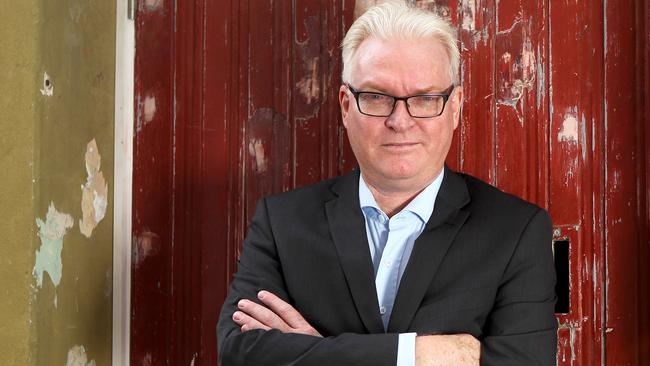

Retiree nest eggs under threat, says Plato boss Don Hamson

A MILLION dollars in savings may sound like a decent nest egg, but veteran investment manager Don Hamson warns that retirees will need every penny they have as they face increasingly tough times.

QLD Business

Don't miss out on the headlines from QLD Business. Followed categories will be added to My News.

A MILLION dollars in savings may sound like a decent nest egg, but veteran investment manager Don Hamson warns that even retirees with that amount will need every penny they have as they face increasingly tough times.

The managing director of Plato Investment Management said self-funded retirees were coping with record-low interest rates, sliding dividends for blue chip stocks such as Telstra and possible changes to retirement income rules.

“The outlook for retirees is not good,” said Queensland-born Mr Hamson. “When my mother and father retired, they would have been getting 15 per cent on a term deposit. Now you would be lucky to get 2 per cent.

“We are not talking about multi-millionaires here, but someone who has perhaps $800,000 to $1 million in savings. That is not a lot considering they are probably only earning $25,000 a year on that.”

Mr Hamson said popular stocks, including Telstra and the Big Four banks, have under performed the ASX 200 by 40 per cent in the past 18 months.

“Banks are collectively down 10 per cent following the royal commission and the bank levy (imposed by the Federal Government on the major banks),” he said. “If you are a retiree with a couple of banks and Telstra in your portfolio, you are in a little bit of trouble.”

He said retirees may need to look a bit broader than Australia for their investments, perhaps considering global funds with foreign currency exposure that could provide better returns.

“Interest rates are low so you have to really work hard for your income,” he said. “The poor old self-funded retirees are being squeezed in the middle.”

Mr Hamson grew up on his parents’ Sunshine Coast pineapple farm where he said his father taught him the value of investing in shares and creating a retirement nest egg.

He now runs the $4.5 billion Plato Investment Management fund, which has carved out a niche targeting self managed super funds and retirees. He was in Brisbane last week to talk to groups of financial planners.

Sydney-based Mr Hamson concedes he has come a long way since his Sunshine Coast days, where he was captain of Caloundra State High School and a contemporary of the late Steve Irwin. Until the recent death of his 91-year-old mother, who lived at Rothwell north of Brisbane, he was a regular visitor to the Sunshine State.

Mr Hamson said he remains committed to championing the interests of retirees, noting they were now facing an uncertain political environment with plans by the Federal Labor Opposition to change the dividend imputation system.

Labor said it will make the tax system fairer by closing down a concession that gives cash refunds for excess dividend imputation credits.

The dividend imputation system was introduced by Paul Keating to eliminate double taxation on dividends from company profits.

Under this system, shareholders can use imputation credits to reduce their overall tax liability. A concession was created allowing some individuals and superannuation funds to receive a cash refund from the ATO if their imputation credits exceeded the tax they owed.

Mr Hamson said that closing the concession would be unfair to self-funded retirees and low-income earners.

Plato has organised an online petition in support of the current rules being retained.

“We can’t keep tinkering and changing without a transition period for those already in retirement,” he said.

The proposed change would have the greatest impact on self-funded retirees who fall just outside the assets test threshold, which is $837,000 for a couple who are homeowners or $556,500 for a single person who owns a home. He said changes to the dividend imputation scheme could see self-funded retirees reduce their investments in Australian shares in favour of global equities, property and even cash.