Closing Bell: ASX hits all-time high as tech stocks lead broad rally

The ASX kissed a record high on Tuesday, led by tech, energy and gold stocks, with gold rising above US$2600.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

ASX hits record high with tech stocks leading

TechnologyOne shares soar after strong earnings results

Gold stocks rally as bullion rises above US$2600

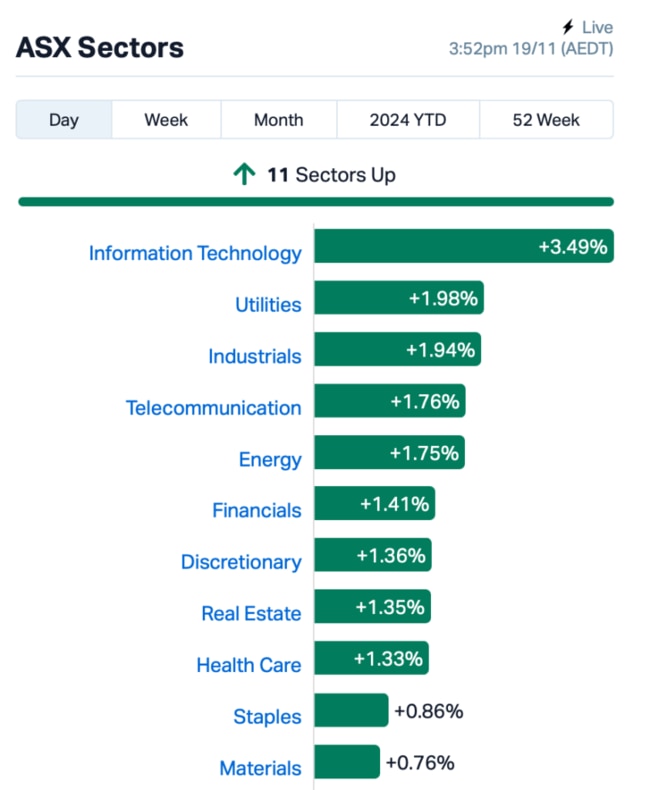

The ASX surged to a new record on Tuesday, with technology and the other 10 sectors driving the rally.

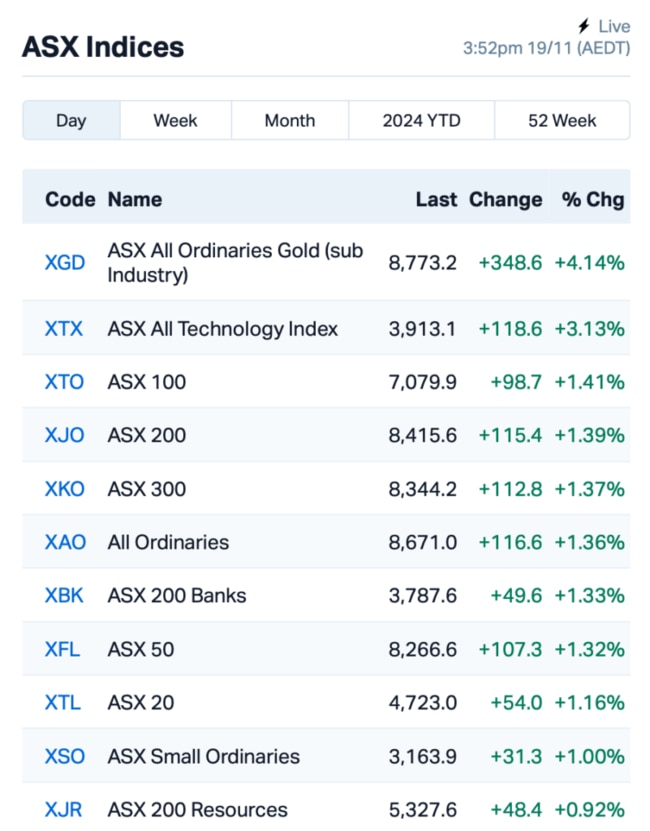

At the close, the S&P/ASX 200 Index had gained 0.89%, having earlier touching its highest-ever level of 8446 points before retreating slightly. This was also the first time the index had ever broken the 8400 barrier.

