Lunch Wrap: ‘Trump slump’ hits ASX again as pharma, China tariffs send stocks tumbling

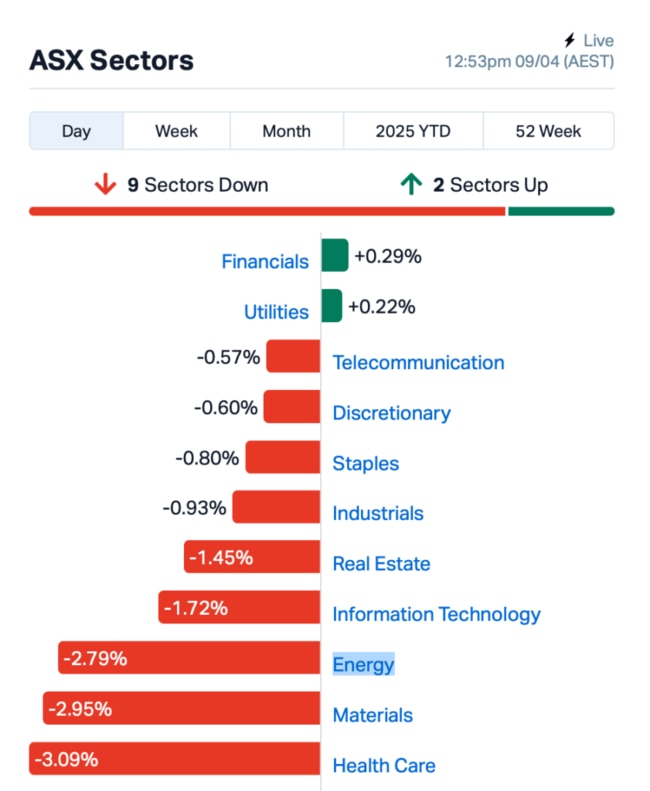

ASX cops a 1.4pc beating as the US-China trade spat rocks markets, pharma faces tariff pain, oil dives, and Aussie miners take a hit.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

ASX hits rough patch again – very rough, with more than $30b wiped out

US-China trade clash sends markets reeling, as pharma about to get tariff hit

Oil slumps, Aussie dollar dives, ASX miners routed

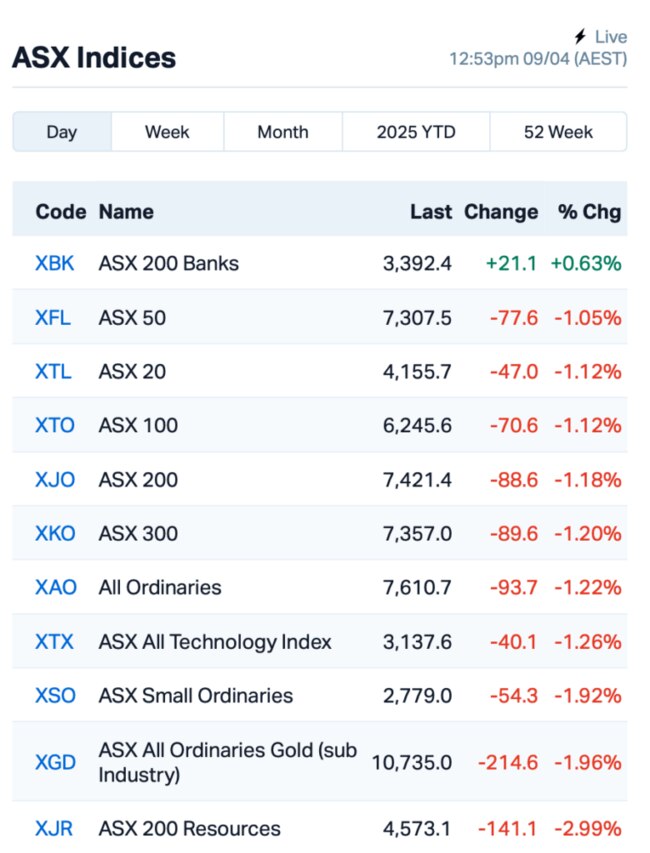

The ASX dropped over 1% pretty quickly on Wednesday, practically wiping out over $30 billion in market value as the US-China trade war tensions escalated. It's now down 1.48% at the time of publishing this article.

In the US overnight, the S&P 500 dropped 1.57%, while the tech-heavy Nasdaq fell by 2.15%.

This comes after the White House dropped the hammer with a 104% tariff on Chinese goods, all because China fired back with a 34% tariff on US imports earlier.

China isn’t backing down... at this stage.

Premier Li Qiang’s been pretty vocal, saying China has all the right tools to absorb these shocks, and said the Chinese economy will keep growing in 2025.

