Up, Up, Down, Down: Uranium lit up in May as gold paused to catch its breath

Gold prices paused to catch their breath as iron ore and lithium fell further in May, with the commodities complex waiting for direction.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

Uranium leads the winners as commodities wait for direction in May

Gold comes off record highs, as volatile US trade policy dominates sentiment

Iron ore, lithium and nickel all struggle

WINNERS

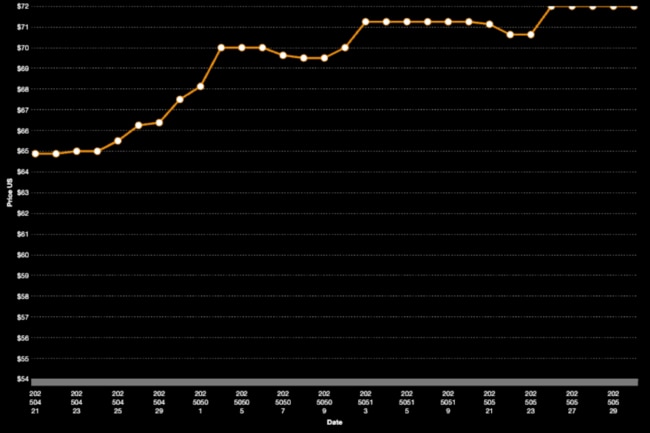

Uranium (Numerco)

Price: US$72/lb

% Change: +6.05%

Uranium returned to the limelight off the back of a string of executive orders from Donald Trump designed to increase nuclear power capacity in the USA fourfold by 2060.

Part of the plan is to ramp up domestic mining and enrichment capabilities, cutting reliance on a supply chain dominated by Russia and nations friendly to Putin like Kazakhstan and Uzbekistan.

That saw a small lift in spot prices after months of inactivity and a large bump for uranium equities after a year long sell-off.

UP

- Wood Mackenzie says the small modular reactor pipeline has grown 42% in the past quarter to 47GW, with data centres now at a 39% share of the unrisked demand pipeline.

- Sprott says with more clarity over US Government policy, yellowcake contracting has resumed, with as much as 67% of the market out to 2045 uncovered by utilities.

DOWN

- Incentive prices remain too low for most new developers, who want to see prices of US$100/lb or above before pushing the button on capital intensive new uranium projects.

- The Global X Uranium ETF is sitting on a 9.89% month gain, but it remains 6.45% YTD with investors yet to really set up their stall behind U3O8 miners.

READ

Going Nuclear: Trump’s EOs offer atomic opportunities for Australian uranium industry

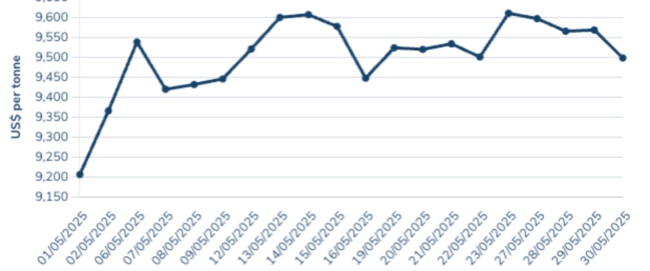

Copper

Price: US$9498/t

% Change: +4.09%

Copper mines continue to be a long term investment goal for major miners, with M&A heating up even as prices remain rangebound.

Johannesburg-headquartered Harmony Gold's US$1.03bn deal to buy MAC Copper (ASX:MAC), a $160m deal for Xanadu Mines (ASX:XAM) and London-listed Central Asia Metals' $185m purchase of New World Resources (ASX:NWC) show how keen miners globally remain to snap up copper projects.

UP

- An underground shutdown of the Kakula mine in the DRC due to seismicity and flooding has helped support copper prices on the supply side. Ivanhoe and Zijin's phase 1 and 2 concentrators are running at half capacity on surface stockpiles, though the phase 3 concentrator, fed from the operating Kamoa mine, remains fully operational.

- Aluminium and steel tariffs levied by the Don this past week have lifted expectations of copper tariffs that could dramatically increase prices in the US, Benchmark analysts say. The CME-LME arbitrage lifted 38% over the weekend.

DOWN

- Copper was projected to be in a 327,000t surplus for the first three months of 2025, according to the International Copper Study Group.

- First Quantum Minerals will be able to sell around 121,000t of copper in concentrate from its suspended Cobre Panama mine to fund maintenance activities on the site. The 350,000tpa operation's early closure due to political opposition helped stir a sudden tightening of the copper market in late 2023 and early 2024.

READ

Art of the Deal: New World's $185m cash takeover has fans

Coal (Newcastle 6000 kcal)

Price: US$103.30/t

% Change: +5.95%

Coal's been in a tough place for a while now, with rising mining costs seeing a number of equities in the doghouse as strong supply hurts pricing.

