Technology stocks surging again, sparking fears around fair value

An 8 per cent, $324bn overnight share price rise by AI chip giant Nvidia helps explain why some experts worry about tech stocks.

“Ludicrous” movements in technology company share prices are continuing despite a couple of recent -pull-backs, as investors chase action and volatility.

Multinational investment manager Schroders says a dangerous trend has emerged in equity markets as investors shift their focus from fundamentals to momentum, and tech stocks remain near record highs.

The momentum and volatility was on full display Thursday morning as positive comments by US-based AI chip manufacturer Nvidia sent its shares surging 8 per cent – an increase in its market capitalisation of $324bn, more than the entire value of Australia’s biggest company, the Commonwealth Bank.

Twice since early July Nvidia has fallen more than 20 per cent from its previous highs before bouncing back, and investment analysts expect the wild ride to continue.

Schroders head of Australian equities Martin Conlon said tech stocks were the most surprising thing to come out of the recent local reporting season.

“The scale of the reactions, to what were in most cases very small earnings surprises, were ludicrous,” he said.

Mr Conlon said WiseTech Global was “probably the poster child” of the Australian reporting season.

“Earnings went from $300m to $380m and the market cap went up more than $9bn,” he said.

“Nine billion dollars is larger than most of the companies in Australia, let alone a price move. WiseTech’s market cap of $40bn-plus is not a mile away from something like Telstra, and Telstra had a reported EBIT of $3bn.”

Mr Conlon said WiseTech’s price-to-earnings multiple was 150, while for Pro Medicus it was 200 and for Life 360 it was 98. PEs near 200 were absurd unless a company was new and had enormous earnings potential, he said.

“The PE multiples are pretty crazy, but that’s the epicentre of speculative activity around the world.

“People are attracted to prices that move most because they love a fast buck.”

Shaw and Partners senior investment adviser Jed Richards said tech stocks were always a “wild ride”.

“We have seen it before … they will have incredibly strong periods, but you need to be prepared to accept massive volatility,” he said.

“WiseTech is the global leader in software for shipping around the world.

“No other company does it better and you have to pay a premium to own the company, but it does look expensive on current valuations.”

Mr Richards said tech stocks that continued to grow earnings and maintained market-leading positions in their fields would remain in demand.

“On today’s earnings, tech stocks are expensive, but they are the companies that are going to give you growth over the next five years,” he said.

Moomoo market strategist Jessica Amir said yesterday’s Nvidia surge was fulled by two “jet packs”.

The first was anticipation of a US Federal Reserve interest rate cut, which pushed stocks higher everywhere, Ms Amir said.

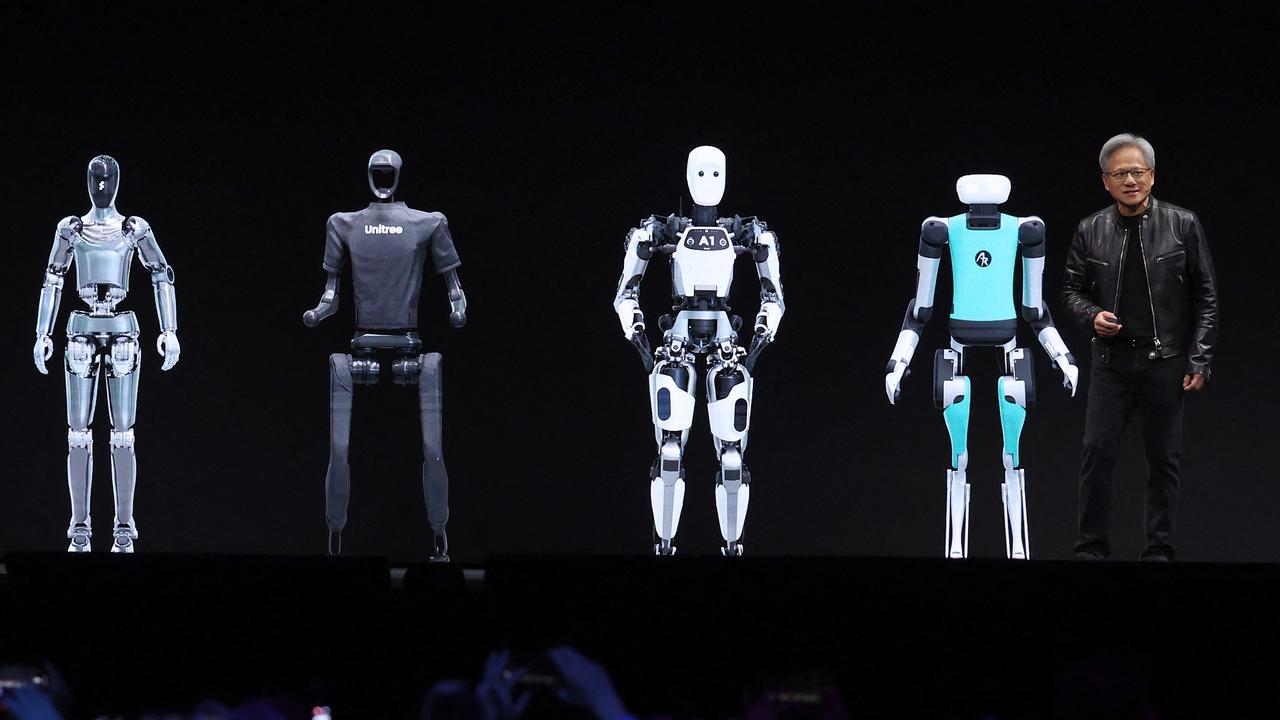

“The second major boost came when Nvidia’s CEO announced overwhelming demand for its latest tech products,” she said.

Mr Conlon said “everyone loves growth everywhere”, which was why US stocks were performing much better then European stocks.

“India is very expensive because it’s growing,” he said. “Maintain growth and investors get excited.”

Mr Conlon said he saw the best opportunities in well-run cyclical companies such as Seven Group and Brambles.

“Cyclical companies provide value because fluctuations in earnings scare people far more than they should,” he said.

More Coverage

Originally published as Technology stocks surging again, sparking fears around fair value