Closing Bell: ASX banks and miners dig in after a tech rout; gold hits record again

Trump’s gone off at Powell again, rattling markets, but the ASX held its nerve with banks and miners stepping up.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

Trump sprays Powell again as markets wobble

ASX holds steady; banks and miners dig in

Gold hits record, Aussie dollar jumps

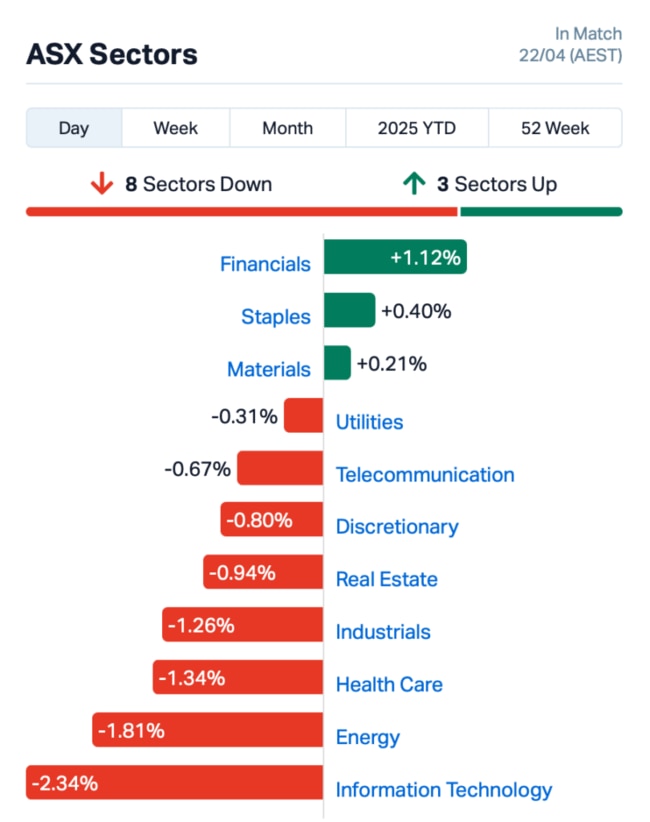

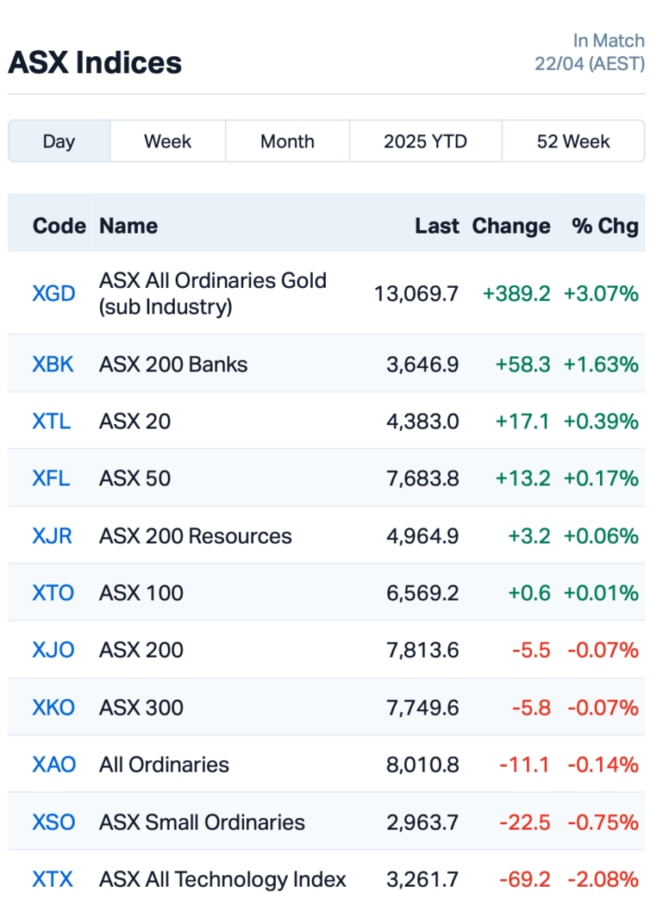

The ASX was mostly treading water on Tuesday, closing flattish despite a rough start to the day.

The market wobbled earlier after a Wall Street sell-off sparked by yet another spray from Donald Trump.

Tech stocks were the hardest hit, while the big miners and banks helped balance things out.

Trump had a go at Jerome Powell again, calling him a “loser” and blaming him for being too slow with rate cuts.

Trump reckons inflation’s done and dusted in the States and demanded the Fed drop rates now, or risk tanking the economy.

Markets didn’t take that too well. Wall Street copped it overnight, with the S&P 500 down 2.4% and the Nasdaq hit even harder.

