Lunch Wrap: ASX creeps up after Trump’s flip; Bellevue down 22pc on cap raise

ASX inches higher on US tariff buzz, Bellevue cops a hit after a big cap raise, and HUB24 steals the spotlight with record inflows.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

ASX lifts slightly as markets cheer US tariff relief

Bellevue gold shares tank after capital raise

HUB24 hits record inflows, perpetual sees major outflows

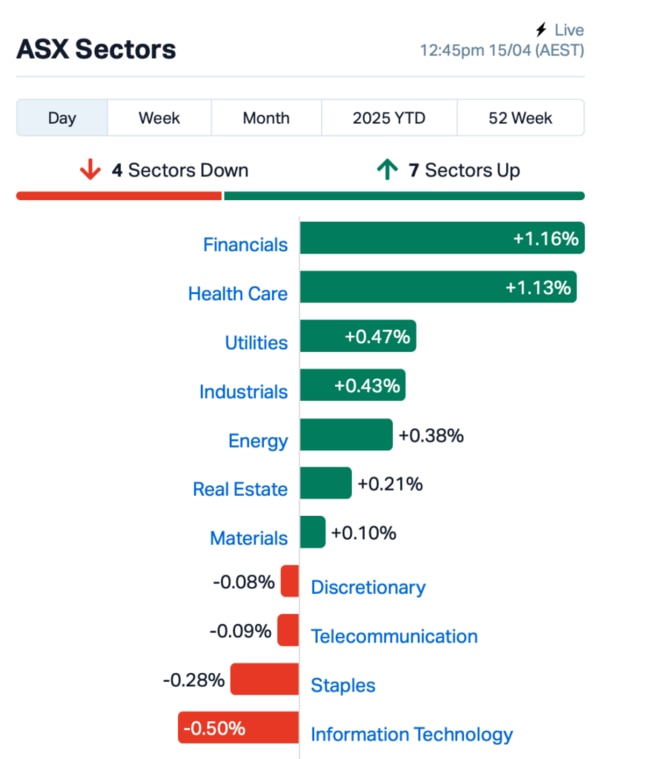

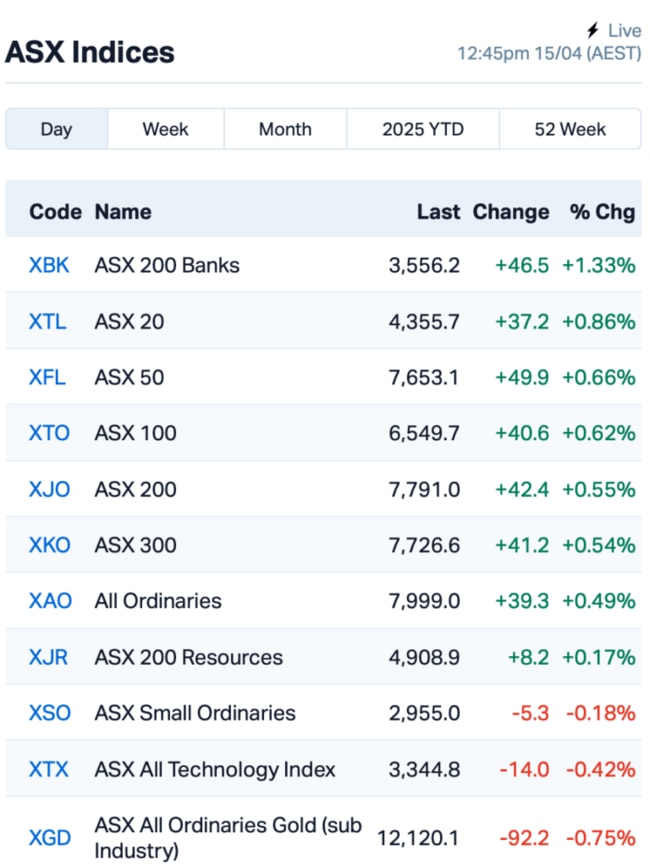

The ASX tiptoed higher on Tuesday, up by 0.5% at lunch time and riding cautiously after President Trump hinted at easing up on tariffs for car imports.

Overnight, Wall Street closed with a 0.8% gain on the S&P 500, largely thanks to Apple jumping 2% after news that certain electronics would also be spared from tariffs, at least for now.

That little breather gave US tech stocks some much-needed oxygen. Still, the whole thing remains as clear as mud.

Trump, true to form, threw both hope and chaos into the mix.

After talking up exemptions for carmakers, which sent Ford and GM bouncing higher, he flipped around and said there’d be no mercy when it came to semiconductors.

