Lunch Wrap: ASX bounces back as big boys Coles, Qantas and Ramsay lead the charge

After a tough run, the ASX has made a comeback, with Coles and Qantas leading the charge driven by solid earnings reports.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

ASX bounces back after rough patch

Coles and Qantas lead the charge with solid earnings

Eagers, Neuren and Ramsay deliver strong results

The ASX bounced back on Thursday morning, having moving up 0.35% at the time of writing, after taking a hit for seven out of the last eight sessions.

Big names led the charge as ASX earnings season really kicked into gear.

Meanwhile overnight in the US, the S&P 500 closed flat, while the Nasdaq saw a small lift of 0.25%.

Nvidia was the big talking point as the chipmaker reported solid but not spectacular earnings.

For Q4, Nvidia posted revenue of $11 billion, driven largely by its Blackwell chips, which it described as having the “fastest product ramp” in the company’s history.

Despite this, its earnings weren't as mind blowing as investors expected, causing the stock to swing between gains and losses in after-hours trading.

Elsewhere, Bitcoin fell to around US$84k, dropping more than 20% from its peak last month, as outflows from ETFs intensified selling.

Investors across asset classes were also left jittery after comments from President Trump caused some confusion.

“The tariffs go on, not all of them, but a lot of them,” Trump said of the April deadline for Mexico and Canada.

“And I think you’re going to see something that’s going to be amazing.”

ASX earnings season highlights

But here is where the action’s at closer to home.

Coles Group (ASX:COL) jumped 5.5% after reporting a 3.7% increase in sales in the half, hitting $23.04 billion. Its net profit rose 6.4% to $666 million, and it’s paying a 37-cent dividend, up 2.8%. E-commerce sales were strong, growing by 22.6%.

Coles chairman James Graham is also stepping down, with Peter Allen set to take over on May 1. Graham’s been at the helm since 2018, when Coles listed on the ASX after being spun off from Wesfarmers.

Qantas (ASX:QAN) also shot up 4% after it posted strong results, with a profit before tax of $1.39 billion for the half, up 11%. The airline carried nearly 10% more customers and saw good demand across both Qantas and Jetstar. The company also announced $400 million in dividends for shareholders.

Hospitals network Ramsay Health Care (ASX:RHC) surged 14% after reporting strong performance in its Aussie and UK hospitals during the half. Aussie EBIT was up 6.2% and UK EBIT up 31.4%. However, cost pressure is still an issue, the company said. Ramsay’s dividend is staying at 40 cents per share.

Eagers Automotive (ASX:APE) reported a 25% drop in net profit for the full year of FY24 to $222.9 million. But despite that, the stock jumped 25%, mainly because its secondhand car business, easyauto123, smashed records. CEO Keith Thornton reckons the company’s still doing better than the overall market, and with over 200 showrooms in the ANZ, size is giving Eagers a leg up in the industry, he said.

Neuren Pharmaceuticals (ASX:NEU) surged 7% after it posted a massive jump in sales for its Rett syndrome drug Daybue in 2024. The company reported US sales hitting US$348.4 million, up 97% from last year, with a record fourth-quarter sales of US$96.7 million. Neuren expects royalties to hit US$56.2 million in 2024, a 110% increase. Neuren also said most diagnosed Rett patients haven't tried Daybue yet.

Meanwhile, IDP Education (ASX:IEL) plunged by 12% after reporting a 16% drop in H1 revenue to $475.4 million, mainly due to lower student placement and English language testing volumes. Despite this, IDP kept costs in check, reducing direct costs by 9% and overheads by 14%.

