Lunch Wrap: ASX rebounds as Wall Street shakes off jitters; focus turns to RBA

ASX bounces back as Wall Street shakes off jitters. Gold and oil prices keep climbing, and all eyes are on the RBA’s next move.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

ASX bounces back as Wall Street steadies

Gold hovers at record highs, oil climbs

All eyes now on RBA rate decision

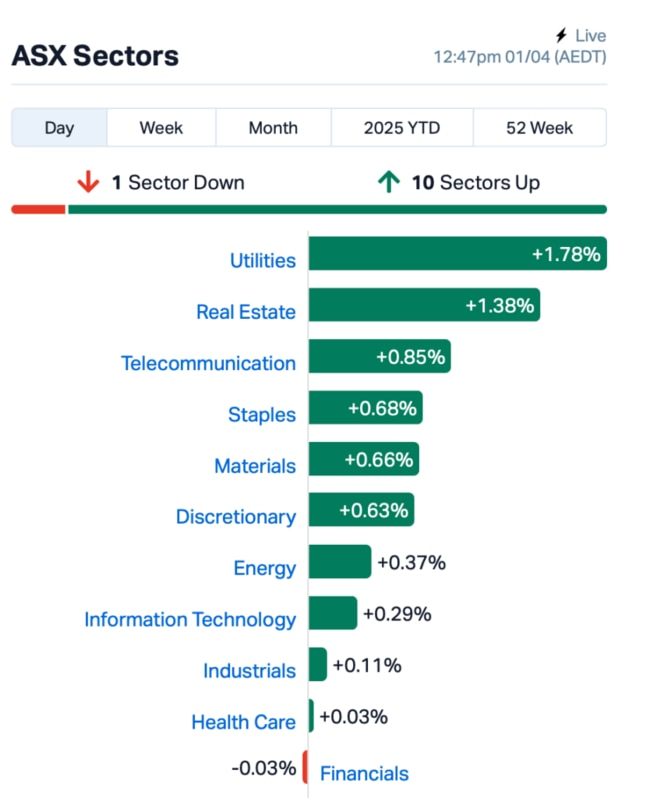

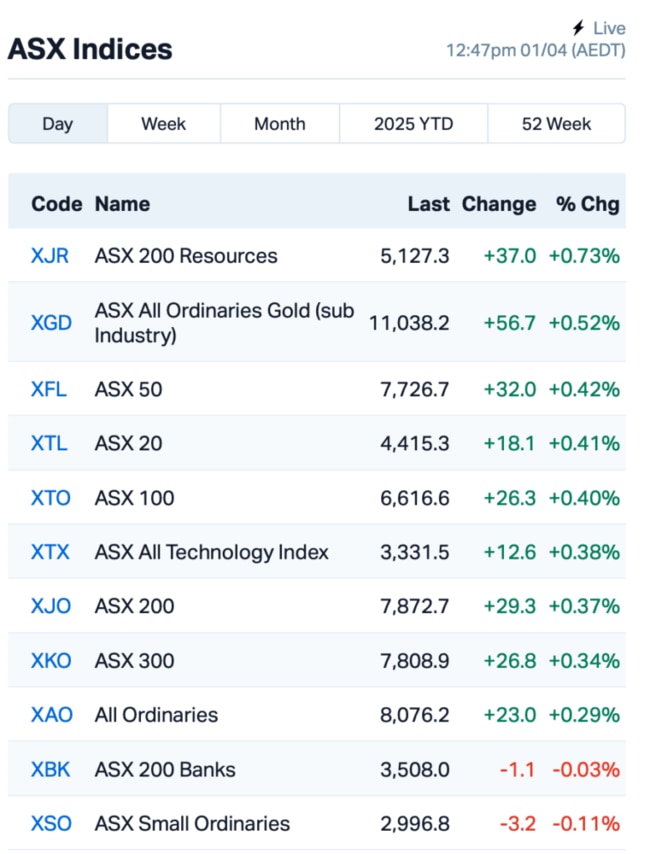

The ASX is off to a strong start on Tuesday morning, up by 0.4% at lunchtime AEDT and making up for some of the heavy losses from yesterday.

Utilities and real estate sectors were leading the charge, with 10 out of 11 sectors showing gains.

On Wall Street overnight, the S&P 500 rebounded 0.6% after some nervous trading, with President Trump set to announce new tariffs tomorrow, April 2.

With Trump’s mixed messages about what he’ll do, traders are on edge, unsure whether the impact will be more severe than expected.

Some are already predicting a US recession is more likely, and with inflation climbing, the fear of stagflation – slow growth paired with rising prices – is growing.

Goldman Sachs has slashed its S&P 500 target for the year, and other experts like Ed Yardeni are saying the tariffs could push the market into a rough patch.

