Forrest links up solar power deal in Qld to supply hydrogen project

Andrew Forrest’s Fortescue Metals will buy solar power from Genex as the mining billionaire bolsters his already substantial renewables portfolio.

QLD Business

Don't miss out on the headlines from QLD Business. Followed categories will be added to My News.

Mining rich-lister Andrew Forrest’s Fortescue Metals has signed a 25-year offtake deal with Genex Power’s planned solar project in Queensland as the billionaire bolsters his already substantial renewables portfolio.

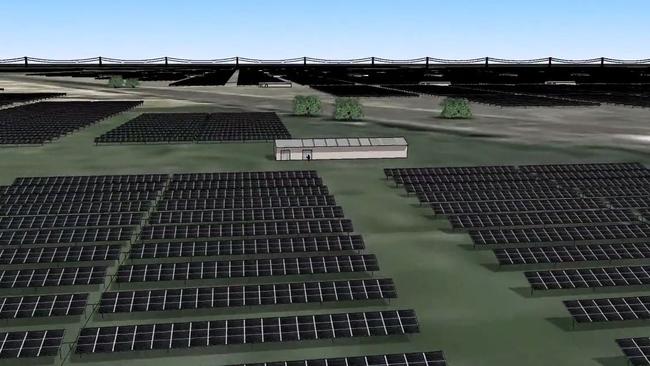

Under the deal, Fortescue will take up to 337.5MW from Genex’s Bulli Creek Solar and Battery Project (BCP) near Toowoomba on the Darling Downs to underpin its Gibson Island green hydrogen and ammonia project.

The news sent Genex shares 10.3 per cent, or 1.5c, higher to 16c on Monday.

The project, which could cost up to $600m to build, is being developed by Genex in partnership with Japan’s Electric Power Development Co (JPower). JPower also is helping Genex develop the Kidston Clean Energy Hub west of Townsville.

Genex chief executive Craig Francis said the deal marked a major milestone, not only for Genex, but for the Australian energy transition to renewables.

Mr Francis said Genex acquired the Bulli Creek project in August 2022, initially envisioning a stand-alone battery energy storage system as a first stage for the project.

However, securing the long-term offtake agreement with Fortescue had reshaped the first stage of the project into a large-scale solar farm. Bulli is located close to the power connector linking Queensland and New South Wales, making it ideal for thes solar project.

“Genex and J-Power anticipate the agreement with Fortescue will underpin a solar farm capacity of 450MW, with the long-term nature of the agreement highly attractive” said Mr Francis. Genex is also developing the Kidston Clean Energy Hub, which includes pumped hydro, solar and wind generation. Kidston has cost almost $800m and has been a decade in the making but could presage a new wave of investment in big ticket hydro energy projects.

Mr Forrest is not the only rich-lister that has expressed an interest in Genex recently. A consortium led by Atlassian co-founder Scott Farquhar last year dropped its proposal to buy Genex for $346.3 million. Mr Francis declined to comment on the proposal. Genex is the only pure-play renewable energy and storage firm listed on the Australian Stock Exchange.

Mr Forrest’s Squadron Energy last year beat a long list of renewable energy investors and heavyweight pension funds to buy CWP Renewables, the country’s largest renewable energy generator, for $4bn. Fortescue intends to utilise the solar energy from Bulli Creek for its planned hydrogen and green ammonia facility at Gibson Island at the Port of Brisbane.

Gibson Island is one of five green hydrogen projects in Fortescue’s global pipeline. It also plans to begin production of Australian-made hydrogen electrolysers at a new Gladstone factory in Queensland later this year.

Mr Forrest said Australian industries’ ability to consign “fossil fuel to history” is robustly demonstrated by the strong track record and commitment of Fortescue Metals, Fortescue Future Industries and other world-leading companies committed to decarbonisation,

Mr Francis said there were ongoing discussions with other parties for further solar offtake at Bulli Creek to increase initial capacity to up to 775MW, making it the largest grid-connected solar farm in Australia. “We are extremely pleased to be working with Fortescue and supporting their plans for a large-scale electrolysis plant at Gibson Island,” said Mr Francis.

“We anticipate this will help pave the way for a significant and prosperous green hydrogen and ammonia industry in Australia,”

He added that having Fortescue involved in the deal would “create comfort in securing debt financing.” “The long-term nature of the agreement is very important,” he said. “Bulli Creek has been talked about for a while but previously there was subdued offtake demand for solar in Queensland. Now that has changed as these big corporates move into renewables or in this case to underpin a green hydrogen project.”

The project is currently in the pre-construction stage with the first stage targeted to reach a final investment decision next year with first energy production targeted in 2026.

More Coverage