REA Insights Property Outlook Report 2021 finds interest surges for West End apartment projects

A range of new apartment projects in this inner Brisbane suburb have triggered a 60 per cent surge in interest among buyers.

QLD Business

Don't miss out on the headlines from QLD Business. Followed categories will be added to My News.

An inner city apartment development hot spot produced a surge in inquiry of a leading real estate website last year as interstate migrants flocked to Queensland.

According to REA Insights’ Property Outlook Report 2021, apartment inquiries for new developments in West End on realestate.com.au surged 61 per cent last year, setting the scene for an increase in sales this year.

A range of developments such as Sekisui House’s West Village development, Aria’s Treehouse tower and Pradella’s Montague Market & Residences have attracted strong interest.

The report found that if it was not for frequent border closures because of the COVID-19 pandemic last year population movement to southeast Queensland would be a lot stronger by now.

“Nevertheless, Queensland gained the most people from interstate with Victoria seeing the biggest movement to the Sunshine State since the early 1990s recession,” the report said.

“This population movement, combined with stronger demand for second homes, led to strong conditions for southeast Queensland in 2020.”

According to the report Brisbane’s inner city, east and west will be the strongest performers in 2021.

“St Lucia in Brisbane’s west was the strongest performing suburb in 2020 with the median house price increasing by 35 per cent while the eastern suburbs saw the strongest price growth overall,” it said.

“New Farm in inner Brisbane saw the strongest price growth for units. For new development, West End has recently seen one of the biggest jumps in inquiries in Australia.”

Chelmer in Brisbane’s inner west saw a 19.4 per cent increase in house rents while the apartment market in Tannum Sands and New Auckland in Gladstone, central Queensland, benefited from the resources boom with a rental increase of 25 per cent and 20 per cent respectively.

The report found that last year the list of $3m plus suburbs in Australia doubled during the pandemic, which included on one Queensland suburb, Main Beach on the Gold Coast.

“This unique trend of house price growth during a recession did not occur during the Global Financial Crisis last decade or the early 1990s recession,” the report said.

“Towards the end of 2020, views per listing on realestate.com.au for homes priced over $10m had increased by 150 per cent compared to prior to the pandemic. While the increased demand may be explained by people stuck at home browsing beautiful properties online, median price increases in Australia’s most expensive suburbs suggests otherwise.

“In 2021, it is possible that the list of $3 million plus suburbs will again double, primarily because much stronger conditions are expected for the residential market.”

The report found that investors will return to the market and they will focus on regional Australia which will again to outperform the rest of the country.

While views per listing on realestate.com.au jumped 16 per cent in capital cities during the second half of 2020, the increase in regional Australia was 44 per cent.

Government initiatives supported played a key role housing sector’s performance last year with only 71 distressed listings on realestate.com.au in 2020, compared to 98 in 2019.

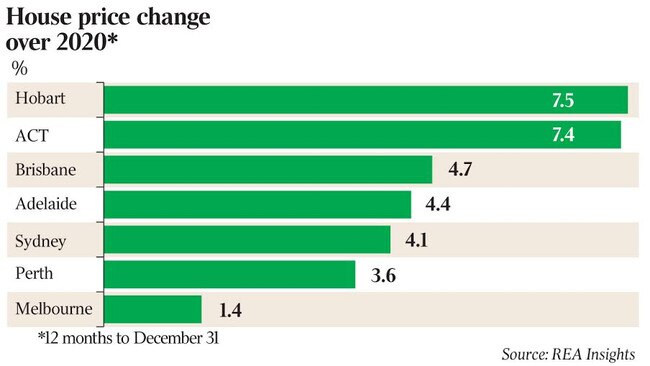

At a state-based level, the ACT continues to lead the charge in terms of growth in views per listing. Demand is lagging in Victoria, most likely driven by the prolonged lockdown during the measurement period.

Nerida Conisbee, realestate.com.au Chief Economist and REA Insights Property Outlook Report 2021 author, said many of the themes and momentum they saw towards the end of last year will continue in 2021.

“Brisbane is experiencing strong conditions, as is the Gold Coast and Sunshine Coast. Greater certainty on interstate borders will help population growth and housing demand,” she said.

Interest in Australian property offshore climbed in 2020 with searches from the top seven

most active countries increasing 13 per cent year-on-year.

The biggest jump in searches was from the US at 57 per cent, likely driven by the political and economic uncertainty, as well as skyrocketing COVID-19 cases.

Hong Kong followed at 17 per cent, also impacted by political upheaval. Third highest was Singapore at 15 per cent.

Meanwhile, interest from China in Australian property continued to plummet, dropping by 39 per cent over the past 12 months.

Originally published as REA Insights Property Outlook Report 2021 finds interest surges for West End apartment projects