“A happy outcome would be that the US would negotiate tariff reductions, but that won’t happen if the US slaps a 20% tariff on all imports across-the-board,” said Yardeni.

Gold, meanwhile, continues to fly high, holding close to its record price of over US$3100 an ounce.

Gold had its best quarter in decades, up nearly 20% this year so far, with more demand from investors buying bars, coins and gold ETFs.

Meanwhile, oil prices are rising, too, hitting US$74 a barrel after Trump hinted at cutting off Russian oil if they don’t back down in Ukraine.

Back on the ASX, energy stocks saw a boost, helped by the jump in oil prices.

Real estate stocks also stood out, with Goodman Group (ASX:GMG) gaining 1.6%.

In large caps news, SSR Mining (ASX:SSR) dropped around 6% despite announcing an upbeat outlook for 2025.

SSR's guidance for 2025 shows production of 410,000 to 480,000 gold equivalent ounces (GEOs) for the year, a jump of over 10% from 2024.

However, investors may have been spooked by the $60 to $100 million development spend for the Hod Maden project, which is a significant chunk of cash for 2025.

HMC Capital (ASX:HMC) dropped 3% after announcing a $150 million payout from its fund after selling some stakes in Sigma Healthcare (ASX:SIG) and Ingenia Communities Group (ASX:INA).

And... all eyes are now on the RBA decision at 2.30pm AEDT, where experts don't expect another rate cut just yet, though there's a possibility of one down the track.

“No one expects the RBA to cut at consecutive meetings, as the most recent messaging effectively took the scenario off the table,” said Scott Solomon at T. Rowe Price.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for April 1 :

| Code | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| EDE | Eden Inv Ltd | 0.002 | 100% | 6,962,049 | $4,109,881 |

| WHK | Whitehawk Limited | 0.014 | 75% | 35,202,762 | $5,195,168 |

| LNU | Linius Tech Limited | 0.002 | 50% | 860,477 | $6,151,216 |

| PPG | Pro-Pac Packaging | 0.027 | 35% | 3,911,292 | $3,633,754 |

| GGE | Grand Gulf Energy | 0.002 | 33% | 50,000 | $3,675,581 |

| M2R | Miramar | 0.004 | 33% | 70,750 | $1,369,040 |

| OZM | Ozaurum Resources | 0.085 | 31% | 12,441,078 | $14,727,497 |

| CZN | Corazon Ltd | 0.003 | 25% | 5,000 | $2,369,145 |

| CVR | Cavalierresources | 0.210 | 24% | 148,303 | $9,833,177 |

| PGD | Peregrine Gold | 0.200 | 21% | 87,857 | $13,111,555 |

| AVE | Avecho Biotech Ltd | 0.006 | 20% | 657,725 | $15,846,485 |

| IPB | IPB Petroleum Ltd | 0.006 | 20% | 353,720 | $3,532,015 |

| JLL | Jindalee Lithium Ltd | 0.285 | 19% | 91,969 | $17,662,044 |

| XGL | Xamble Group Limited | 0.020 | 18% | 6,315 | $5,763,242 |

| PUA | Peak Minerals Ltd | 0.011 | 17% | 1,094,225 | $25,265,892 |

| DVL | Dorsavi Ltd | 0.007 | 17% | 774,371 | $4,387,428 |

| HHR | Hartshead Resources | 0.007 | 17% | 474,535 | $16,852,093 |

| PIL | Peppermint Inv Ltd | 0.004 | 17% | 3,950,449 | $6,634,438 |

| XPN | Xpon Technologies | 0.007 | 17% | 490,000 | $2,174,649 |

| BP8 | Bph Global Ltd | 0.004 | 14% | 450,112 | $2,129,079 |

| GBZ | GBM Rsources Ltd | 0.008 | 14% | 2,670,000 | $8,197,490 |

| GLL | Galilee Energy Ltd | 0.008 | 14% | 390,500 | $3,900,350 |

| STM | Sunstone Metals Ltd | 0.008 | 14% | 16,280,686 | $36,050,025 |

Concrete tech company, Eden Innovations (ASX:EDE), announced that Holcim US has placed its first major order for EdenCrete Pz7, worth around $145,668, for a large construction project in Colorado. This order will cover 25,000 cubic yards of concrete. Over the past 10 months, Eden has received over $675,000 worth of orders from Holcim in the US and Ecuador. EdenCrete Pz7 is also being trialled in countries like Canada, Mexico, and the UK, which could open up more markets for the product in the future.

Cybersecurity firm WhiteHawk (ASX:WHK) has just bagged a major spot as the core cyber partner on a massive US$920m US federal government contract. Teaming up with Knexus Research and other big names, WhiteHawk will deliver AI-powered tools for managing cyber risks in federal supply chains. This 10-year deal could bring in recurring revenue as task orders are released. Backed by a 2025 White House Executive Order, the contract will streamline government procurement, opening up more opportunities for WhiteHawk.