The US dollar tanked to a 15-month low, which helped gold smash through US$3400 an ounce to a fresh record, and pushed the Aussie dollar above 64 US cents.

Back home, Commonwealth Bank (ASX:CBA) led the large caps charge, jumping 2.75% and dragging the rest of the banks with it.

Macquarie Group (ASX:MQG) gained 1% after flogging off its European and US public investments arm to Japan’s Nomura for $2.8 billion.

Miners also lent a hand. Iron ore bounced back toward US$99 a tonne, giving BHP (ASX:BHP) and Rio Tinto (ASX:RIO) a lift.

Gold stocks surged off the back of that record price, while copper hit a two-week high as the sliding greenback made base metals cheaper.

But tech stocks didn’t have the same luck, with WiseTech Global (ASX:WTC) dropping 2% and NextDC (ASX:NXT) sinking over 5%.

Among other moves, Bellevue Gold (ASX:BGL) slid 5%, even though it unwound some hedges that had locked in when gold prices sat way below current levels.

This is where things stood around Tuesday's close:

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| TKL | Traka Resources | 0.002 | 100% | 37,100,000 | $2,125,790 |

| PSL | Paterson Resources | 0.009 | 50% | 614,850 | $2,736,227 |

| 88E | 88 Energy Ltd | 0.002 | 50% | 5,574,997 | $28,933,812 |

| AXP | AXP Energy Ltd | 0.002 | 50% | 2,199,985 | $6,574,681 |

| EDE | Eden Inv Ltd | 0.002 | 50% | 1,150,000 | $4,109,881 |

| WNR | Wingara Ag Ltd | 0.007 | 40% | 570,000 | $877,713 |

| CUL | Cullen Resources | 0.004 | 33% | 3,126,154 | $2,080,206 |

| IS3 | I Synergy Group Ltd | 0.004 | 33% | 86,979 | $1,332,625 |

| OLI | Oliver'S Real Food | 0.004 | 33% | 598,383 | $1,622,196 |

| RLG | Roolife Group Ltd | 0.004 | 33% | 508,242 | $4,488,094 |

| SRN | Surefire Rescs NL | 0.004 | 33% | 1,423,524 | $7,248,923 |

| SMM | Somerset Minerals | 0.012 | 33% | 1,310,323 | $2,357,032 |

| AUR | Auris Minerals Ltd | 0.005 | 25% | 199,210 | $1,906,504 |

| YAR | Yari Minerals Ltd | 0.005 | 25% | 416,946 | $1,929,431 |

| ASE | Astute Metals NL | 0.026 | 24% | 958,961 | $12,980,945 |

| PFT | Pure Foods Tas Ltd | 0.021 | 24% | 79,147 | $2,302,236 |

| OM1 | Omnia Metals Group | 0.011 | 22% | 1,190,909 | $1,953,825 |

| WTM | Waratah Minerals Ltd | 0.200 | 21% | 1,128,923 | $33,503,937 |

| BGE | Bridgesaaslimited | 0.018 | 20% | 70,305 | $2,997,888 |

| CUF | Cufe Ltd | 0.006 | 20% | 3,088,625 | $6,732,874 |

| EM2 | Eagle Mountain | 0.006 | 20% | 826,905 | $5,675,186 |

| SHP | South Harz Potash | 0.006 | 20% | 500,000 | $5,412,894 |

| TMS | Tennant Minerals Ltd | 0.006 | 20% | 2,618,272 | $4,779,452 |

| WBE | Whitebark Energy | 0.006 | 20% | 196,248 | $1,999,534 |

| CEL | Challenger Gold Ltd | 0.085 | 20% | 17,430,612 | $119,829,517 |

Traka Resources (ASX:TKL) has just made a move into Guinea’s gold-rich Siguiri Basin, teaming up with local outfit Alamako to take on the Didi Gold Project. It’s locked in a deal to earn 75% of the project, which sits right between two of AngloGold Ashanti’s big gold mines. Early drilling and trenching work by Alamako has already turned up some juicy gold hits, with grades up to 17 grams a tonne and wide intercepts too.

Astute Metals (ASX:ASE) is having a crack at turning its Red Mountain Lithium Project in Nevada into something serious, and the early signs are looking good. Testwork on some low-grade drill samples showed it can strip out a chunk of the waste rock and bump up the lithium grade by 22%. It’s only early days with one test so far, but it’s a solid proof-of-concept. The lab reckons results should get even better once Astute runs the numbers on richer clay samples.