In a social media post, he said the US would be looking “at the WHOLE ELECTRONICS SUPPLY CHAIN” as part of a national security review.

Still, the Japanese market loved the auto tariff pause, with the Nikkei jumping more than 1% this morning; Toyota led the charge.

Back home on the ASX, investors played it relatively safe.

Banks led the way, while CSL (ASX:CSL) added 2.5%, pushing the health sector higher with it.

Tech names, though, slumped. WiseTech Global (ASX:WTC) was down 2%, and TechnologyOne dropped 1.3%. No relief there.

Miners did their bit. BHP (ASX:BHP) nudged up 0.5% thanks to higher iron ore prices.

The biggest mover in the large caps space this morning was Bellevue Gold (ASX:BGL). After a three-week trading pause, Bellevue came out and got knocked flat.

BGL shares plunged as much as 23% after the company revealed a $156.5 million capital raise, aimed at closing out hedge contracts and strengthening its balance sheet.

In the finance space, investment platform Hub24 (ASX:HUB) was flying high after posting record platform inflows for the March quarter, pulling in $3.6 billion. But shares were down 1.5%.

Meanwhile, asset manager Perpetual (ASX:PPT) was busy plugging leaks. The firm reported net outflows of $8.9 billion in Q3, more than double the previous quarter’s $3.8 billion. Shares slipped 2%.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for April 15 :

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| SUH | Southern Hem Min | 0.030 | 43% | 16,086,362 | $15,461,041 |

| MAY | Melbana Energy Ltd | 0.032 | 33% | 21,943,902 | $80,884,898 |

| MSG | Mcs Services Limited | 0.004 | 33% | 1,521,756 | $594,299 |

| DAL | Dalaroo Metals | 0.020 | 33% | 1,347,945 | $3,734,279 |

| SNS | Sensen Networks Ltd | 0.031 | 29% | 559,452 | $19,032,899 |

| IXR | Ionic Rare Earths | 0.009 | 29% | 25,088,730 | $36,668,998 |

| MEI | Meteoric Resources | 0.088 | 28% | 22,934,148 | $161,243,532 |

| SRL | Sunrise | 0.620 | 25% | 564,062 | $44,662,612 |

| AVE | Avecho Biotech Ltd | 0.005 | 25% | 54,838 | $12,677,188 |

| BYH | Bryah Resources Ltd | 0.005 | 25% | 2,691,128 | $3,479,814 |

| CHM | Chimeric Therapeutic | 0.005 | 25% | 1,711,055 | $6,480,599 |

| FAU | First Au Ltd | 0.003 | 25% | 5,000,000 | $4,143,987 |

| IPB | IPB Petroleum Ltd | 0.005 | 25% | 2,000,000 | $2,825,612 |

| KTA | Krakatoa Resources | 0.010 | 25% | 2,915,550 | $4,961,072 |

| RAN | Range International | 0.003 | 25% | 2,729,000 | $1,878,581 |

| RLG | Roolife Group Ltd | 0.005 | 25% | 12,675,283 | $5,984,125 |

| GUL | Gullewa Limited | 0.098 | 24% | 182,827 | $17,223,752 |

| AR3 | Austrare | 0.110 | 24% | 1,251,146 | $14,150,086 |

| LKY | Locksleyresources | 0.021 | 24% | 557,824 | $2,493,333 |

| CPO | Culpeominerals | 0.016 | 23% | 939,331 | $2,859,509 |

| PSC | Prospect Res Ltd | 0.135 | 23% | 1,555,442 | $62,992,928 |

| VMM | Viridismining | 0.305 | 22% | 768,527 | $21,313,256 |

| 4DX | 4Dmedical Limited | 0.310 | 22% | 1,678,944 | $114,856,860 |

| ATH | Alterity Therap Ltd | 0.009 | 21% | 8,309,004 | $63,891,595 |

Southern Hemisphere Mining (ASX:SUH) reckons it’s onto something big at its Curiosity copper-gold target in Chile. It just wrapped up a deep Magneto-Telluric survey, and the results line up nicely with earlier geochem modelling and IP data. Basically, all signs point to a large zone of low resistivity, stretching over 1.4km deep. The setup it said, looks a lot like Atex Resources' Valeriano project. Southern Hemisphere believes it’s building a case that this part of Llahuin might be much bigger than first thought.