All sectors were in the green, but tech stocks were the standout as investors piled into the sector.

One tech stock in particular, Technology One (ASX:TNE), saw its shares soar by 11%. The software giant’s strong performance, with a 15% rise in annual profits to $118 million and a 17% jump in revenue, helped boost investor confidence.

In Healthcare, the second biggest health stock on the ASX – Sonic Healthcare (ASX:SHL) – had its AGM today in which the CEO said its outlook is cautiously optimistic.

Sonic has already seen its earnings margins dip in recent years, but it's now focused on a major project aimed at improving these margins through effective cost management. Early results are expected to show in FY25, with momentum building through FY26 and FY27. Sonic's shares were up 7%.

Energy stocks also had a solid day, supported by a rise in crude prices on the back of geopolitical tensions and a weakening US dollar.

Brent crude oil hit above $US73 a barrel after the US gave Ukraine the go-ahead to use long-range missiles inside Russia, which stoked fears of further conflict.

Still in Energy, Santos (ASX:STO) announced plans to increase shareholder returns starting in 2026, as its major projects in the Timor Sea and Alaska begin to pay off. The company plans to increase its payout ratio to 60% of free cash flow, up from the current 40%. Santos rose almost 1%.

Gold stocks also rallied after the bullion price lifted above US$2600 an ounce.

A note from broker IG suggested this current level could signal further gains towards $2,800. Goldman Sachs is even forecasting a price surge to $3,000 in 2025.

Newmont Corporation (ASX:NEM), the world’s largest gold producer, climbed 2.4% after announcing the sale of its Musselwhite mine in Canada for up to US$850 million, part of its broader strategy to divest non-core assets. NEM's shares lifted 2.5%.

What else is happening today?

Asian markets took a cue from Wall Street’s gains overnight.

The MSCI index of regional shares rose by around 1%, with Japan, Australia, and South Korea leading the charge.

The US dollar continued to slide, marking its third day of losses, as the initial 'Trump trade' momentum faded. The USD/AUD is currently trading at US65.20 cents.

Last night, tech stocks such as Tesla surged, with the Nasdaq 100 gaining 0.7% after news that Trump’s transition team is considering relaxing regulations for self-driving cars.

Meanwhile, the RBA believes its current policy is appropriate to reduce core inflation, which remains "too high".

Minutes of the RBA’s November meeting released today said the board expects the cash rate to remain steady for several months before being reduced in 2025 and 2026.

The RBA has kept the cash rate at 4.35% for the past year.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| PTR | Petratherm Ltd | 0.105 | 110% | 26,081,085 | $15,174,115 |