Glencore has given some support to thermal coal prices, by trimming output from its Cerrejon operation in Colombia.

China has been ramping up domestic production and trimming imports in a hit for thermal coal producers, while met coal prices are also at cyclical lows (albeit at historically strong levels of around US$186/t) on weak steel demand in China.

The caveat there is that only a c0uple BHP mines in Queensland actually pull in that premium price point. For PCI and semi-soft coking coal miners the world is a bit tough right now.

UP

- Prices are miles into the cost curve for both thermal and coking coal, suggesting prices will have to rise with both market demand and green tape shackling investment in new sources of supply.

- With a number of miners struggling, calls are set to grow louder for the end of a coal royalty regime that pulled in billions of additional dollars for the Queensland Government following the Russian invasion of Ukraine and subsequent coal boom. The LNP Government says no for now ... we'll see.

DOWN

- Westpac says the met coal market will remain in surplus until 2027, with a number of miners now struggling to make ends meet. Thermal coal is also in strong supply heading into the typically muted demand market of the northern hemisphere's shoulder season.

- Stanmore Coal (ASX:SMR) and Coronado Global Resources (ASX:CRN), the latter dearly in need of new capital, have both announced millions in spending cuts to preserve margins at their Queensland operations.

READ

Resources Top 5: Yari Minerals a prime mover on Bowen Basin coal project acquisition

Rare Earths (NdPr Oxide)

Price: US$60.78/kg

% Change: +6.66%

Rare earths prices are moving back in a positive direction (note: the chart below contains prices which exclude China's value added tax).

Shanghai Metals Market analysts think prices will fluctuate upwards across 2025 as the market moves into balance and new sources of demand, like humanoid robots, emerge.

Away from prices, rare earth stocks have received strong support from the policies of US President Donald Trump, with miners increasingly hopeful of seeing a ramp up in demand as America aims to restore its mineral and energy security.

The race for the world's top deposits is on in earnest, with China's Shenghe Resources signing a deal to acquire Peak Rare Earths (ASX:PEK) and its Ngualla project in Tanzania in a $150.5m takeover.

UP

- Shanghai Metals Market experts think praseodymium and neodymium demand will increase 5.4% this year despite falling magnet metal exports, related to controls placed by China on rare earth materials after Trump's tariffs were introduced.

- China's access to imported rare earth metal ores is set to drop from 55,000t in 2024 to 43,000t in 2025 as local supply chain buildout by MP Materials reduces supply to China from its Mountain Pass mine in California.

DOWN

- Despite lifting revenue by around a quarter, US producer MP Materials sunk from a US$16.5m profit in the first quarter of 2024 to a US$22.6m loss in the first quarter of 2025.

- A recent rise in NdPr oxide prices was led by restocking from Chinese magnet producers, which could make the recent price run short-lived.

READ

Could MTM’s Flash Joule processing tech be the shot in the arm America needs for REE independence?

LOSERS

Gold

Price: US$3277.55/oz

% Change: -0.76%

After months of gains driven by economic uncertainty, a trade war, actual wars and the unpredictability of Donald Trump, gold hit the pause button in May.

An apparent thawing in relations between the US and China, including a pause in the extraordinary 145% tariff regime levied on Beijing by Washington (reciprocated by a vengeful Xi Jinping) took prices below US$3200/oz for the first time since Liberation Day changed the game for gold miners.

Investors flocked back for safe haven as the month progressed however, with a late dip below US$3300/oz coming as US annual inflation came in at a five month low of 2.1% late last month, with core inflation of 2.5% slightly below expectations.

UP

- M&A continues to rage in the gold market as ASX mid-tiers look to grow, exemplified by Genesis Minerals' (ASX:GMD) $250m cash splash on Focus Minerals' (ASX:FML) 4Moz Laverton gold project.

- Liquidity is starting to get very strong for gold juniors. Warriedar Resources (ASX:WA8) raised $17m in a recent placement while Golden Horse Minerals (ASX:GHM) pulled in $15m. All this just to drill – a sign of the times given the modest nature of the two WA gold explorers.

DOWN

- While gold bulls have been waiting for a big move into gold ETFs to add to demand from China and central banks that has stirred the record price run, US retail investors have been shifting to Bitcoin ETFs instead.

- An auction of one of Australia's largest gold mines has reportedly been called off after EMR Capital and Indonesia's Golden Energy and Resources were reportedly unable to find an acceptable bidder for the Ravenswood mine in Queensland.

