The CEO of tech firm Tritium has stepped down as part of a reshuffle of the senior ranks

There’s been a major reshuffle in the top tier of a Brisbane tech firm which is expanding across the world while also piling up huge amounts of red ink

QLD Business

Don't miss out on the headlines from QLD Business. Followed categories will be added to My News.

SHAKING IT UP

There’s been quite a shake-up in the senior ranks of Tritium, the Brisbane tech outfit aiming to control a good chunk of the global market for fast chargers servicing electric vehicles.

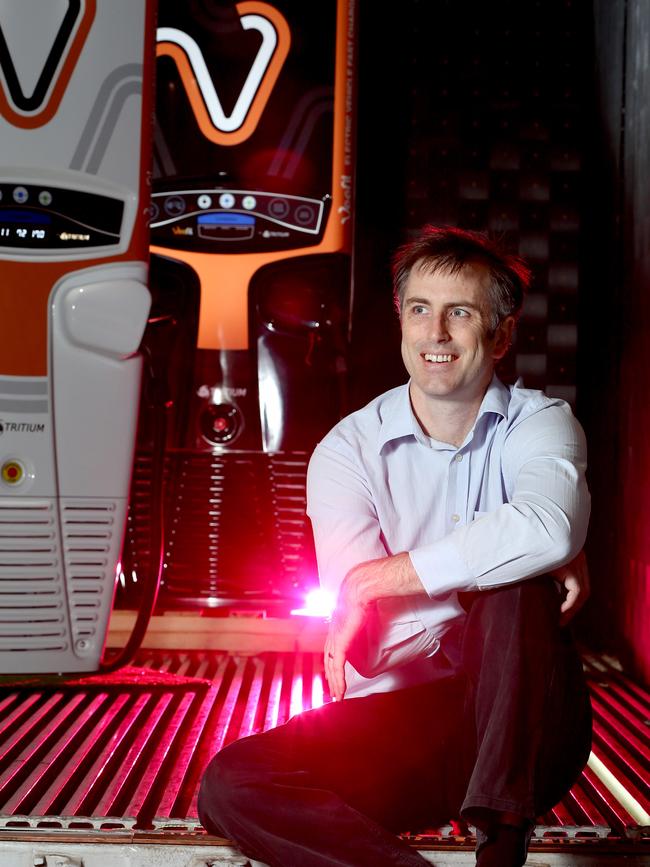

David Finn, one of three founders of the company back in 2001, has given up his job as CEO but will still show up at the office, according to an email sent to all staff yesterday.

He now plans to act as “chief growth officer,’’ focusing on engineering and technology issues, especially new product development.

That will leave the operational challenges to his associate Jane Hunter, who has been anointed as the new boss.

Hunter, a barrister, came aboard last September, taking on the job of “deputy CEO’’ and chief operating officer after long stints with Boeing and Tabcorp.

She most recently spent seven years with the aviation giant, including nearly two years as a director of Boeing Defence Australia.

It’s also understood another Tritium co-founder, Dr Paul Sernia, is leaving his post as “chief product officer’’.

We hear he’s decamping to the St Baker Energy Innovation Fund, the vehicle used by Rich Lister Trevor St Baker and his family to bankroll innovative green power initiatives, including Tritium.

MIXED PICTURE

The corporate reshuffle comes as Tritium finds itself in the most unusual of spots.

It continues to grow substantially while still amassing huge amounts of red ink that long ago would have sunk any other company without extremely wealthy backers.

The company suffered a staggering $47.7 million net loss in the last financial year, three times the size of the loss in 2018. Negative operating cash flow amounted to $57 million, four times that of the previous year, and 10 per cent of the work force in Brisbane were made redundant.

It was enough for EY auditor Brad Tozer to wheel out the usual warning about a “material uncertainty’’ hanging over the company’s ability to stay afloat. But Tritium appears unlikely to collapse while its board includes energy titan St Baker, his son Stephen St Baker and fellow Rich Lister Brian Flannery, the billionaire investor who made his fortune in coal.

These gents have tipped in vast amounts of cash as the company has embarked on a series of desperately-needed capital raisings.

In the last financial year alone, Tritium rustled up $58 million in fresh equity. It sourced another $30 million last August. In addition, Gilbarco Veeder-Root, a global leader in petrol pumps and fuel delivery, has forked out $58 million for a 19 per cent stake in the firm.

All that money allowed Tritium to open new production facilities in Los Angeles and Amsterdam last year, sending revenues up 78 per cent to nearly $61 million.

“On average, sales have doubled every year for the past five years,’’ the company’s latest consolidated financial statement says.

“2019 continued to be a high growth and investment phase for the business as the directors deliberately invested in product development and operational expansion of profitable products in order to have the capacity to deliver on future market demand.’’

Tritium already has more than 3000 fast-charging sites spread across about 30 countries, including parts of Europe and the UK.

As the world gradually transitions to electric vehicles, the company has forecast that profits and positive cash flow will eventuate as growing sales exceed its swelling cost base. Major new global markets have also been targeted, prompting it to forecast an eventual turnaround in its financial picture. “The group has a number of significant additional sales opportunities in the pipeline, in addition to the already established long term customers, which the directors are confident will deliver positive returns in the short term.

“As the market matures, the breadth of sales opportunities is growing and, with key partnerships in place, the company is in position to participate in developing market segments such as utilities, fuel and adjacent retail opportunities.’’