Closing Bell: ASX dodges negative sentiment to climb 0.3pc as gold stocks rally

The ASX closed up 0.3pc on Friday, driven by a 1.9pc surge in gold stocks. Retail sales softened, raising the likelihood of an RBA rate cut.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

ASX climbs 0.3pc

Gold stocks surge, up almost 2pc

Retail sales soften, increasing chance of RBA rate cut

The Australian share market worked hard for its gains today, seesawing between negative and positive territory before making a convincing recovery after about 2pm AEST to climb 0.3%.

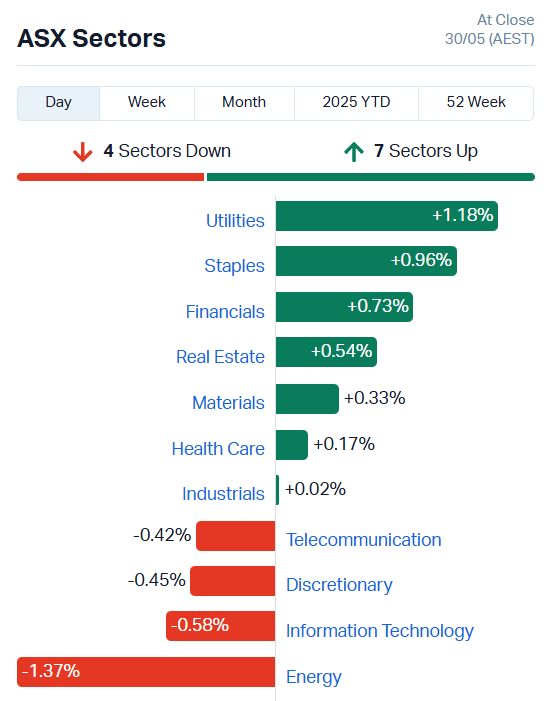

Seven of our 11 sectors ended up crossing over into the green during all that back and forth, with the defensive stock sector Utilities leading the way.

While Materials and Financials are sitting fairly middle-of-the-pack at market close, particular sub-sectors outperformed their brethren, making outsized moves on the ASX.

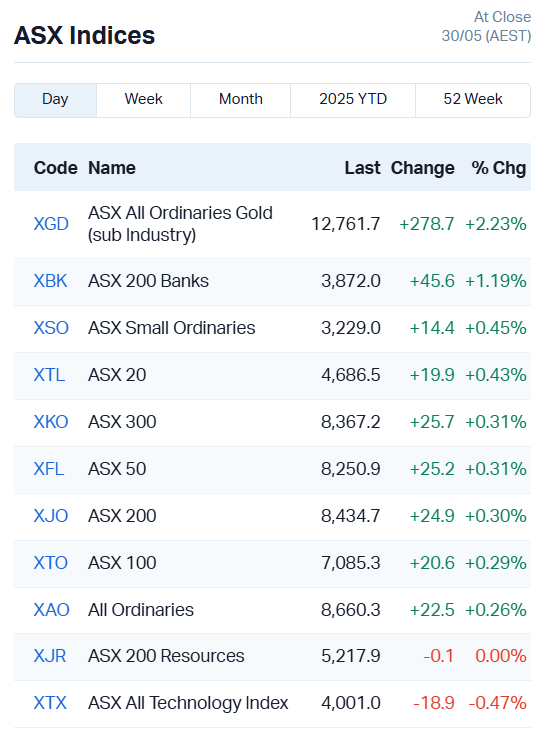

Gold stocks left their Materials cousins in the dust, climbing 1.9% as an index while the ASX 200 Resources added only 0.01%.

Ora Banda (ASX:OBM) shot up 7.51%, West African Resources (ASX:WAF) added 5.6%, Bellevue Gold (ASX:BGL) 4.21% and Resolute Mining (ASX:RSG) 3.28%.

The banks also outperformed other financial stocks, although as big cap stocks the movements were a little less energetic.