READ

Gold Digger: The factors driving gold higher will continue to grow – Sprott

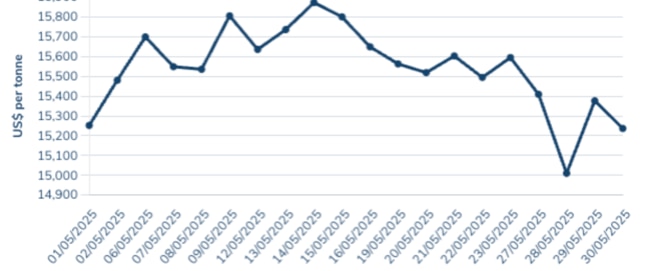

Nickel

Price: US$15,237/t

% Change: -1.17%

Not much to write home about for nickel this month, which remains in a holding pattern after Indonesian supply growth surged well ahead of demand.

UP

- The head of Indonesia's nickel mining association APNI has warned miners they will need to clean up their operations to remain players in the global nickel industry after a string of media reports criticising the sector's ESG credentials.

- A royalty rise for Indonesia's nickel mines could lead to some mine closures and layoffs, which could support prices with a number of producers in the Southeast Asian country already losing cash.

DOWN

- Bloomberg says an Indonesian HPAL plant that killed two workers in a landslide in March has restarted operations.

- A 198,000t surplus, around 5% of mined supply, is expected for the nickel market in 2025 as per the International Nickel Study Group.

READ

Monsters of Rock: The West is talking the talk on critical metals, but it ain't walking the walk

Iron ore (SGX Futures)

Price: US$93.63/t

% Change: -2.78%

Iron ore tumbled steeply at the end of May at the China Iron and Steel Association warned in its monthly report that steel markets are oversupplied ahead of a hot and wet season in China when construction activity normally falls.

MySteel reported last week that Chinese mills were keeping less stock on hand ahead of the low period, hitting a YTD low of 12.1Mt.

It has come amid broader discontent in Australia over the future of the Aussie cash cow, with Pilbara iron ore miner Andrew Forrest warning competition from new high grade African iron ore sources means WA and Australia needs to invest in 'green iron' making capacity at home.

Whether that talk can be converted into action remains anyone's guess. The iron ore trade to China remains a lucrative one, for now.

UP

- Despite fears over the impact of the US-China trade war, steel exports from China continue to rise, up 13.42% YoY in April to over 10Mt. It's the second 10Mt month in a row, with exports picking up the slack of weak demand from the Chinese property sector.

- Port iron ore stocks are at their lowest level in 15 months in China, down for a fourth straight week to end May on 138.7Mt.

DOWN

- Chinese rebar prices hit an 8-year low in early June. The key steel product is especially exposed to property and construction markets.

- Concerns are growing over the impact of high grade exports from West Africa on Australian iron ore demand. With ore grades declining and weak steel profits pushing mills to purchase less pure ores, Fastmarkets has introduced a 61% Fe iron ore index, down on the traditional 62% benchmark.

READ

Bulk Buys: Calls for Aussie green iron grow, but we’re missing the crucial ingredient

Lithium (Fastmarkets Carbonate CIF China, Japan and Korea)

Price: US$8150/t

% Change: -6.32%

Lithium prices crumbled to a new four year low, with spodumene concentrate particularly hard hit.

The benchmark price for the product delivered to the Chinese market by WA hard rock miners has sunk to US$615/t, but the actual sale price of Aussie product is likely lower still, given few shipments meet the 6% Li2O grade set out in the benchmark price.

As prices rip lower, the question is how soon before supply really starts to get taken out of the battery supply chain?

UP

- With prices plunging even further, the bottom must be near ... surely?

- Rio Tinto (ASX:RIO) signalled ita confidence in the long-term outlook for lithium, announcing big investments into brine assets in Chile.

DOWN

- Albemarle's woes have been compounded, with the world's largest lithium producer falling off the Fortune 500 list on the back of a sustained downturn in prices.

- SQM's latest accounts showed a US$137.5m quarterly profit, well below the US$171.2m tipped by analysts. But the boss of the Chilean miner, Ricardo Ramos, said he thought a "reasonable price environment" would return next year.

READ

Bolivian lithium brines emerging from the shadows cast by Chile and Argentina

OTHER METALS

Prices correct as of May 30, 2025.

Silver

Price: US$33.08/oz

%: +2.64%

Tin

Price: US$30,406/t

%: -3.00%

Zinc

Price: US$2620/t

%: -11.26%

Cobalt

Price: $US33,700/t

%: 0.00%

Aluminium

Price: $2444/t

%: +1.85%

Lead

Price: $1958/t

%: +0.03%

Graphite

Price: US$420/t

%: +1.20%

Originally published as Up, Up, Down, Down: Uranium lit up in May as gold paused to catch its breath