| OLY | Olympio Metals Ltd | 0.055 | 62% | 638,036 | $2,923,200 |

| 1AE | Auroraenergymetals | 0.068 | 58% | 5,752,494 | $7,699,741 |

| RHT | Resonance Health | 0.059 | 55% | 3,956,935 | $17,465,413 |

| MTB | Mount Burgess Mining | 0.002 | 50% | 44,625 | $1,298,147 |

| SI6 | SI6 Metals Limited | 0.002 | 50% | 1,349,401 | $2,767,292 |

| DAF | Discovery Alaska Ltd | 0.018 | 38% | 421,289 | $3,045,051 |

| VKA | Viking Mines Ltd | 0.014 | 27% | 6,081,956 | $11,688,509 |

| FRB | Firebird Metals | 0.115 | 26% | 201,743 | $12,954,887 |

| VTM | Victory Metals Ltd | 0.390 | 26% | 293,357 | $33,635,841 |

| VAR | Variscan Mines Ltd | 0.010 | 25% | 4,857,269 | $5,906,671 |

| VML | Vital Metals Limited | 0.003 | 25% | 812,389 | $11,790,134 |

| BB1 | Blinklab Limited | 0.320 | 23% | 1,851,957 | $14,842,395 |

| TMB | Tambourahmetals | 0.030 | 20% | 10,000 | $2,719,751 |

| CDE | Codeifai Limited | 0.003 | 20% | 7,736,079 | $6,603,237 |

| DTI | DTI Group Ltd | 0.012 | 20% | 125,000 | $4,485,514 |

| RMX | Red Mount Min Ltd | 0.012 | 20% | 7,978,866 | $3,873,578 |

| CLG | Close Loop | 0.245 | 20% | 3,941,953 | $109,029,223 |

| AS1 | Asara Resources Ltd | 0.025 | 19% | 3,790,643 | $20,929,866 |

| AWJ | Auric Mining | 0.300 | 18% | 841,648 | $37,906,610 |

| SXG | Southern Cross Gold | 2.940 | 18% | 254,790 | $496,116,510 |

| C29 | C29Metalslimited | 0.110 | 17% | 5,371,120 | $16,373,694 |

| BMR | Ballymore Resources | 0.140 | 17% | 524,760 | $21,207,670 |

| AAU | Antilles Gold Ltd | 0.004 | 17% | 5,577,319 | $5,567,228 |

| ALY | Alchemy Resource Ltd | 0.007 | 17% | 242,163 | $7,068,458 |

Petratherm (ASX:PTR) has announced promising results from its initial tests on heavy mineral samples from the Rosewood prospect in South Australia.

The samples, taken from historical drilling, showed high concentrations of valuable titanium minerals, with titanium dioxide (TiO2) content ranging from 63% to 65%. These minerals include rutile, which is a key component for various industries, including electric vehicles and wind technology.

The company is expanding its drilling programme across a larger area, with additional test results expected in the coming weeks. The findings, according to Petratherm, suggest that the Rosewood has the potential to become a significant source of high-value titanium minerals, which could be a major boost for the company.

Aurora Energy Metals (ASX:1AE) has secured an option to acquire Metalbelt Holdings, which owns several uranium exploration projects in Western Australia. These projects are focused on areas with uranium anomalies, identified through airborne surveys, and located in potential palaeochannel settings, known for hosting significant uranium deposits.

Aurora plans to evaluate the projects over the coming months, starting with landholder engagement and surface inspections. While uranium mining is currently banned in Western Australia, Aurora sees this as a low-risk, low-cost opportunity to explore these prospective sites in the meantime.

Olympio Metals (ASX:OLY) has secured an option to acquire 80% of the Dufay copper-gold project in Quebec, Canada, located on the prolific Cadillac Break. The project covers 60km² and contains multiple high-grade copper showings, including rock samples with up to 7.7% copper.

It is situated near large mineral resources like the Kerr-Addison gold mine and the Rouyn-Noranda copper smelter. Despite limited drilling since the 1980s, the property has significant potential, with untested geophysical targets and promising copper-gold mineralisation. Olympio plans to begin drilling in January 2025, with approval processes already underway.

Resonance Health (ASX:RHT) has secured a $13.775 million contract with Sun Pharmaceutical to support a clinical drug trial in Australia over the next two years. The contract covers a range of services, including clinical research, trial site management, and imaging analysis.

Resonance will receive the first payment of $2.066 million within 30 days, with further payments subject to regulatory approvals. The company expects to begin recruiting patients for the trial in early 2025, with its recently acquired TrialsWest business playing a key role in the process.

The company said the contract marks a significant win, as it continues to expand its presence in the global pharmaceutical and clinical trials sector.

NICO Resources (ASX:NC1) has been granted Major Project Status (MPS) by the Australian government for its Wingellina nickel-cobalt project, recognising its national importance. This status gives Nico access to additional resources and support from the Major Projects Facilitation Agency, helping to streamline the development process.

The Wingellina project, located in Western Australia, is one of the largest undeveloped nickel-cobalt reserves in the world, and the company said it will play a key role in meeting the growing demand for critical minerals needed for global decarbonisation. Once developed, Nico believes it will provide a long-term, secure supply of nickel and cobalt for use in batteries and energy storage.

