McCrann: Budget just more crazily out-of-control spending

It’s another depressing return to an all-too familiar Labor Fiscal Future – high-taxes, big spending, budget deficits and rising debt set to exceed $1 trillion.

It’s another depressing return to an all-too familiar Labor Fiscal Future – high-taxes, big spending, budget deficits and rising debt set to exceed $1 trillion.

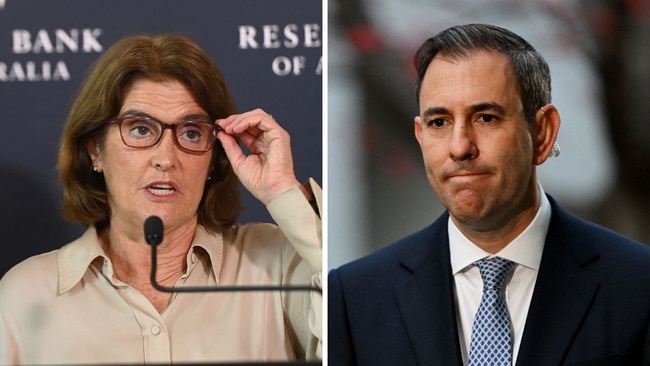

The idea that Reserve Bank governor Michele Bullock is going to rush out an interest rate cut because of the budget’s $300 energy rebate inflation trick is silly.

The one thing you can say with absolute certainty about every budget is that every forecast in it will be wrong — so take claims about controlling inflation with a pinch of salt.

Watch out for all the spin in Tuesday’s federal budget. The future remains uncertain and Jim Chalmers won’t be `delivering it’.

Take a bow PM and Treasurer – ripping the heart out of Stage 3 tax cuts is the most clear-cut and outrageous of your growing list of broken election promises.

The $212bn Future Fund is Australia’s greatest national financial asset and it must be protected at all costs.

The looming meetings of the RBA and the Federal Reserve plus the latest inflation figures will set the foundations for the year ahead and also test Treasurer Jim Chalmers.

It took until the last two months of the year, but the ‘Golden 2023’ for investors, that I suggested just on a year ago might be delivered by the Fed, did finally arrive.

The world – led by China and India – is burning coal at record levels, while a wind and solar fantasy threatens to plunge Australia into darkness.

We’re lurching towards an energy disaster, and Chris Bowen is captain of the ship.

ANZ made a deliberate decision to mislead its shareholders and the market in 2015 and now its board, in its stupidity, wants to ‘own’ that decision.

Treasurer Jim Chalmers has ridden an extraordinary, unprecedented and also totally unpredicted $200bn two-year revenue surge.

Original URL: https://www.couriermail.com.au/business/terry-mccrann/page/12