Lunch Wrap: ASX wipes out 2025 gains; energy stocks lead sell-off this morning

The ASX has taken another dive after Trump’s tariff news. Aussie miners and tech stocks have been hit, while Suncorp swirls lower amid cyclone worries.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

ASX drops after Trump's tariff news, big losses on Wall Street

Aussie miners hurt as iron ore slumps, tech stocks, too

Suncorp down as cyclone fears add to insurer's woes

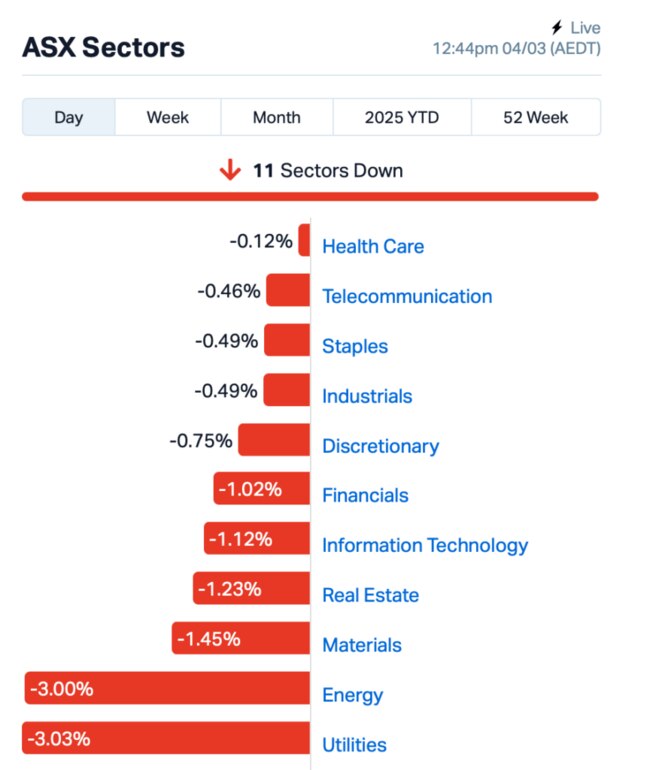

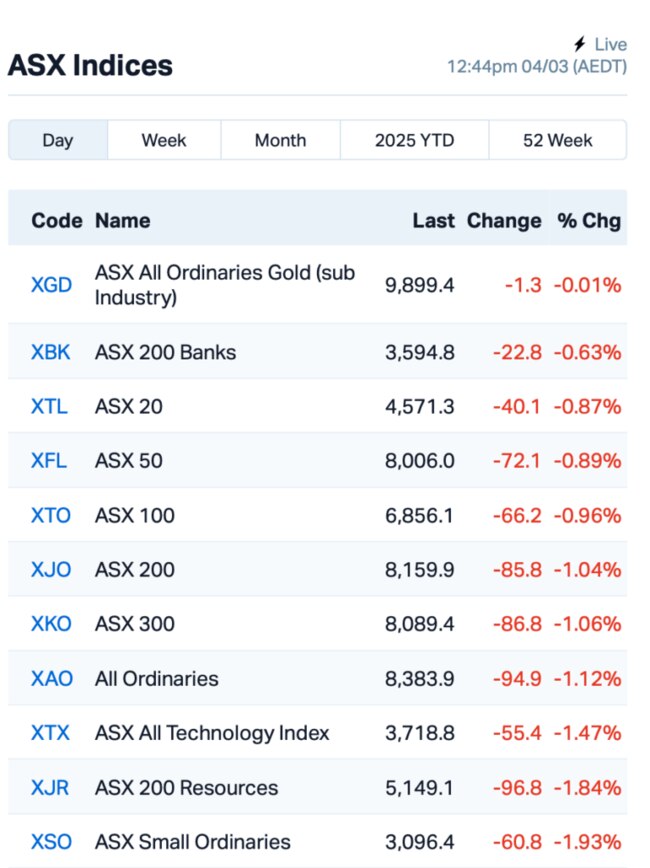

The ASX took a hit at the open today, with the Aussie market sliding by 0.9% after Trump confirmed that tariffs would soon be smacking America's big trade partners.

The benchmark S&P/ASX 200 index has now pretty much wiped out its gains for the year.

Overnight on Wall Street, it was an absolute bloodbath.

Trump's blunt confirmation of the 25% tariff on Mexico and Canada, along with an additional 10% on China, effective today, slammed risk assets, particularly tech stocks.

"There is no room for negotiations," he said.

The S&P 500 took a hammering, down 1.75%, and the tech-heavy Nasdaq dropped 2.6%. Nvidia plummeted by almost 9%, while Bitcoin fell over 8% on the risk-off sentiment.

