Worried investors reassured after family feud splits $1.3bn Sentinel Property Group

Investors have been assured a family feud at the top of one of Queensland’s largest property fund managers will not affect their stakes.

QLD Business

Don't miss out on the headlines from QLD Business. Followed categories will be added to My News.

Worried investors concerned over the impact of a bitter family dispute that split one of Queensland’s largest privately owned property funds management businesses, have been reassured that their multimillion-dollar investments remained unchanged.

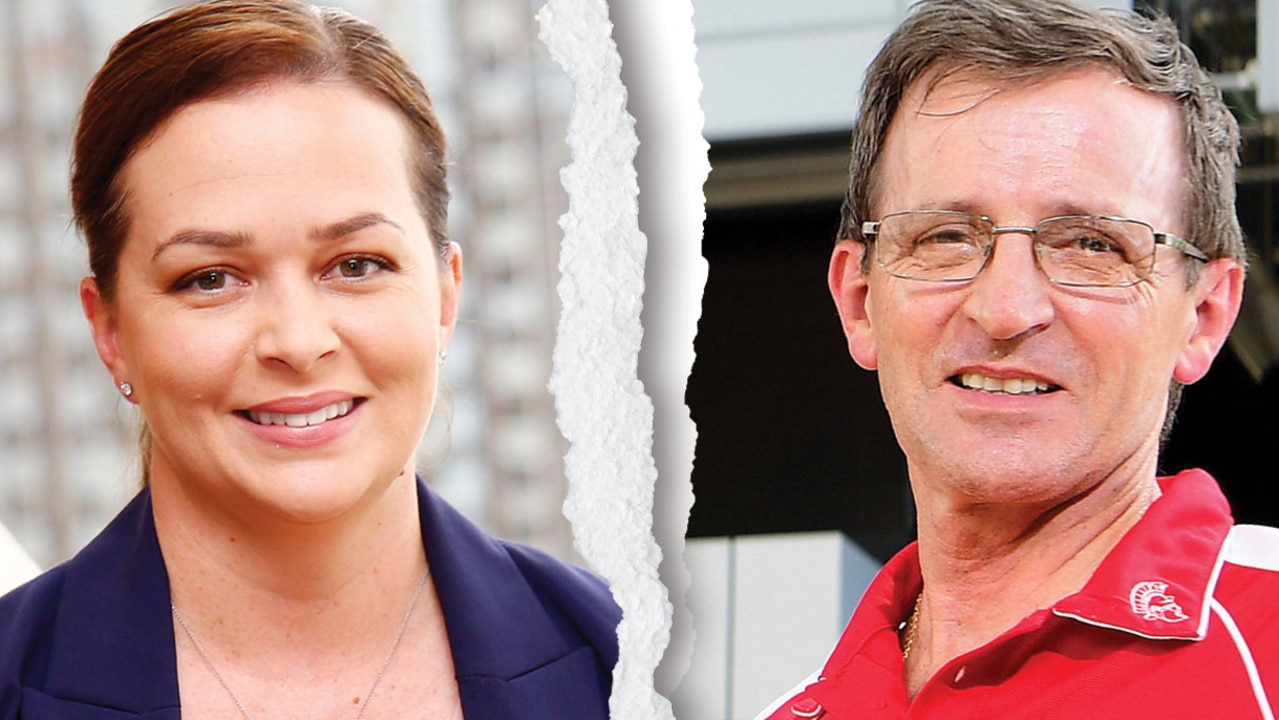

Warren Ebert, who founded Sentinel Property Group 11 years ago and built it into a company with more than $1.3 billion in funds under management, said he was disappointed over the dispute with his chief executive daughter Stacey Jones.

In the split, Mr Ebert keeps SPG which will manage nine funds with assets worth around $550m while Ms Jones through the umbrella company Sentinel Group Australia (SGA), will keep the remainder of the portfolio under management — six property trusts and two other investment vehicles — and 82 staff including 11 heads of department.

Ms Jones refused to comment on the relationship with her father but she said their management styles were different.

She said she told investors that their investments “remained unchanged”.

“They just wanted some comfort. The business had been marketed as being very dependent on Warren and he definitely has many strengths but it's a very large team and it brings comfort to them to know that we have that in-house capability to perform all functions,” she said.

“I think it’s now a good opportunity to bring in different ways of thinking that in the past we may not have looked at.”

In a note to investors, Mr Ebert said he owned 100 per cent of SPG “contrary to the statement by SGA’s CEO, Stacey Jones, I am not leaving the group to pursue separate business interests”.

“I can also assure you that I am not planning to retire, I have never been busier and am still enjoying doing deals.

“My focus has always been to deliver for all our investors, who are highly valued, and to achieve the best possible results for your investments. Over the past 11 years since Sentinel started operations, we have purchased more than $2 billion worth of assets and achieved an IRR (Internal Rate of Return) of 23 per cent for retail and more than 20 per cent for all assets.”

Mr Ebert said of the 740-plus investors with Sentinel he has spoken directly to 30 to 50.

“Most calls I am getting are from people asking if I’m OK, what can we do to help?” he said.

“We don’t have institutional investors. We have individuals and most have my phone number and they’re happy with Sentinel Property Group and its business.”

He refused to comment on his relationship with his daughter other than to say the situation was “very disappointing”.

“It’s certainly not something I wanted or planned. I have a very successful business. I have a great team and will keep doing what I have done to deliver great returns to investors,” he said.

“It’s sad. I took Sentinel from zero to $1.3 billion in seven years. Since then we sold $850 million of properties and bought another $900 million. I’ve done all of that, she hasn’t.

“People ask if I’m having a bad day. I’ve had worse I can tell you. I am now at peace and I know what I have to do.”

Mr Ebert said as well as $550 million in assets under management he will also take about 30 key staff with him when he moves to 260 Creek St in the CBD by the end of the year including chief financial officer Scott Tynan, chief marketing officer Michael Sherlock and general manager — capital acquisitions, Tim Kent.

He said they currently have 11 deals in the pipeline worth more than $600 million.

Ms Jones said they wanted to recruit a head of acquisitions but in the short-term they were “bedding down” the portfolio.

“I don’t think its appropriate to be looking at acquisitions from day one. I want to make sure we are a 100 per cent across everything that needs to be done so when we do make a decision to move forward into acquisitions the rest of the portfolio is in the best position is can be,” she said.