Jirsch Sutherland’s Michael Chan warns of insolvency cliff looming with a ‘perfect storm’

A ‘perfect storm’ of interest rate rises and cost of living increases could see a spike in insolvencies similar to past downturns.

A “perfect storm” of interest rates increases along with the cost of living and pay rises failing to keep pace with surging inflation will potentially generate a wave of insolvencies across Australia, warned a leading insolvency and turnaround solutions specialist.

Michael Chan – Jirsch Sutherland principal and personal insolvency specialist – said history could be about to repeat itself with a personal and corporate insolvency cliff looming.

He warned that “mum and dads” and retail and hospitality businesses were likely to bear the brunt just like with past economic crises.

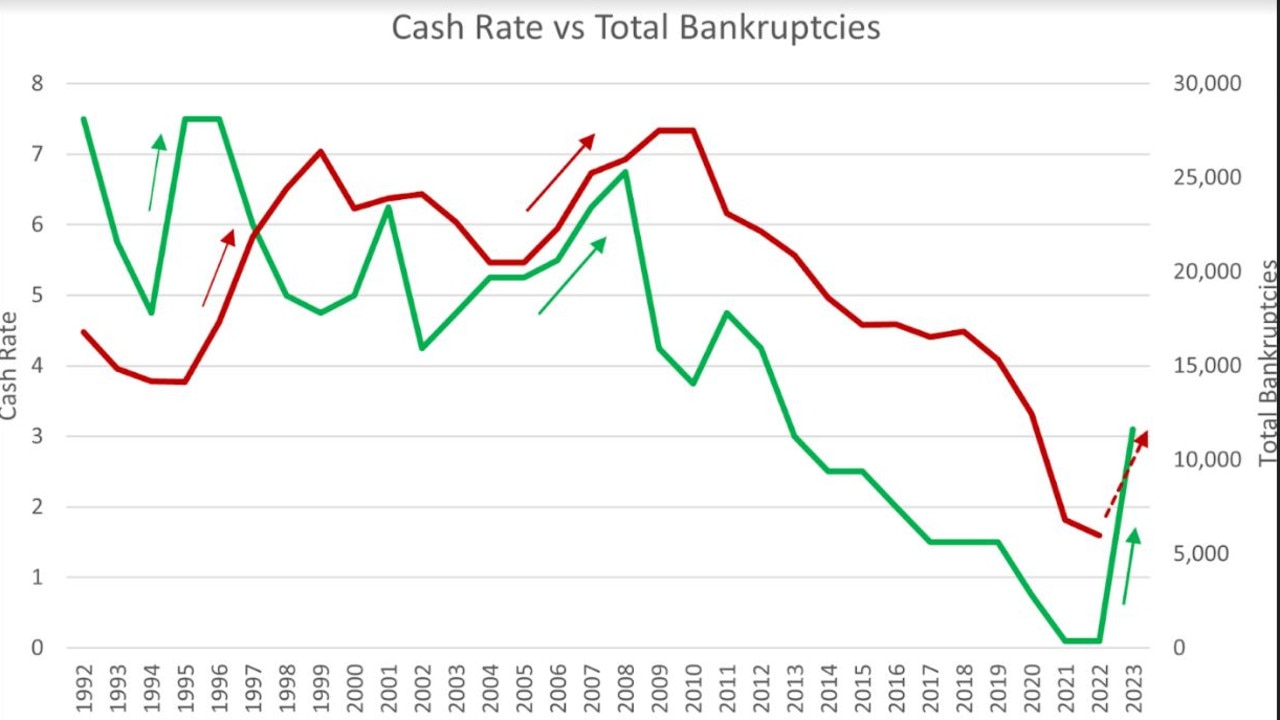

“The perfect storm is brewing. When rising interest rates are coupled with inflationary pressures, past trends have shown a corresponding rise in bankruptcies,” he said.

“There are distinct correlations: there was a sharp economic slowdown in the mid-90s (following the 1991 recession) when the cash rate and bankruptcies rose simultaneously. Bankruptcies and the cash rate were almost in lock-step during the 2007-2008 GFC and it’s a similar situation now.

“And while bankruptcy numbers are currently still stable and homeowners still have some savings, cracks are appearing.

“For example, staff cuts and recession warnings are more prevalent, the tax man is lurking and regulators are getting ready. We are already seeing a definite increase in corporate insolvencies and believe personal insolvencies will follow.”

The Reserve Bank of Australia on Tuesday lifted interest rates for the ninth time in a row by 25 basis points to cash rate of 3.35 per cent which is a 10-year high.

Sydney-based Mr Chan said similar to the GFC homeowners be impacted including those who bought an investment property.

“We are looking at what has happened in the past and back in the 2008 era we had mums and dads who invested in property and when the interest rates rose their rental income was not sufficient to cover the mortgage repayments and they fell behind,” he said.

“The big difference from 2008 for homeowners and investors is that property prices are now significantly higher. We are coming off record low interest rates and depending when you bought your property you may be able to build up a savings buffer.

“For those who bought in the last couple of years at the peak they won’t have that buffer and also when they calculated their repayments they didn’t factor in the rise in the cost of living and that’s where it will cause the most pain.”

Mr Chan said the perfect storm will also hit retail and hospitality based businesses whose income will be reduced because of less discretionary spending with cost of living increases.

“The greatest impact will be in Sydney and Melbourne which traditionally has the most insolvencies,” he said.

“We saw how zombie companies emerge during the Covid-19 pandemic with government incentives and creditors are now becoming more aggressive in debt collection.”

Mr Chan urged consumers and business owners to do a financial health check to determine their position and to seek help immediately if there were issues.

“Financial distress can sometimes take you by surprise,” he said.

“The cost of living is increasing so quickly that even if you’re currently employed, you might not be able to service your debts. Having a job doesn’t mean you’re not at risk of bankruptcy.

“And there are other pressures to take into consideration with the value of homes falling so rapidly, it might put homeowners into a negative equity position, not to mention people falling off the fixed-rate cliff when they revert to sharply higher variable rates.

“We don’t recommend sticking your head in the sand and doing nothing.”