US Federal Reserve is out of ammo to fight coronavirus meltdown

The US Federal Reserve was supposedly the font of all policy wisdom and prudence. But as the coronavirus bites, everyone knows the Fed’s almost out of ammo, and that firing that ammo at the virus and the way everyone is reacting to it is like firing blanks, writes Terry McCrann.

Terry McCrann

Don't miss out on the headlines from Terry McCrann. Followed categories will be added to My News.

Once again we’ve had the honour of “leading” the world.

We — along with of course, New Zealand — got to open global trading for the week for share, bond and currency markets, at the precise point where the virus seemed to go Code Red. As in: now let’s really panic.

And boy, did we go at it: opening down and just continuing to go down, down, down. Our 8 per cent fall was in anticipation of Wall St opening up for the week down at least 5 per cent.

That was where their futures were trading all day — smack on the limit; they were not allowed to go down any further. We’ll find out where it did open — and where it ended early Tuesday our time and what the Fed came out with.

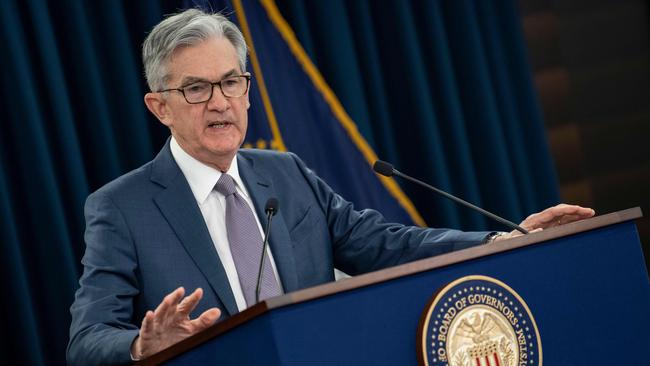

Ah, the Fed — the Federal Reserve, the US version of our Reserve Bank and supposedly the font of all policy wisdom and prudence.

Or at least, that was the misconceived belief up until the curtain was pulled aside, Wizard of Oz-style, in 2008 when the GFC hit; and the Fed was shown to be an empty vessel or an entity populated by empty vessels.

As a former Fed head once remarked, it was his job to snatch away the punchbowl (by ratcheting up interest rates) when the party — the economy, markets — got too raucous.

But for at least all of this century the Fed’s been doing the exact opposite — not just refilling the punch bowl, but refilling it with 100-proof pure monetary hooch, any time the party looked like flagging.

Fed head, chairman Jerome Powell did exactly that a week back when he slashed the official rate by 50 points. At that point Wall St had only retreated 10 per cent or so — defined as a (usually, healthy) correction, from its dizzying all-time peak.

A peak that was reached precisely because the Fed had kept its official rate at zero for almost the entire period since the GFC, way back in 2008 and printed trillions of dollars of loose money to pour into shares and property.

Our market had — much more modestly — gone along for the ride; finally getting back to its pre-GFC peak last year and hitting a new one only three weeks ago.

Our RBA was also dragged along reluctantly by that zero-interest Fed; cutting its official rate slowly and reluctantly first to 3 per cent and then later to 1.5 per cent under previous Governor Glen Stevens; and then last year to 0.75 per cent under Philip Lowe.

Well the big impact of the Fed’s 50-point cut before there was an actual economic or financial problem to fight — other than trying to keep the wolf from the, well, wolves of Wall St’s doors — was to very loudly announce the Fed was about to run out of hooch.

It’s just got two 50-point cuts left and then it will be at zero. It could start buying bonds by the trillion again. But just exactly how that will “fix the virus” or even just offset the very real real-world consequences of both the virus and the measures taken to fight it, well, eludes me.

It’s possible that another emergency blockbuster statement from the Fed overnight Monday could partially or fully reverse the coming Monday plunge.

But if it did, like last week’s effort, it would only be temporary.

Everyone knows the Fed’s almost out of ammo, and that firing that ammo at the virus and the way everyone is reacting to it — probably perfectly and entirely captured in the Great Toilet Paper Run — is like firing blanks. Or pouring in de-alcoholed hooch.

With the virus we are at the point of maximum uncertainty and fear — and that’s colliding with overvalued share markets and policymakers that are both clueless and with precious little ammo. Ab in any event ammo that is all-but useless anyway; as I said, like blanks.

If they government’s thinking of spending $10 billion, it better start thinking again and quickly. That is likely to go down like the Fed’s rate cut — like one big fat punctured balloon.

It needs to be much more. And even though targeted at businesses and industries directly impacted by the virus and even more the reaction to the virus — and the bushfires, let’s not forget the bushfires — plus some broad relief/injection for all business cash flows, it will do little more than ease the pain.

We are headed in to a recession in this June half — both the silly “two successive quarters of negative growth” and the real version like we had in 1991; Westpac’s Bill Evans is now predicting the former and a “mild” version of the second.

But he’s predicting a snapback in the December half. He’s boldly — “courageously”? — predicted the jobless rate will not get as high as 6 per cent.

I’m not so sure. We’ve never been “here’’ before. And we really don’t know “where” exactly we are headed. To my mind, it’s impossible to predict the end point and the time it will take us to get to that “end point”.

a bizarre point

IN this crazy, panic-driven world, one fact stands out most bizarrely of all, at least to me.

The Chinese share market, Shanghai, is still up for the last month and so also obviously for the 2020 year so far.

Every major market in the world has plunged around 20 per cent (assuming overnight Wall St) — and that takes them straight in to bear-market territory. But despite dropping more than — only? — 3 per cent on Monday, Shanghai is still up — true, just, but still a positive — 2.5 per cent over the last month.

They gave the world the problem — and the consequent financial implosion; yet they seem to be now getting on top of both.

Maybe that’s a positive — even a very positive — pointer on both. If of course you can believe either.

We shall obviously have to see. Meanwhile Europe opened immediately down around 7 (Germany) to 8 per cent (UK). And then took up a “waiting for Wall St” stance. With Wall St stuck on the 5 per cent limit-down for futures — and the question of whether the Fed jumps in and if so, how, again we shall have to wait and see.

But, whatever, we are really only at the start.

MORE FROM TERRY McCRANN

Originally published as US Federal Reserve is out of ammo to fight coronavirus meltdown