But it’s hard to shake the feeling that something’s about to break when two economic powerhouses are butting heads this hard.

The bad news, though, doesn’t end there.

Trump’s on the verge of pushing another round of tariffs, this time targeting pharmaceuticals.

Experts reckon Aussie pharmaceutical exporters could take a hit of around $1.6 billion a year, with CSL (ASX:CSL) already feeling the sting as its stock price plummeted 4% this morning.

And let’s not forget about oil. The price of crude took another massive dive last night, with crude prices sliding to four-year lows.

The Aussie dollar, meantime, is now trading at just under US60c, its lowest level in years as iron ore prices tumbled to a seven-month low.

Back home, the impact of this trade war is hitting the ASX’s big miners especially hard this morning.

Investors were pulling out of big names like BHP (ASX:BHP), Rio Tinto (ASX:RIO), CSL (ASX:CSL) and Woodside Energy Group (ASX:WDS).

In large caps news, fund manager Regal Partners (ASX:RPL) fell 7% after its funds under management (FUM) dropped to $16.5 billion from $18 billion in the March quarter.

Fellow fundie GQG Partners (ASX:GQG), however, saw a nice uptick of 4%, with net flows climbing by 64% in March, showing that some fundies are still holding their ground despite the chaos.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for April 9 :

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| OSX | Osteopore Limited | 0.045 | 181% | 36,618,975 | $1,933,897 |

| ENT | Enterprise Metals | 0.003 | 50% | 333,333 | $2,356,635 |

| VML | Vital Metals Limited | 0.003 | 50% | 1,265,416 | $11,790,134 |

| AJL | AJ Lucas Group | 0.007 | 40% | 2,641,039 | $6,878,648 |

| PVT | Pivotal Metals Ltd | 0.009 | 38% | 5,704,797 | $5,896,968 |

| AOA | Ausmon Resorces | 0.002 | 33% | 450,000 | $1,966,820 |

| GGE | Grand Gulf Energy | 0.002 | 33% | 508,000 | $3,675,581 |

| JAY | Jayride Group | 0.002 | 33% | 3,000,000 | $2,117,588 |

| NNL | Nordicresourcesltd | 0.115 | 24% | 131,173 | $13,706,698 |

| BMM | Bayan Mining | 0.043 | 23% | 13,700,273 | $3,366,631 |

| CND | Condor Energy Ltd | 0.028 | 22% | 25,878,575 | $16,139,521 |

| OD6 | Od6Metalsltd | 0.035 | 21% | 135,500 | $4,618,126 |

| ATG | Articore Group Ltd | 0.175 | 21% | 1,144,513 | $41,307,145 |

| GAS | State GAS Limited | 0.030 | 20% | 200,647 | $9,815,022 |

| LM1 | Leeuwin Metals Ltd | 0.180 | 20% | 1,770,234 | $12,644,957 |

| FBR | FBR Ltd | 0.006 | 20% | 2,961,166 | $28,178,159 |

| ROG | Red Sky Energy. | 0.006 | 20% | 1,958,647 | $27,111,136 |

| CTQ | Careteq Limited | 0.014 | 17% | 14,501 | $2,845,425 |

| EE1 | Earths Energy Ltd | 0.007 | 17% | 902,602 | $3,179,785 |

| FCT | Firstwave Cloud Tech | 0.014 | 17% | 49,999 | $20,562,224 |

| IXR | Ionic Rare Earths | 0.007 | 17% | 12,615,696 | $31,430,570 |

| SHN | Sunshine Metals Ltd | 0.007 | 17% | 22,029,731 | $11,905,869 |

| SPX | Spenda Limited | 0.007 | 17% | 81,269 | $27,691,293 |

| EMD | Emyria Limited | 0.029 | 16% | 97,162 | $12,281,104 |

| GED | Golden Deeps | 0.022 | 16% | 11,782,681 | $3,365,388 |

Osteopore's (ASX:OSX) shares skyrocketed after the company secured European Union Medical Device Regulation (EU MDR) approval for its custom orthopaedic and cranial implants, marking a huge milestone in its expansion into Europe. This approval allows Osteopore to offer its custom-made implants alongside its already approved off-the-shelf neurosurgical and craniofacial products.

With the European orthopaedic market set to grow at 3.3% annually and the cranial implant market at 9.4%, Osteopore said it was well-positioned to take advantage of this demand. The company’s exclusive distribution deal with Zimmer Biomet further strengthens its presence, creating an opportunity for Osteopore to broaden its reach across Europe.

