Remi Capital collapsed owing Melbourne dad $300,000

The Melbourne father described the current situation as “torture” with the firm owing $70m to creditors, but a bombshell email has revealed the extent of its troubles.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

EXCLUSIVE

A Melbourne family has been left “shocked” and heartbroken after an Australian investment firm collapsed on Wednesday owing them $300,000, but a bombshell email has revealed the extent of the company’s problems well before it went into liquidation.

The company, Remi Capital, went under with a whopping debt of $70 million and 450 investors impacted.

Dad-of-two Richard*, had used the company to invest with a wife and friend, and together the trio are owed hundreds of thousands, despite trying to pull out the money before REMI Capital’s downfall.

Part of their investment included an $150,000 payout after he claims his wife was bullied at work, with Richard describing it as “emotional money”.

Now they fear they will never see their money after Chris Baskerville from insolvency firm Jirsch Sutherland was appointed as administrator, with the firm undertaking urgent financial investigations to map out where the $70 million had gone.

“This is heartbreaking. I am going home at the end of day and both my wife and I, we are in tears separately driving back home from work,” Richard told news.com.au

“It’s very emotional, it’s impacting my relationship with my wife.

“This is torture. We don’t know how long this is going to go on for.”

Richard said the trio started investing with REMI Capital back in May 2019 when it was originally known as C2 Capital, before it changed its name in July last year.

Everything was good with interest payments being made on time, he said.

But when Covid hit this all changed, with payments initially delayed by two to three months before blowing out to wait times of four to five months.

“When there was a delay on payments for two to three months, they paid it back with additional interest, so we didn’t see any sign of trouble,” he said.

But when Richard requested their funds be returned once the investment was completed as the family wanted to buy a house things started to go wrong.

Payments including amounts between $25,000 and $125,000, which were due from September last year, have not been paid and he reached out to the company for an explanation.

Bombshell email

The trio of investors received an email on 25 March this year from Peter Kral chief financial officer at Remi Capital, which said the company had “experienced several delays in making” repayments in recent months.

In the bombshell email, Mr Kral said the company was “proposing a payment plan to you of amounts owed” and blamed a number of factors for the delays including “forfeiture on the repayments of loans/monies by external parties to Remi totalling approximately $4 million (Aus) which was expected to be repaid to Remi late last/early this year”.

Other reasons highlighted by Mr Kral included the impact of the pandemic and “restructuring of the business which takes time to produce results whilst dealing with legacy issues that were inherited from previous director”.

He also revealed that the sale of properties was “time consuming and prone to significant delays” and there was a “failure of promised funding to effect settlement and unlock existing equity within current projects”.

“Remi currently is in the process of selling several major property assets. It is expected that these divestments will create liquidity events shortly,” he wrote in the email.

“Remi expects to make significant payments in mid to late April on outstanding amounts to you of a minimum of 50 per cent and the balance in a reasonably short space of time thereafter.”

There is no suggestion of any wrongdoing by Mr Kral.

Desperate plea for the money

But no payments were ever made, according to Richard.

His wife emailed the firm on April 11 begging for the $245,000 invested by Richard and his friend and another $63,000 from the couple to be returned offering to forfeit the $33,000 outstanding interest for both, adding they were “hardly coping financially due to the delayed payment”.

But the family never received a response to their desperate plea.

In an email earlier this week, REMI managing partner Mark Prestige acknowledged there had been a “lack of communication” from the company in recent weeks in an email to investors and shareholders.

“Remi had been advised by external legal counsel not to communicate over recent weeks until the modelling was complete that allowed this difficult decision to be made,” Mr Prestige wrote in the email.

In an email to investors on April 29, the company said law firm HWL Ebsworth had been appointed and a plan would be provided in 14 days, but its unclear if this ever happened.

News.com.au can reveal at least one creditor had demanded payment of debt under the Corporations Act 2001 as of May 3.

Affected investors had also reached out to the Australian Securities Investment Commission for help before Remi collapsed.

Staff exodus

It’s understood that Remi Capital had employed more than 50 investment, venture capital and property professionals but many staff had left the business in recent months.

Richard’s account manager emailed on March 8 saying he had been chasing answers regarding delayed payments for “some time now” and he was “completely embarrassed and angered at the action displayed by our leadership team”.

The email added that he had “no visibility into the accounts” but would continue to fight for his clients.

However, he resigned from the company just three weeks later claiming there was “terrible” communication, a lack of payment to clients in a timely fashion and that he was owed superannuation.

“As a man with a young family and responsibilities, resigning from my job is not something I take lightly, and it certainly isn’t the easy option to take, however I believe it is the right and ethical thing to do,” he wrote in an update to clients.

Richard, who has two kids aged three and six, said the family recently brought a new car expecting the repayments from REMI Capital to help pay it off, while he is also worried about his funding his children’s education.

The family’s entire life savings are tied up with the company, he added.

“For me personally I have gone back 10 years in terms of my finances. It’s impacting my relationship and everything, they knew they were in trouble last year,” he claimed.

Company goes dark

After news.com.au broke the news of Remi’s demise on Thursday, the company shut down its website and social media accounts, while Mr Prestige also deactivated his LinkedIn account.

Despite the difficulties the company was facing, its LinkedIn had shown a series of posts in recent months urging self-managed super fund investors to consider diversifying their portfolio and investing in the group.

“What makes a good investment for an SMSF will depend on each fund’s objectives,” one post read.

“If you are looking for investment to enhance your portfolio, talk to one of our experts today!”.

The company had promised access to “responsibly and ethically managed investments” and included a range of boutique property developments, its website showed before it was shut down.

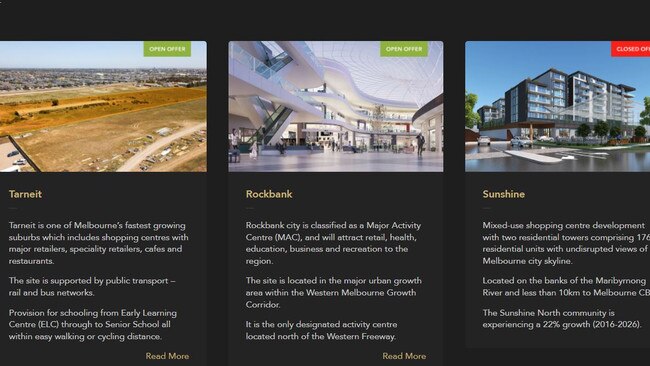

Remi also had a property portfolio worth millions with key projects it was spruiking to investors.

Its property portfolio spanned Melbourne including a site in the suburb of Tarneit site that it acquired for $9 million to turn into mixed-use development and its flagship project at Rockbank which was purchased for $30 million, with plans for a major activity centre.

The administrator, Mr Baskerville, said they did not believe the company going into administration is related to the construction sector challenges, and have heard nothing about the rising costs of materials or labour shortages etc having an impact.

“We believe the issues were finance related and will continue our investigations to identify the cause of the issues. Our role is to provide the best outcome for creditors,” he told news.com.au.

He said REMI owned two properties and had an option to buy another one and current options being explored included undertaking a marketing campaign to sell the properties in situ, seeking a refinance package or any other option that is in creditors’ best interests.

A creditor’s meeting will be held on June 6.

*Name has been changed

Do you know more or have a similar story? We want to hear from you sarah.sharples@news.com.au

Originally published as Remi Capital collapsed owing Melbourne dad $300,000