Backing Winners: Why Malcolm Norris leapt at the opportunity to join Nordic’s Finnish gold expedition

Malcolm Norris is bringing a history of exploration success to his new role as the chair of Finland gold explorer Nordic Resources.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

Backing Winners is Stockhead’s recap of executives with a solid track record looking to replicate the success of their previous roles.

Today we hear from Nordic Resources non-executive chairman Malcolm Norris, who has joined the company just days before a potential company-making Finnish gold acquisition.

Malcolm Norris may be best known to Australian investors as a titan of the South American exploration game.

A pioneer who lifted the lid on the exploration secrets of the underexplored porphyries of Ecuador with the discovery of SolGold's Cascabel copper-gold-silver deposit and then Sunstone Metals (ASX:STM), what has led him to a new role as the non-executive chairman of Finland focused Nordic Resources (ASX:NNL)?

And why does he think they have the potential to quickly become the ASX's next million ounce gold prospect?

Norris' legacy as a geologist spans four decades, dating back to his time leading Western Mining Corporation brownfields gold and nickel exploration in WA and the Tanami.

For the past 15 years his name has been synonymous with porphyry hunting in the Ecuadorean Andes and Indonesia, where he was part of the Intrepid Mines team that found the Tujuh Bukit copper project.

But his time at the head of Sunstone included a four year period deeply entrenched in the precious and base metals sectors of Scandinavia, first in Sweden before a sojourn to gold prospect in Nordic's focus jurisdiction of Finland.

"The reason that we got involved in Scandinavia in the first place was that the copper project, which is called Viscaria, we thought was a really good development opportunity and that would form a foundation for the company," Norris told Stockhead in an interview.

"So we started off doing that and then the copper price fell, we couldn't raise money.

"We went off and looked for gold and lithium opportunities in Scandinavia more broadly, and we ended up in Finland. And we explored for gold and lithium in Southern Finland.

"So I'm very familiar with how to operate in Finland, very familiar with the exploration and development landscape in Finland and so I followed what the Nordic Resources guys have been doing."

The call

Norris' interest in Nordic goes back to its IPO days in 2022, when NNL, then known as Nordic Nickel, hit the bourse with the now 862,800t nickel, 40,000t copper and 22,100t cobalt Pulju project.

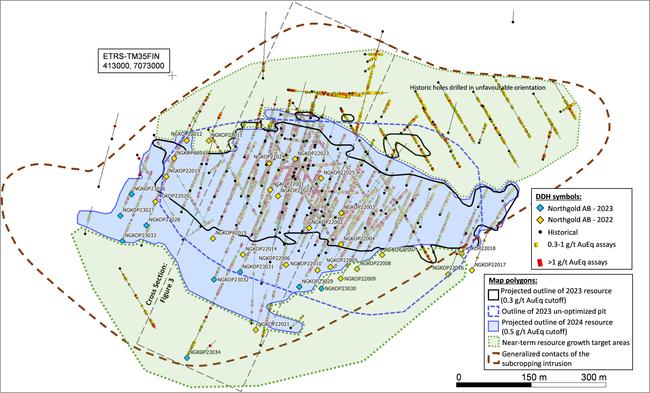

His interest was piqued again when he heard of the company's latest bold move this year – the acquisition of three gold projects in Finland from Sweden based Northgold, including the ~815,000oz gold equivalent Kopsa project.

A maiden resource estimate of 147,000oz at Agnesneva in the separate Kiimala Trend project has already been posted by NNL, taking its bounty to 961,800 gold equivalent ounces from a deal with a cash component of just $330,000 along with 70 million shares. A third project in the Middle Ostrobothnia Belt of central Finland, Hirsikangas, has a non-JORC resource that presents low hanging fruit for an upgrade.

That acquisition closed yesterday, with drilling to begin at Kopsa by the end of July.

"They did a really good deal. These are three projects, one of which is quite advanced at Kopsa, with a good resource base (and) in my opinion, plenty of opportunity to grow," Norris said.

"And it's geologically a belt of rocks that is very highly prospective.