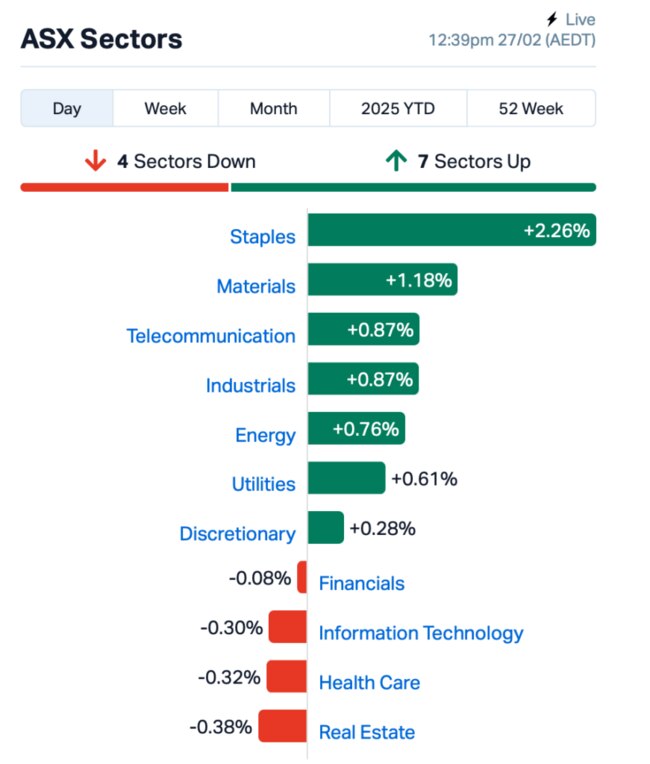

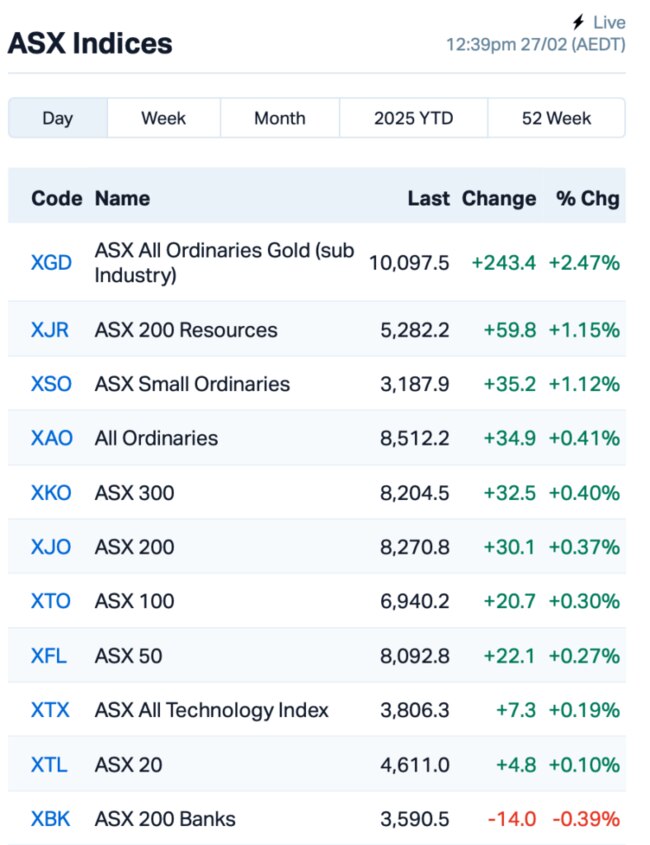

This is where things stood at around lunch time, AEDT:

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for February 27 :

| Code | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| FFF | Forbidden Foods | 0.008 | 60% | 20,212,634 | $3,560,510 |

| HTM | High-Tech Metals Ltd | 0.270 | 59% | 912,946 | $5,582,802 |

| ADD | Adavale Resource Ltd | 0.003 | 50% | 204,000 | $4,546,558 |

| EEL | Enrg Elements Ltd | 0.002 | 50% | 500,000 | $3,253,779 |

| OLY | Olympio Metals Ltd | 0.059 | 48% | 6,106,392 | $3,479,059 |

| WOA | Wide Open Agricultur | 0.018 | 46% | 32,572,108 | $6,404,239 |

| VRC | Volt Resources Ltd | 0.005 | 43% | 59,414,961 | $15,852,877 |

| RLL | Rapid Lithium Ltd | 0.004 | 33% | 22,361,992 | $3,097,334 |

| WYX | Western Yilgarn NL | 0.034 | 31% | 100,000 | $3,219,048 |

| PBH | Pointsbet Holdings | 1.080 | 30% | 6,249,041 | $275,331,976 |

| ZMI | Zinc of Ireland NL | 0.014 | 27% | 7,860,467 | $6,237,118 |

| ALV | Alvomin | 0.059 | 26% | 219,720 | $5,506,468 |

| PER | Percheron | 0.015 | 25% | 3,419,156 | $13,049,252 |

| 1TT | Thrive Tribe Tech | 0.003 | 25% | 14,167 | $4,063,446 |

| ERA | Energy Resources | 0.003 | 25% | 11,821,205 | $810,792,482 |

| LNR | Lanthanein Resources | 0.003 | 25% | 35,399 | $4,887,272 |

| ENV | Enova Mining Limited | 0.008 | 23% | 4,486,313 | $7,999,184 |

| AMS | Atomos | 0.006 | 20% | 4,003,331 | $6,075,092 |

| ASR | Asra Minerals Ltd | 0.003 | 20% | 1,900,000 | $5,932,817 |

| EVR | Ev Resources Ltd | 0.006 | 20% | 15,000 | $9,662,517 |

| IS3 | I Synergy Group Ltd | 0.006 | 20% | 270,313 | $1,981,089 |

| WBE | Whitebark Energy | 0.006 | 20% | 162,698 | $1,541,046 |

| FBR | FBR Ltd | 0.024 | 18% | 23,129,395 | $101,197,175 |

| BNL | Blue Star Helium Ltd | 0.007 | 17% | 15,050,141 | $16,169,312 |

| MGU | Magnum Mining & Exp | 0.007 | 17% | 1,142,857 | $4,856,168 |

Matsa Resources (ASX:MAT) has struck a deal with AngloGold Ashanti where the mining giant has the option to buy the majority of the Lake Carey gold project for $101 million. Matsa will be keeping some key assets though, like the Devon Pit Gold Mine and Fortitude North project. The deal includes a non-refundable $8 million upfront, with the bulk of it based on gold price fluctuations, plus a deferred payment of up to $20 million depending on future gold discoveries.