"An improvement in the US economic growth outlook will be required to fully reverse the recent equity-market weakness," said David Kostin at Goldman Sachs.

Back home, Aussie tech stocks couldn’t dodge the bullet either, with big names like Technology One (ASX:TNE) and Xero (ASX:XRO) shedding up to 2%.

Meanwhile, iron ore prices got crunched, slipping under $US100 a tonne, dragging miners like Fortescue (ASX:FMG) down with them.

But it was oil and gas stocks that were hammered the most after OPEC+ confirmed plans to ramp up oil production from April. Karoon Energy (ASX:KAR), which was down 2.75%, led the sell-off along with energy giant Woodside Energy Group (ASX:WDS), which fell 2%.

Still in large cap news, the Healthco Healthcare and Wellness REIT (ASX:HCW), owned by David Di Pilla, dropped 5% after its tenant, Healthscope, failed to pay rent on 11 of its facilities.

As a result, HCW has pulled its earnings and distribution guidance for FY25, which was set at 8.4 cents per unit, until the issue with Healthscope is sorted out.

Suncorp Group (ASX:SUN) shares were down 1.3%, extending losses over the past week to 8%. The insurer’s shares were impacted by concerns over tropical cyclone Alfred, which was likely to make landfall in Brisbane.

This is where things stood at about lunch time, AEDT:

Meanwhile, the RBA’s minutes from its first meeting of 2025 didn’t offer any big surprises.

The RBA has cut the cash rate to 4.1%, the first reduction since 2020, but essentially said it was keeping cards close to its chest about further rate cuts.

And finally, in economics data, Aussie retail sales saw a small lift in January, up 0.3%, according to the ABS this morning.

Not massive, but it’s keeping things ticking along as the RBA figures out its next move.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for March 4 :

| Code | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| ERG | Eneco Refresh Ltd | 0.015 | 50% | 100,000 | $2,723,583 |

| 88E | 88 Energy Ltd | 0.002 | 50% | 5,326,028 | $28,933,812 |

| NGS | NGS Ltd | 0.034 | 42% | 247,211 | $3,251,588 |

| ADD | Adavale Resource Ltd | 0.003 | 25% | 1,583,156 | $4,546,558 |

| TAS | Tasman Resources Ltd | 0.005 | 25% | 167,264 | $3,220,998 |

| EGR | Ecograf Limited | 0.130 | 24% | 4,946,784 | $47,683,841 |

| IFG | Infocusgroup Hldltd | 0.021 | 24% | 34,620,573 | $3,102,769 |

| MM1 | Midasmineralsltd | 0.120 | 20% | 28,666 | $12,412,968 |

| AKN | Auking Mining Ltd | 0.006 | 20% | 2,636,953 | $2,873,894 |

| ALM | Alma Metals Ltd | 0.006 | 20% | 615,166 | $7,931,727 |

| BCB | Bowen Coal Limited | 0.006 | 20% | 2,732,667 | $53,878,201 |

| GTR | Gti Energy Ltd | 0.003 | 20% | 858,333 | $7,469,874 |

| CCO | The Calmer Co Int | 0.007 | 17% | 100,071 | $15,263,749 |

| TMK | TMK Energy Limited | 0.004 | 17% | 398,012 | $27,976,695 |

| RAD | Radiopharm | 0.030 | 15% | 16,950,584 | $60,683,484 |

| GBZ | GBM Rsources Ltd | 0.008 | 14% | 3,710 | $8,197,490 |

| VAR | Variscan Mines Ltd | 0.008 | 14% | 800,000 | $5,480,004 |

| VEN | Vintage Energy | 0.004 | 14% | 2,263,184 | $5,843,359 |

| POD | Podium Minerals | 0.040 | 14% | 460,709 | $23,849,371 |

| AGC | AGC Ltd | 0.170 | 13% | 301,198 | $38,489,583 |

| SIX | Sprintex Ltd | 0.048 | 13% | 140,464 | $23,673,128 |

| MIO | Macarthur Minerals | 0.035 | 13% | 7,000 | $6,189,631 |

| PFT | Pure Foods Tas Ltd | 0.035 | 13% | 48,361 | $4,198,194 |

| APW | Aims Pror Sec Fund | 2.300 | 11% | 336 | $92,154,502 |

| FRE | Firebrickpharma | 0.100 | 11% | 683,149 | $18,909,766 |

Nutritional Growth Solutions (ASX:NGS) is making moves in the US, kicking off with Wakefern, a major grocery chain in the Northeast. It's rolling out four Healthy Heights products in around 300 stores, which could bring in about US$750k in annual sales, the company said. NGS is also ramping up its presence in Walmart, with the distribution of its Healthy Heights shakes expanding from 762 to 972 stores, plus a new flavour (Strawberry) being added to the mix.