Bayan Mining and Minerals (ASX:BMM) has just secured an exclusive deal with Macquarie University for a solar panel recycling tech that uses microwave heating to separate valuable materials like silver and silicon. The new method makes recycling way easier by avoiding the high heat and harsh chemicals used in traditional methods, which is a big win for both the environment and the economy. With the global market for solar cell recycling booming, Bayan believes this tech positions it at the forefront of a major growth opportunity in critical mineral recovery.

Condor Energy (ASX:CND) has got the green light on a 3 billion barrel oil potential across five prospects in the Tumbes Basin off Peru. The Bonito prospect alone holds a billion barrels, with the majority of the resources in a proven oil zone. This independent estimate from leading consultants shows big exploration potential, and builds on Condor’s already discovered gas field. The company’s now in talks with multiple parties as it moves forward with the farm-out process.

Red Sky Energy (ASX:ROG) reported some solid numbers coming out of its Block 6/24 offshore Angola, with a net 5.1 million barrels of contingent resources from the Cegonha oil field. There's also an additional 11 million barrels of potential across three other prospects in the area. Red Sky said it’s got its sights set on rapid production and cash flow. The company’s also eyeing a promising pre-salt structure under the Ibis prospect, with plenty of room for more exploration and growth.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for April 9 :

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| MOM | Moab Minerals Ltd | 0.001 | -50% | 719,849 | $3,467,332 |

| CDT | Castle Minerals | 0.002 | -33% | 771,452 | $5,783,469 |

| RAS | Ragusa Minerals Ltd | 0.016 | -30% | 592,667 | $3,279,772 |

| MEG | Megado Minerals Ltd | 0.011 | -27% | 1,609,543 | $6,295,249 |

| AOK | Australian Oil. | 0.002 | -25% | 1,000,000 | $2,003,566 |

| ABE | Ausbondexchange | 0.031 | -23% | 26,333 | $4,506,725 |

| PKD | Parkd Ltd | 0.028 | -20% | 9,445 | $3,640,486 |

| AMS | Atomos | 0.004 | -20% | 1,800 | $6,075,092 |

| AVE | Avecho Biotech Ltd | 0.004 | -20% | 112,489 | $15,846,485 |

| AYT | Austin Metals Ltd | 0.004 | -20% | 280,000 | $7,870,957 |

| CTN | Catalina Resources | 0.002 | -20% | 39,285 | $3,790,655 |

| IPB | IPB Petroleum Ltd | 0.004 | -20% | 75,000 | $3,532,015 |

| OVT | Ovanti Limited | 0.004 | -20% | 3,000,000 | $13,507,739 |

| APC | APC Minerals | 0.009 | -18% | 3,065,222 | $1,288,904 |

| ENL | Enlitic Inc. | 0.046 | -18% | 516,105 | $32,234,120 |

| PBL | Parabellumresources | 0.035 | -17% | 670,638 | $2,616,600 |

| BTC | BTC Health Ltd | 0.050 | -17% | 9,092 | $19,519,398 |

| ADO | Anteotech Ltd | 0.010 | -17% | 1,301,812 | $32,463,604 |

| AZL | Arizona Lithium Ltd | 0.005 | -17% | 1,870,857 | $27,370,887 |

| BP8 | Bph Global Ltd | 0.003 | -17% | 203,588 | $1,824,924 |

| EMU | EMU NL | 0.020 | -17% | 137,300 | $4,646,434 |

| W2V | Way2Vatltd | 0.005 | -17% | 75,000 | $5,604,001 |

| SPN | Sparc Tech Ltd | 0.135 | -16% | 142,129 | $15,339,672 |

| PCL | Pancontinental Energ | 0.006 | -14% | 8,456,193 | $56,956,101 |

IN CASE YOU MISSED IT

Leveraging petrophysics, Riversgold (ASX:RGL) has confirmed the high chargeability and low resistivity of a sulphide copper-silver sample from the Saint John project in Canada, which also graded at 10.15% copper and 65.8 g/t silver. The results give RGL a strong geophysical signature to find more mineralisation via airborne surveys.

Caprice Resources (ASX:CRS) has gained a wealth of commodity and exploration expertise in the form of incoming non-executive director Robert Waugh, who played a pivotal role in bringing Musgrave Minerals from IPO, through several gold discoveries, until it was acquired by Ramelius Resources for more than $200 million.

In one of the last steps before producing battery-grade lithium carbonate, Anson Resources (ASX:ASN) has begun “polishing” 43,500 gallons of highly purified lithium chloride eluate produced at the Green River lithium project in the US.

At Stockhead, we tell it like it is. While Riversgold, Caprice Resources, and Anson Resources are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Lunch Wrap: ‘Trump slump’ hits ASX again as pharma, China tariffs send stocks tumbling