BlinkLab's (ASX:BB1) latest study confirms that its digital diagnostic platform, BlinkLab Dx 1, is highly accurate in detecting autism in children. The study, conducted on 441 children, showed that BlinkLab Dx 1 achieved a 91% sensitivity and 85% specificity, improving on previous results.

This smartphone-based test uses advanced machine learning and digital biomarkers to measure sensory responses, offering a faster, more accessible alternative to current autism diagnostic methods, which often involve long wait times and expensive assessments.

The company said the results strengthen BlinkLab’s confidence in its upcoming FDA trial. Data shows the market for autism diagnostics is expected to grow to $5.41 billion by 2036.

Red Mountain Mining (ASX:RMX) has reported strong results from its soil sampling program at the Flicka Lake project in Ontario, Canada. The company found exceptionally high gold values in soil samples, including up to 17.8g/t gold, suggesting the potential for significant gold mineralisation in the area.

Also, the soil samples revealed high copper levels, with some samples showing up to 2420ppm copper, indicating the possibility of a large base metal discovery.

These results, combined with previous findings, suggest that Flicka Lake may host valuable gold and copper mineralisation, and the company plans to continue its exploration efforts in the area.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| SBW | Shekel Brainweigh | 0.017 | -60% | 1,872,638 | $9,578,572 |

| TX3 | Trinex Minerals Ltd | 0.001 | -50% | 71 | $3,657,305 |

| GGE | Grand Gulf Energy | 0.002 | -33% | 1,217,387 | $7,351,161 |

| IVX | Invion Ltd | 0.002 | -33% | 5,327,950 | $20,449,775 |

| RLC | Reedy Lagoon Corp. | 0.002 | -33% | 819,990 | $2,285,120 |

| TKL | Traka Resources | 0.001 | -33% | 3,725,000 | $2,918,488 |

| 88E | 88 Energy Ltd | 0.002 | -25% | 17,364,797 | $57,867,624 |

| AMD | Arrow Minerals | 0.002 | -25% | 51,837,268 | $26,447,256 |

| BYH | Bryah Resources Ltd | 0.003 | -25% | 88,499 | $2,013,147 |

| EDE | Eden Inv Ltd | 0.002 | -25% | 300,000 | $8,216,419 |

| RIE | Riedel Resources Ltd | 0.002 | -25% | 544,482 | $4,447,671 |

| AON | Apollo Minerals Ltd | 0.016 | -20% | 2,133,365 | $13,926,858 |

| BNL | Blue Star Helium Ltd | 0.004 | -20% | 945,633 | $13,474,426 |

| CDT | Castle Minerals | 0.002 | -20% | 552,819 | $4,182,035 |

| MOM | Moab Minerals Ltd | 0.004 | -20% | 2,045,000 | $4,464,294 |

| NAE | New Age Exploration | 0.004 | -20% | 333 | $10,719,495 |

| SCP | Scalare Partners | 0.205 | -18% | 1,412 | $8,720,700 |

| LMS | Litchfield Minerals | 0.100 | -17% | 150,000 | $3,307,500 |

| ADD | Adavale Resource Ltd | 0.003 | -17% | 104,075 | $3,671,296 |

| EXT | Excite Technology | 0.010 | -17% | 2,466,501 | $20,235,351 |

| LML | Lincoln Minerals | 0.005 | -17% | 7,132,062 | $12,337,557 |

| M2R | Miramar | 0.005 | -17% | 6,752,000 | $2,380,940 |

| RB6 | Rubixresources | 0.092 | -16% | 657,910 | $6,759,500 |

| DOU | Douugh Limited | 0.011 | -15% | 14,598,229 | $14,066,896 |

KMD Brands (ASX:KMD), which owns Rip Curl and Kathmandu, saw sales drop in the first quarter of the year, with Rip Curl sales slipping 6.7%, and Kathmandu and Oboz also seeing declines. The company is staying cautious on its outlook.