Westpac (ASX:WBC) jumped 2.68%, NAB (ASX:NAB) 1.33% and Commonwealth Bank (ASX:CBA) managed a positive showing of 0.87% despite some (now resolved) internet banking disruptions for its customers today.

All in all, the bourse made a fairly good showing considering the reinstatement of Trump’s tariffs by a US Court of Appeals overnight and disappointing Aussie retail data for April.

Retail sales soften in April

The ABS released its retail turnover numbers for the month of April today, which contracted by 0.1% despite lifting by 0.3% in March.

“Retail spending eased in April, particularly on clothing purchases,” ABS head of business statistics Robert Ewing said.

“Clothing retailers told us that the warmer-than-usual weather for an April month saw people holding off on buying clothing items, especially new winter season stock.”

Oxford Economics lead economist Benjamin Udy said Australian consumers are wary of macroeconomic headwinds.

“Today's data shows Queenslanders returned to the shops in April, but that rebound was offset by weaker sales across all other states,” Udy said.

"The weakness outside of Queensland may be related to the stalling in the recovery consumer sentiment due to rising global trade uncertainty.

“Unless consumption picks up a little more strongly in the coming months, the RBA may cut rates even sooner than we currently expect.”

Yesterday, markets were pricing a 59% chance that the RBA would cut the cash rate to 3.6% at its next meeting.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

| Security | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| PRM | Prominence Energy | 0.004 | 100% | 114700 | $778,353 |

| ERL | Empire Resources | 0.005 | 67% | 554786 | $4,451,740 |

| ASP | Aspermont Limited | 0.008 | 60% | 2432297 | $12,365,938 |

| 1AD | Adalta Limited | 0.003 | 50% | 112186 | $1,286,446 |

| ASR | Asra Minerals Ltd | 0.003 | 50% | 7479385 | $5,533,072 |

| CR9 | Corellares | 0.003 | 50% | 412320 | $2,011,213 |

| LOC | Locatetechnologies | 0.1 | 43% | 724138 | $14,083,568 |

| TAS | Tasman Resources Ltd | 0.025 | 39% | 558543 | $3,314,567 |

| CZN | Corazon Ltd | 0.002 | 33% | 700000 | $1,776,858 |

| GMN | Gold Mountain Ltd | 0.002 | 33% | 296327 | $8,429,639 |

| AYT | Austin Metals Ltd | 0.005 | 25% | 198136 | $6,296,765 |

| BYH | Bryah Resources Ltd | 0.005 | 25% | 818236 | $3,479,814 |

| EAT | Entertainment | 0.005 | 25% | 23175 | $5,235,144 |

| MQR | Marquee Resource Ltd | 0.01 | 25% | 1874067 | $4,466,420 |

| PRX | Prodigy Gold NL | 0.0025 | 25% | 1000000 | $6,350,111 |

| RGL | Riversgold | 0.005 | 25% | 228348 | $6,734,850 |

| RLG | Roolife Group Ltd | 0.005 | 25% | 7657763 | $6,371,125 |

| RNX | Renegade Exploration | 0.0025 | 25% | 750000 | $2,576,727 |

| VRC | Volt Resources Ltd | 0.005 | 25% | 2214605 | $18,739,112 |

| WBE | Whitebark Energy | 0.005 | 25% | 100006 | $2,749,334 |

| NHE | Nobleheliumlimited | 0.011 | 22% | 787895 | $5,395,725 |

| RML | Resolution Minerals | 0.017 | 21% | 8629662 | $7,361,016 |

| LKY | Locksleyresources | 0.08 | 21% | 44328092 | $9,680,000 |

| OLL | Openlearning | 0.018 | 20% | 145461 | $7,240,120 |

| AZL | Arizona Lithium Ltd | 0.006 | 20% | 10117519 | $26,351,572 |

Making news…

Mining media company Aspermont (ASX:ASP) has clocked up its 35th straight quarter of subscription growth, with subs now making up 75% of total revenue. Recurring subscription revenue hit $11.2 million, up 4% year-on-year, while overall group revenue dipped 6% to $6.7 million. EBITDA was negative, but the company is still debt-free and sitting on $700k in cash.