Pro-Pac Packaging (ASX:PPG) has acknowledged a challenging start to 2025, with results for the first quarter falling below expectations. The company is now conducting a strategic review to improve profitability and assess funding needs, with a focus on resolving short-term requirements. To support this, Pro-Pac has appointed David Hewish from Leaders on Demand as Chief Transformation Officer for six months to help implement the changes.

OzAurum Resources (ASX:OZM) has hit it big with high-grade gold at the New Cross Fault discovery in its Mulgabbie North Gold Project. Recent drilling showed impressive gold results, like 48m at 1.66 g/t gold, including 9m at 5.79 g/t, and 12m at 4.26 g/t, with a bonanza 2m at 22.58 g/t. These results have confirmed the potential for a major gold system.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for April 1 :

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| CDT | Castle Minerals | 0.002 | -33% | 2,218,239 | $5,783,469 |

| VML | Vital Metals Limited | 0.002 | -33% | 169,336 | $17,685,201 |

| CRS | Caprice Resources | 0.060 | -30% | 54,682,807 | $43,492,470 |

| SUM | Summitminerals | 0.056 | -25% | 748,623 | $6,534,599 |

| CPO | Culpeominerals | 0.012 | -20% | 1,753,192 | $3,299,433 |

| EMU | EMU NL | 0.028 | -20% | 73,936 | $6,776,049 |

| CHM | Chimeric Therapeutic | 0.004 | -20% | 2,746,153 | $8,100,749 |

| HLX | Helix Resources | 0.002 | -20% | 2,000,000 | $8,410,484 |

| IFG | Infocusgroup Hldltd | 0.008 | -20% | 1,290,478 | $2,407,900 |

| LML | Lincoln Minerals | 0.004 | -20% | 3,375,000 | $10,281,298 |

| TEG | Triangle Energy Ltd | 0.004 | -20% | 115,000 | $10,446,170 |

| PFE | Pantera Lithium | 0.014 | -18% | 78,341 | $8,054,323 |

| TOY | Toys R Us | 0.030 | -17% | 50,000 | $5,445,438 |

| ADG | Adelong Gold Limited | 0.005 | -17% | 4,271,657 | $8,384,917 |

| CTN | Catalina Resources | 0.003 | -17% | 910,000 | $4,548,786 |

| EPM | Eclipse Metals | 0.005 | -17% | 191,315 | $17,158,914 |

| GTR | Gti Energy Ltd | 0.003 | -17% | 13,612 | $8,996,849 |

| AYT | Austin Metals Ltd | 0.006 | -15% | 3,104,167 | $8,607,244 |

| PBL | Parabellumresources | 0.040 | -15% | 60,122 | $2,928,100 |

| ALY | Alchemy Resource Ltd | 0.006 | -14% | 7,881,732 | $8,246,534 |

| KGD | Kula Gold Limited | 0.006 | -14% | 6,602,959 | $6,448,776 |

| BRX | Belararoxlimited | 0.235 | -13% | 409,808 | $38,870,311 |

| ADN | Andromeda Metals Ltd | 0.007 | -13% | 2,607,195 | $27,429,822 |

| ASR | Asra Minerals Ltd | 0.004 | -13% | 14,453,128 | $9,492,507 |

IN CASE YOU MISSED IT

AnteoTech (ASX:ADO) has appointed Glenda McLoughlin as its new non-executive chair, recognising her extensive investment banking and board experience spanning more than 20 years. The company has farewelled outgoing chair Ewen Crouch AM and Dr. Katherine Woodthorpe AO, thanking them for their contributions as it advances the commercialisation of its clean energy and life sciences technologies.

Well-funded GWR Group (ASX:GWR) has agreed to amend the terms of its Wiluna West iron ore project royalty agreement with Gold Valley, adjusting payments in response to lower iron ore prices. To date, the company has earned a royalty of $2.53 million, with all amounts received.

Mount Hope Mining (ASX:MHM) has completed a ground gravity survey at its namesake project in the Cobar Basin, NSW. The survey covered 97 km² with 1732 stations, exceeding initial plans, and data is now being processed by Southern Geoscience Consultants to refine exploration targets for potential Cobar-style mineralisation.

Sun Silver (ASX:SS1) has appointed former Barrick Gold and Nevada Gold Mines chief geologist, Keith Wood, as exploration manager to drive resource development at Maverick Springs in Nevada. Wood has over 25 years of experience, leading major discoveries and growth strategies in the silver state, strengthening Sun Silver’s technical leadership as it advances its silver-gold project.

At Stockhead, we tell it like it is. While AnteoTech, GWR Group, Mount Hope Mining, and Sun Silver are Stockhead advertisers, they did not sponsor this article

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Lunch Wrap: ASX rebounds as Wall Street shakes off jitters; focus turns to RBA