Melbana Energy (ASX:MAY) has just wrapped up a workover at its Block 9 project in Cuba, and the results are looking sharp. It managed to boost production at Unit 1B from 293 barrels a day to 488, a 66% jump, after sorting out damage caused when the well was shut in last year. The well is now flowing full-time to build up stock for its first shipment. Melbana reckons this reservoir has serious potential, with earlier tests showing Unit 1B could pump out as much as 1,235 barrels a day.

Dalaroo Metals (ASX:DAL) is gearing up for its first boots-on-ground program at the Blue Lagoon critical minerals project in Greenland, kicking off late June. It’s chasing zirconium, niobium and rare earths – all the juicy stuff the world’s scrambling for. Uranium anomalies were first spotted here back in 1979, but no one’s touched those results since, so Dalaroo’s the first to give it a proper look. It’s also brought in Greenland geologist heavyweight Ole Christiansen.

Meteoric Resources (ASX:MEI) has just dropped its maiden resource for Barra do Pacu in Brazil, and it’s a ripper. The new estimate adds 389 million tonnes at 2,204ppm TREO to its Caldeira rare earths project, with a solid chunk, 77Mt, now sitting in the Indicated category. Even better, there’s a high-grade zone of 32Mt going over 4,000ppm. Barra do Pacu sits right next door to its own Capão do Mel project, and the two combined now clock over 150Mt of high-grade rare earths close to the planned processing plant.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for April 15 :

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| 88E | 88 Energy Ltd | 0.001 | -33% | 4,417,586 | $43,400,718 |

| ICL | Iceni Gold | 0.050 | -29% | 1,473,306 | $21,551,984 |

| EEL | Enrg Elements Ltd | 0.002 | -25% | 849,999 | $6,507,557 |

| CYB | Aucyber Limited | 0.071 | -24% | 594,256 | $15,374,956 |

| KAL | Kalgoorliegoldmining | 0.059 | -24% | 25,328,978 | $29,628,170 |

| AD1 | Adneo Limited | 0.043 | -22% | 165,926 | $8,052,382 |

| BGL | Bellevue Gold Ltd | 0.898 | -22% | 27,579,505 | $1,469,907,308 |

| ERL | Empire Resources | 0.004 | -20% | 953,799 | $7,419,566 |

| VRC | Volt Resources Ltd | 0.004 | -20% | 2,968,848 | $23,423,890 |

| E79 | E79Goldmineslimited | 0.033 | -20% | 3,859,853 | $6,494,918 |

| AT1 | Atomo Diagnostics | 0.018 | -18% | 1,594,766 | $14,062,451 |

| ASQ | Australian Silica | 0.015 | -17% | 365,028 | $5,073,487 |

| ICG | Inca Minerals Ltd | 0.005 | -17% | 321,936 | $7,658,340 |

| LU7 | Lithium Universe Ltd | 0.005 | -17% | 110,000 | $4,715,878 |

| SER | Strategic Energy | 0.005 | -17% | 14,997 | $4,026,200 |

| SCN | Scorpion Minerals | 0.017 | -15% | 532,043 | $10,234,124 |

| DTZ | Dotz Nano Ltd | 0.065 | -14% | 493,323 | $43,040,870 |

| ODE | Odessa Minerals Ltd | 0.006 | -14% | 71,430 | $11,196,728 |

| PCL | Pancontinental Energ | 0.006 | -14% | 1,692,790 | $56,956,101 |

| SPX | Spenda Limited | 0.006 | -14% | 1,412,930 | $32,306,508 |

| AX8 | Accelerate Resources | 0.007 | -13% | 341,534 | $6,297,510 |

| GLA | Gladiator Resources | 0.007 | -13% | 162,500 | $6,066,375 |

| ATG | Articore Group Ltd | 0.150 | -12% | 513,500 | $48,429,067 |

| A8G | Australasian Metals | 0.061 | -12% | 183,208 | $3,994,391 |

Collins Foods (ASX:CKF) decided it’s had enough of Taco Bell in Australia. The company announced it’ll be pulling the plug on the burrito-slinging brand within the next 12 months. Shares were plunging south of the border at the time of writing, down 5%.

IN CASE YOU MISSED IT

In a bid to focus on the Rae copper project in Canada, White Cliff Minerals (ASX:WCN) has offloaded its Reedy South gold project in Australia to Bain Global Resources Pty Ltd for $1.2 million in cash. The sale will allow WCN to devote all of its attention to the Rae project, where drilling is well underway.

At Stockhead, we tell it like it is. While White Cliff Minerals is a Stockhead advertiser, it did not sponsor this article. This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Lunch Wrap: ASX creeps up after Trump’s flip; Bellevue down 22pc on cap raise