Renegade Exploration (ASX:RNX) has acquired four new gold-silver and base metal projects in the Nevada Walker Lane trend, in the US state of Nevada. With gold prices still hovering around US$3,300 an ounce, the company snapped up the licences for just US$150k, in an area responsible for 70% of domestic gold production in the US.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

| Security | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| BLZ | Blaze Minerals Ltd | 0.002 | -33% | 142857 | $4,700,843 |

| ICU | Investor Centre Ltd | 0.002 | -33% | 1056 | $913,534 |

| KPO | Kalina Power Limited | 0.004 | -33% | 2520373 | $17,597,818 |

| MSG | Mcs Services Limited | 0.004 | -33% | 550000 | $1,188,598 |

| OEL | Otto Energy Limited | 0.004 | -33% | 19939911 | $28,770,059 |

| AOA | Ausmon Resorces | 0.0015 | -25% | 357633 | $2,622,427 |

| BMO | Bastion Minerals | 0.0015 | -25% | 1000000 | $1,807,255 |

| OB1 | Orbminco Limited | 0.0015 | -25% | 13220340 | $4,795,136 |

| AVE | Avecho Biotech Ltd | 0.004 | -20% | 1994020 | $15,867,318 |

| C7A | Clara Resources | 0.004 | -20% | 145000 | $2,558,021 |

| WNX | Wellnex Life Ltd | 0.31 | -19% | 115162 | $26,092,038 |

| MGA | Metalsgrovemining | 0.066 | -19% | 150000 | $8,539,020 |

| PLC | Premier1 Lithium Ltd | 0.009 | -18% | 1932229 | $4,048,666 |

| DBO | Diabloresources | 0.014 | -18% | 265439 | $2,296,970 |

| BIT | Biotron Limited | 0.0025 | -17% | 210802 | $3,981,738 |

| BP8 | Bph Global Ltd | 0.0025 | -17% | 392643 | $3,152,954 |

| DAF | Discovery Alaska Ltd | 0.01 | -17% | 25000 | $2,810,816 |

| EE1 | Earths Energy Ltd | 0.005 | -17% | 100000 | $3,179,785 |

| JAV | Javelin Minerals Ltd | 0.0025 | -17% | 2850000 | $18,138,447 |

| TEG | Triangle Energy Ltd | 0.0025 | -17% | 500999 | $6,267,702 |

| CML | Connected Minerals | 0.13 | -16% | 36159 | $6,410,523 |

| CDX | Cardiex Limited | 0.042 | -16% | 616975 | $20,303,194 |

| T88 | Taitonresources | 0.08 | -16% | 12500 | $7,073,451 |

| TG1 | Techgen Metals Ltd | 0.023 | -15% | 1341405 | $4,283,974 |

| ADG | Adelong Gold Limited | 0.006 | -14% | 70299873 | $9,782,403 |

IN CASE YOU MISSED IT

Stockhead’s Tylah Tully looks at White Cliff Minerals’ (ASX:WCN) exploration at Danvers, where continuous, high-grade copper and silver mineralisation at surface has been confirmed.

Tylah also breaks down the latest from West Coast Silver (ASX:WCE),which has started drilling to test extensions of known high-grade mineralisation at its Elizabeth Hill project in Western Australia.

Trading halts

Nico Resources (ASX:NC1) – cap raise

Pacific Edge (ASX:PEB) – cap raise

Patrys (ASX:PAB) – operations update

At Stockhead, we tell it like it is. While White Cliff Minerals and West Coast Silver are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Closing Bell: ASX dodges negative sentiment to climb 0.3pc as gold stocks rally