Somerset Minerals (ASX:SMM) has locked in $2.4 million from investors to kick off its first drill campaign at the Coppermine Project in Canada. It’s planning to sink around 1500 metres of drilling into the Coronation target from early July, chasing high-grade copper and silver hits, including past rock chip samples with up to 45% copper. Permits are nearly sorted, with final ticks expected in a week or two, and the project itself still needs shareholder approval next week to go ahead.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| SRL | Sunrise | 0.400 | -44% | 895,040 | $64,061,524 |

| TEG | Triangle Energy Ltd | 0.003 | -40% | 48,258,537 | $10,446,170 |

| 1TT | Thrive Tribe Tech | 0.001 | -33% | 2,000,000 | $3,047,585 |

| EEL | Enrg Elements Ltd | 0.001 | -33% | 17,412,733 | $4,880,668 |

| PAB | Patrys Limited | 0.002 | -33% | 37,508 | $6,172,342 |

| ADD | Adavale Resource Ltd | 0.002 | -25% | 1,202,302 | $4,574,558 |

| FFF | Forbidden Foods | 0.006 | -25% | 9,219,224 | $5,696,816 |

| GTR | Gti Energy Ltd | 0.003 | -25% | 6,431,216 | $11,995,799 |

| AVE | Avecho Biotech Ltd | 0.004 | -20% | 1,340,689 | $15,867,318 |

| C7A | Clara Resources | 0.004 | -20% | 91,999 | $2,558,021 |

| CCO | The Calmer Co Int | 0.004 | -20% | 22,000 | $12,769,356 |

| NAE | New Age Exploration | 0.004 | -20% | 9,753,859 | $13,296,995 |

| VMM | Viridismining | 0.285 | -20% | 1,276,076 | $30,264,823 |

| MEI | Meteoric Resources | 0.105 | -19% | 18,569,969 | $303,792,162 |

| EPX | Ept Global Limited | 0.029 | -17% | 10,000 | $23,055,762 |

| ANR | Anatara Ls Ltd | 0.005 | -17% | 7,232,914 | $1,280,302 |

| ANX | Anax Metals Ltd | 0.005 | -17% | 100,000 | $5,296,845 |

| PER | Percheron | 0.010 | -17% | 4,542,293 | $13,049,252 |

| RDN | Raiden Resources Ltd | 0.005 | -17% | 177,607 | $20,705,349 |

| ROG | Red Sky Energy. | 0.005 | -17% | 2,680,218 | $32,533,363 |

| KNG | Kingsland Minerals | 0.105 | -16% | 57,478 | $9,070,114 |

| VHM | Vhmlimited | 0.320 | -16% | 423,151 | $82,516,982 |

| SNS | Sensen Networks Ltd | 0.032 | -16% | 468,365 | $30,135,424 |

| SKY | SKY Metals Ltd | 0.043 | -16% | 86,343 | $36,245,861 |

| BRX | Belararoxlimited | 0.115 | -15% | 143,445 | $21,130,518 |

Deep Yellow (ASX:DYL) took an 8% hit after pushing back work on its Namibian uranium project due to soft prices.

IN CASE YOU MISSED IT

Prospect Resources (ASX:PSC) has completed its $15 million strategic investment from global miner First Quantum Minerals, first announced on April 15. The deal involved the issue of just over 100 million new shares at 15 cents each, making FQM a 15 per cent cornerstone shareholder in Prospect. FQM will also act as a key technical partner, supporting exploration at PSC’s Mumbezhi copper project in north-western Zambia.

Blue Star Helium (ASX:BNL) has received approval to build a helium and CO2 processing plant in Las Animas county, Colorado, a key step forward for its Galactica project. The company’s Jackson-29 well has delivered the strongest gas flows of the current campaign, with helium concentrations reaching up to 3.3%.

Indiana Resources (ASX:IDA) has hit high-grade gold of up to 44.9g/t at its Minos deposit within the Gawler Craton project, extending the known depth of mineralisation to 380m. The company plans to resume RC and diamond drilling from April 28 to progress toward a maiden resource estimate.

AKORA Resources (ASX:AKO) has secured renewal of the main tenement (PR 10430) at its Bekisopa iron ore project in Madagascar, supporting its planned 2Mtpa direct shipping ore operation. The renewal marks the first under Madagascar’s updated Mining Code and clears the way for AKORA to progress toward a mining permit and further development.

TRADING HALTS

- Trek Metals (ASX:TKM) - cap raise

- Eastern Metals (ASX:EMS) - cap raise

- Atomo Diagnostics (ASX:AT1) - cap raise

- NT Minerals (ASX:NTM) - potential disposal of the Redbank Copper Project

At Stockhead, we tell it like it is. While Prospect Resources, Blue Star Helium, Indiana Resources and AKORA Resources are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Closing Bell: ASX banks and miners dig in after a tech rout; gold hits record again