Fund manager Australian Ethical Investment (ASX:AEF) had a cracking first half of FY25, with profits and revenue all up. Funds Under Management (FUM) hit a record $13.26 billion, up 27% from June 2024, and NPAT jumped 50% to $9.3 million. The company’s growth strategy is clearly paying off, all while expanding through the acquisition of Altius Asset Management.

Non-bank lender Pepper Money (ASX:PPM) reported a 16% increase in originations in the second half of 2024, with mortgage originations up 27% and asset finance a bit slower. PepperMoney posted a 9% increase in pre-tax profit, reaching $209.2 million, though NPAT was down 10%. The company maintained a healthy dividend yield of 8.6%, up from 6.4% last year.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for February 27 :

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AXP | AXP Energy Ltd | 0.001 | -50% | 5,510,526 | $13,149,361 |

| OVT | Ovanti Limited | 0.008 | -38% | 93,263,524 | $27,978,574 |

| ALA | Arovella Therapeutic | 0.125 | -36% | 6,958,457 | $207,509,941 |

| VPR | Voltgroupltd | 0.001 | -33% | 16,584 | $16,074,312 |

| IDX | Integral Diagnostics | 1.970 | -31% | 7,148,867 | $1,063,402,254 |

| APX | Appen Limited | 2.060 | -28% | 24,315,930 | $752,131,172 |

| 88E | 88 Energy Ltd | 0.002 | -25% | 2,418,329 | $57,867,624 |

| TIG | Tigers Realm Coal | 0.003 | -25% | 124,949 | $52,266,809 |

| PTM | Platinum Asset | 0.595 | -21% | 6,549,592 | $436,625,337 |

| ATV | Activeportgroupltd | 0.012 | -20% | 8,819,849 | $10,274,656 |

| HLO | Helloworld Travl Ltd | 1.640 | -20% | 1,835,474 | $333,776,129 |

| AAU | Antilles Gold Ltd | 0.004 | -20% | 187,998 | $9,476,880 |

| CAV | Carnavale Resources | 0.004 | -20% | 42,666 | $20,451,092 |

| HFY | Hubify Ltd | 0.008 | -20% | 900,000 | $5,111,363 |

| PRX | Prodigy Gold NL | 0.002 | -20% | 125 | $7,937,639 |

| VFX | Visionflex Group Ltd | 0.002 | -20% | 900,000 | $8,419,651 |

| ACL | Au Clinical Labs | 3.040 | -18% | 1,945,956 | $742,130,604 |

| KLS | Kelsian Group Ltd | 2.990 | -17% | 2,252,962 | $981,526,586 |

| 1AI | Algorae Pharma | 0.005 | -17% | 20,000 | $10,124,368 |

| BPP | Babylon Pump | 0.005 | -17% | 4,952,001 | $14,997,294 |

| DTM | Dart Mining NL | 0.005 | -17% | 8,301,772 | $3,588,333 |

| RNX | Renegade Exploration | 0.005 | -17% | 2,000,000 | $7,704,021 |

| TEG | Triangle Energy Ltd | 0.005 | -17% | 800,001 | $12,535,404 |

| PGD | Peregrine Gold | 0.105 | -16% | 30,103 | $9,932,996 |

IN CASE YOU MISSED IT

Riversgold (ASX:RGL) is adding another rig to kick off its 2025 drill season at the Kalgoorlie East gold project in WA. The aircore rig will drill 2000 metres to test shallow mineralisation, while a newly added RC rig from Topdrill will complete 1280 metres at depths of 100 to 120 metres, targeting extensions of previous high-grade shallow intercepts.

After executing binding toll milling agreements, Challenger Gold (ASX:CEL)has appointed veteran mining engineer Ubirata (Bira) De Oliveira as general manager of operations for its Hualilan gold project in San Juan, Argentina.Oliveira will lead the operational readiness phase for toll milling, managing the transition from development to full-scale production and overseeing daily mining activities.

European Lithium (ASX: EUR)has announced that Critical Metals Corp has appointed Michael C. Ryan as an independent director to its board. Ryan will also serve as chairman of the Audit Committee, bringing the total number of directors on Critical Metals Corp’s board to five.

At Stockhead, we tell it like it is. While Riversgold, Challenger Gold, and European Lithium are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Lunch Wrap: ASX bounces back as big boys Coles, Qantas and Ramsay lead the charge