"This belt of rocks in Finland is related to a similar belt across in Sweden and that belt has been a long-term historical mining and exploration belt.

"So the upside is significant."

Norris responded to the news by picking up the phone to NNL executive director Rob Wrixon, a discussion which progressed to bringing the exploration export on board as chair.

Officially starting in the role on June 1, Norris' entry to the role rounds out the NNL board's expertise with one of the brightest exploration minds in the Australian resources market.

"The role that I'm taking on at Nordic, it's very much about making sure that the exploration process is managed appropriately and implemented appropriately and that you call on your experience to make sure you don't miss anything," Norris said.

"And I think Rob is very much focused on taking this down the development path and he's well qualified to do that and he'll call on me to get involved with some of the geologists in the team."

1Moz opportunity

The exploration opportunity screens, immediately, as a huge one.

Kopsa already hosts a substantial resource, even before considering Kiimala Trend and the pre-resource Hirsikangas projects.

Some 283,200oz of gold equivalent (226,800oz gold, 11,780t copper) are already in the very high confidence measured category and 278,400oz AuEq (211,100oz Au, 14,060t Cu) are in the indicated category.

All of that is of a high enough confidence level to report to mineable reserves.

But it's important to remember just 23,400m of drilling has been completed at Kopsa, 6600m in the past three years.

With the support of institutional backing in the form of a recent $3.5m placement, Nordic will have $6m in the bank from Aussie and international investors to greatly expand that exploration focus.

On the announcement of the deal NNL pledged 4500m of drilling into Kopsa, which Norris thinks can get much larger than it currently is ... and fast.

"There's going to be opportunities for upside within the current area of drilling – hopefully that's grade related – but there's absolutely opportunity on the belt," Norris said.

"There are geophysical anomalies that sit around the main area of drilling, there's the belt but trends northeast-southwest which is the sort of subsidiary structure that is of interest.

"So there's opportunity at various scales, within the deposit, immediately surrounding where there's defined geophysical targets and then broader still where you go into the more conceptual geological targets.

"If there's gold at Kopsa then there should be gold at this nearby feature that is similar to Kopsa."

Growing that resource base further will take $13 million capped Nordic to a scale where it can be considered by a new class of investors.

"We're going to take it over that million ounces very comfortably and that means you join a club of deposits that make people sit up and look at them," Norris added.

"And then there's also upside on the other two projects that have been picked up as part of this package as well."

A great place to operate

Oft overlooked, Norris says Finland's rich mining heritage has close parallels to that of Australia's base metals rich east coast.

Famous for having one of Europe's largest militaries, conscripting youth cognisant of its 1340km long border with Russia, Finland has long known the importance of its critical mineral sector and ranks among the top 20 jurisdictions globally as per the Fraser Institute's Investment Attractiveness Index.

"If you look at the history of the great mining centres in Australia, and Mt Isa is a really good example, a lot of people from Finland were involved in that early development 100 years ago," Norris said.

"Finland being part of the whole EU debate around the EU being more self-sustaining with regards to metals is valuable and they're really keen to be part of that.

"And one of the interesting things about Kopsa and these other couple of deposits is that they're gold deposits, but they have a pretty significant byproduct in copper.

"It looks like probably 10% to 15% of the value of these deposits will be in copper, and that's a really valuable add-on, particularly when it comes to developing and permitting and getting involved in this whole EU approach to critical metals."

With time often "the enemy" when it comes to developing projects, Norris is confident Nordic Resources can find a pathway to prove up its Finnish gold assets quickly.

"As you head further north in Finland, you have a few more environmental and other challenges, whereas in central Finland, in an area where mining has been going on for decades, the general social acceptance of mining is greater," Norris said.

"I think it's just a matter of following those steps for permitting. I don't see it as a really challenging area for developing a mine."

At Stockhead, we tell it like it is. While Nordic Resources is Stockhead advertiser, it did not sponsor this article.

Originally published as Backing Winners: Why Malcolm Norris leapt at the opportunity to join Nordic’s Finnish gold expedition