Ecograf (ASX:EGR) has hit a milestone with the granting of the Epanko Graphite Project's "Life of Mine" Special Mining Licence (SML) from the Tanzanian government. This key approval gives EcoGraf the green light to move ahead with financing for the project, which includes a 73,000-tonne-per-year graphite processing plant. The new licence also doubles the mining area, covering a massive 18.9 square km, and positions Epanko as Africa’s largest development-ready graphite resource. EcoGraf said it plans to meet the growing demand for graphite in electric vehicle and clean energy markets.

InFocus Group Holdings (ASX:IFG) has scored a $1.5 million deal to develop a cross-border stablecoin payment platform for GBO Assets, a company based in the Seychelles. The platform will use AI to optimise exchange rates and liquidity. Over the next two years, InFocus said it will design and launch the platform in four phases, with the total value of this project potentially reaching $1.9 million. This is just one of several big contracts InFocus has landed recently, including a $2.5 million deal to develop a digital gaming product for GBO.

Auking Mining (ASX:AKN) has just struck a deal to up its stake in the Cloncurry Gold Project to 50%. It already had a 15% interest and will now invest $5 million by 2027 to bump that up. Orion Resources, which is buying the project’s key assets, including the Lorena processing plant, is aiming to restart mining and processing in the region, with plans to include material from nearby mines like Tick Hill. Auking said this move gives it a shot at a major role in the Cloncurry gold scene.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for March 4 :

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| 1TT | Thrive Tribe Tech | 0.001 | -50% | 295,944 | $4,063,446 |

| CDE | Codeifai Limited | 0.001 | -50% | 7,620,324 | $6,340,628 |

| RFA | Rare Foods Australia | 0.014 | -42% | 250,584 | $6,527,598 |

| AOK | Australian Oil. | 0.002 | -33% | 3,565,000 | $3,005,349 |

| MMR | Mec Resources | 0.003 | -25% | 100,000 | $7,399,063 |

| FG1 | Flynngold | 0.022 | -21% | 460,214 | $7,316,861 |

| BMH | Baumart Holdings Ltd | 0.040 | -20% | 50,024 | $7,237,238 |

| ERA | Energy Resources | 0.002 | -20% | 810,424 | $1,013,490,602 |

| IS3 | I Synergy Group Ltd | 0.004 | -20% | 2,416,520 | $1,981,089 |

| LCL | LCL Resources Ltd | 0.008 | -20% | 715,000 | $11,948,127 |

| APC | APC Minerals | 0.019 | -17% | 885,125 | $2,694,981 |

| LNR | Lanthanein Resources | 0.003 | -17% | 730,000 | $7,330,908 |

| RDN | Raiden Resources Ltd | 0.005 | -17% | 482,095 | $20,705,349 |

| CMB | Cambium Bio Limited | 0.270 | -16% | 27,700 | $4,525,765 |

| AMN | Agrimin Ltd | 0.075 | -15% | 279,732 | $30,207,124 |

| BLZ | Blaze Minerals Ltd | 0.003 | -14% | 7,620,643 | $5,484,317 |

| IXR | Ionic Rare Earths | 0.006 | -14% | 7,026,003 | $36,668,998 |

| NPM | Newpeak Metals | 0.012 | -14% | 107,708 | $4,509,004 |

| TYX | Tyranna Res Ltd | 0.006 | -14% | 900,000 | $23,015,477 |

| BUX | Buxton Resources Ltd | 0.026 | -13% | 212,519 | $6,668,474 |

| RAN | Range International | 0.004 | -13% | 800,000 | $3,757,161 |

| SHP | South Harz Potash | 0.007 | -13% | 13,000 | $8,660,630 |

| MYG | Mayfield Group Ltd | 0.810 | -12% | 81,334 | $85,690,317 |

| SPA | Spacetalk Ltd | 0.250 | -12% | 23,499 | $18,176,263 |

IN CASE YOU MISSED IT

Lanthanein Resources (ASX:LNR) has kicked off diamond drilling at its Lady Grey project in WA’s Yilgarn to test a high-priority modelled conductor plate under MLEM Survey Line #1, which aligns with a significant surface gold anomaly. Despite some delays, drilling is now underway with two planned holes to depths of 325m and 350m, using existing historical access lines.

At Stockhead, we tell it like it is. While Lanthanein Resources is a Stockhead advertiser, it did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Lunch Wrap: ASX wipes out 2025 gains; energy stocks lead sell-off this morning