Why rate override power must go

The one proposed change to the RBA that should be entirely uncontroversial is the ending of the government’s ability to overrule an interest rate decision.

The one proposed change to the RBA that should be entirely uncontroversial is the ending of the government’s ability to overrule an interest rate decision.

Billionaire Solomon Lew is determined to show there is still life in retail and that much if not indeed most of that future life will still be in real actual bricks and mortar stores.

The Labor Government’s push for a 4 per cent minimum wage increase has effectively set it against RBA governor Michele Bullock’s desire for a wage moderation and productivity increases.

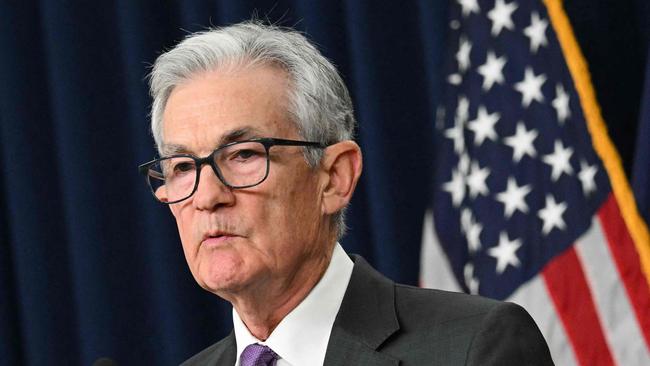

The US Fed’s ‘dot points’, supposedly predicting rate cuts, stirred up the markets bigtime. But they’re well known for their inability to forecast the future.

There are simply no downsides for us from the US reporting lower inflation figures. That doesn’t mean that catastrophe is not looming though.

Poor policy on a number of fronts means there are dark economic times ahead, and the hoped-for surge from increased immigration is not working.

The four big banks made a big headline figure of $49bn in profit – but don’t forget the $13bn in tax paid and $42bn they injected into the economy.

The RBA has delivered the big banks an unparalleled golden period, the likes of which we have never seen before, and which we should hope to never see again.

Next year we’ll be told how the votes have flowed for and against interest rate rises at the RBA, which will pose a challenge for the governor.

This interest rate rise was a surprise to many – but it indicates that Michele Bullock and this board are answerable only to what they see as their one job – to control inflation.

Everyone needs to take a chill pill about the prospect of a Cup Day rate hike. It’s not as significant as ‘they’ are saying, for the economy or for the new RBA governor.

Failing to back Star’s recent capital raise has turned out to be a winning strategy for the retail shareholders who passed on the ‘opportunity’.

Original URL: https://www.couriermail.com.au/business/terry-mccrann/page/15