KMD shares were down over 2%.

IN CASE YOU MISSED IT

Bevis Yeo reported that:

Codeifai’s (ASX:CDE) Chinese operations have demonstrated positive cashflow and profits over the past two consecutive quarters, underscoring the effectiveness of its focus on high-margin, scalable digital solutions, high margin historical tracer solutions and overall operational efficiency.

It reflects the increasing adoption of the company’s tracer/scanner solutions in the Chinese market and lays a solid foundation for continued growth.

The company has also launched a new user-focused website to better communicate its offerings and capture growing market demand.

Impact Minerals (ASX:IPT) has defined a maiden measured resource of 189,000t contained alumina at its Lake Hope project in WA. This is enough to support 15 years of production at its proposed 10,000tpa high purity alumina plant.

Javelin Minerals (ASX:JAV) has identified numerous, fresh and strong targets at its brownfields Eureka project that it intends on testing with the drill as soon possible. Some targets are immediately along strike from the project’s namesake deposit, which has a resource of 112,000oz.

Perpetual Resources’ (ASX:PEC) rock chip sampling at its Isabella lithium project in Brazil has returned over 5% Li2O with mineralisation expanding into multiple >1km pegmatite corridors which are part of a regionally interpreted pegmatite trend that could extend for up to 3km.

Metallurgical testing of historical drilling samples from Petratherm’s (ASX:PTR) Rosewood prospect within its Muckanippie project in South Australia has returned significant heavy mineral grades of up to 12.5%. This contains high titanium mineral content of up to 65% titanium dioxide.

Legacy Minerals (ASX:LGM) has started drilling at its Bauloora gold-silver epithermal project in NSW to test a combination of undrilled, interpreted outcropping low-sulphidation epithermal veins and high-tenor geochemical anomalies with coincident geophysical anomalies.

The company will drill up to four holes totalling ~1000m which are funded by partner Newmont under the Phase 1 earn-in of their joint venture. Veins occur within a ~29km2 epithermal field that includes zones of high-level chalcedonic veins, clay alteration and local sinter-related formations.

“The targets include some of the largest and broadest outcropping epithermal veins across the Bauloora Project area with coincident geochemical and geophysical anomalies,” managing director Christopher Byrne said.

“This initial reconnaissance drilling at Bauloora has already yielded intercepts of gold, silver, and base metals in previously undrilled and unrecognised areas, creating opportunities for future follow-up work.”

Octava Minerals (ASX:OCT) has mobilised a drill rig to its Yallalong antimony project in WA with drilling expected to start this weekend.

The 3000m reverse circulation program targets further high-grade antimony at the Discovery prospect where historical drilling had returned hits of up to 7m at 3.27% antimony from 12m and 3m at 6.83% antimony from 21m over a strike of ~300m. Drilling will also be carried out at the undrilled Central antimony prospect about 2km north along strike.

A detailed geophysical survey over the antimony corridor at Yallalong is now complete, with the data being processed. This is expected to generate further targets within the antimony corridor.

Metallurgical testwork at Spartan Resources' (ASX:SPR) Dalgaranga gold project has yielded an average gold recovery of 92.3% on fresh ore samples from Stages 1 to 4 of the Never Never deposit.

Fresh ore from Never Never is relatively competent and hard, typical of similar underground orebodies in WA and consistent with the deeper ore previously mined from the Gilbey’s Main Zone.

The work also found that a relatively strong relationship exists between grind size and recovery, with economics supporting a current P80 grind size target of 75µm, while reagent consumptions are consistent with previously processed Gilbey’s fresh ore. Testwork on ore from Never Never Stages 5 and 6 as well as Stage 1 of the Pepper deposit is also underway.

At Stockhead, we tell it like it is. While Codeifai, Impact Minerals, Javelin Minerals, Legacy Minerals, Octava Minerals, Perpetual Resources, Petratherm and Spartan Resources are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Closing Bell: ASX hits all-time high as tech stocks lead broad rally