dan Murphys and even car listings group Carsales, a picture is emerging of consumers still willing to spend after surging prices and an uncertain outlook given a slowing economy.

Helping this is a massive $300bn savings cushion built up by consumers through the Covid-19 pandemic, which remains the biggest driver of spending. At the same time shoppers are still catching up after been locked down for all those years.

But with interest rates and inflation set to drive household costs even higher and in effect “real” incomes falling, no one is certain about the appetite of households willing to dip into their savings buffer to keep spending.

The big barometer of consumer spending is electronic goods retailer JB Hi-Fi and it shows resilience is in the air after experiencing a booming Christmas. However JB’s Smart cautions there are early signs that sales growth has started to moderate from the high levels seen in the past six months. Some of this though he puts down to product mix which is impacting the top line sales.

Even after price hikes over the past year Smart says consumers are still flocking to retailers and brands they have enormous trust in and spending their cash there. There are signs of discounting returning to the retail market, particularly for Smart’s household and whitegoods chain The Good Guys. But he says this is a returning to more normal behaviour after two extraordinary Covid years of little retail discounting.

The good news is we may have seen the last of the price hikes for electronic goods for now.

“The feedback from suppliers is we’re not going to be seeing any price rises … the main reason is stock is returning to normal and suppliers are going to be fighting among themselves for as much share of retail,” the JB Hi-Fi boss says.

Car surge

Australians are still buying big-ticket items with online car listing player Carsales expecting underlying demand for new and used cars to remain buoyant.

Part of this is Carsales’ increasing its share over the overall market, but demand is strong for luxury cars and remains elevated across the used car market in particular.

Momentum from a record year of industry-wide car sales continued, with 1.08 million units shipped in the last 12 months. The average car price is up a hefty 44 per cent from the period before Covid, Carsales’ chief Cameron McIntyre says.

Signs of normality again are returning with inventory levels fast-improving after last year’s supply squeeze, which should help cap surging prices and bring down those multi-month wait times.

Elsewhere Endeavour says it saw record sales over Christmas and New Year across

Dan Murphy’s and BWS. This came on the back of strong sales in the December half. For Dan Murphy’s in particular there was a positive signs as customers went for more expensive wine, beer and liquor options. Shoppers going down-market on alcohol pricing is often a good indicator of broader economic pressures. Customers were also prepared to keep trying new products, Endeavour’s Donohue says.

Endeavour, which also operates pubs, is too experiencing sales levels returning to normal after the surge through Covid when everyone was stuck at home, although alcohol sales in the first five weeks of this calendar year are so far up 0.2 per cent from the same time last year.

Storm clouds

In terms of the pain trade, Insurance Australia Group, the nation’s biggest general insurer, has warned of double-digit percentage price increases across home and motor premiums as it grapples with inflation costs on repairing cars and houses. Adding to this global reinsurance costs have skyrocketed following Australian and New Zealand floods.

IAG chief executive Nick Hawkins acknowledged it’s a “tough time” for consumers with inflationary pressures coming from multiple fronts. However, one lead indicator insurers look at is retention rates – which highlights the level of churn as households stop taking out insurance policies. For IAG retention remains 91 per cent mark for motor and 95 per cent for home, which is holding at historically high levels.

“We acknowledge an affordability challenge on a number of topics within the community, but we’re not seeing that follow through with us at the moment,” Hawkins tells The Australian.

One tougher spot is in property where construction major Lendlease is seeing some pressure on its residential development arm. Sales of apartments and developments in the December half are down sharply from the same time a year ago. Settlements of property for the year to end-June are expected to fall below its previous guidance of 3000-4000 showing that the property market slump is well underway.

More than $13bn in profits are scheduled to be delivered across corporate Australia just this week. Despite a grim outlook for the economy and housing, it is not as bad as it seems. Consumers are starting to change their ways, although the shift is more subtle than dramatic.

The ASX is still holding near record levels and jobs figures, due to be released Thursday, are expected to show an increase in employment through January and this will continue to underpin spending.

johnstone@theaustralian.com.au

More Coverage

Originally published as Behind the smart pricing machine being built by JB Hi-Fi