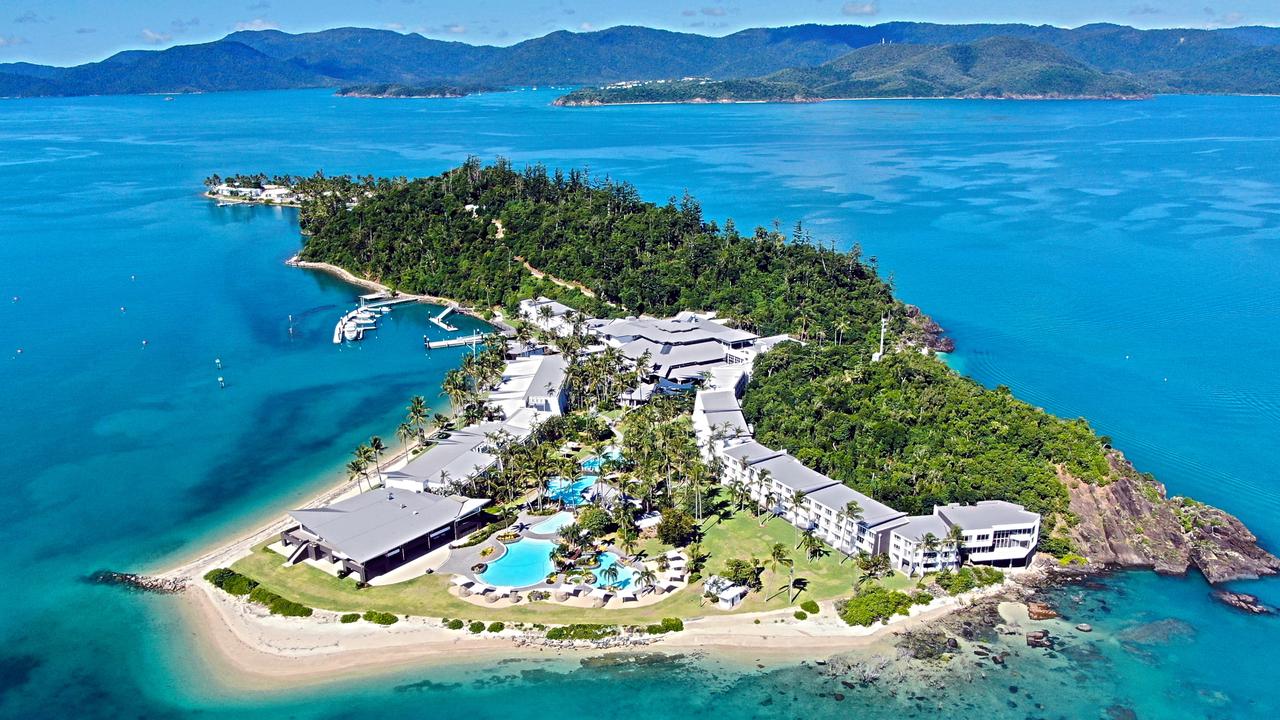

Daydream Island owner, China Capital Investment Group, is set to put the resort on the market

The Chinese owner of one of the island jewels in the Whitsundays is preparing to put the resort back on the market, six years and a $100 million revamp after buying it. Here’s what they’re asking.

QLD Business

Don't miss out on the headlines from QLD Business. Followed categories will be added to My News.

While Australian holiday-makers and investors have rediscovered some of Queensland’s most iconic island resorts the Chinese owner of one of them has been quietly putting feelers out to potential buyers.

Sources says Daydream Island’s owner, China Capital Investment Group, has been in talks about the chances of offloading the resort in the Whitsundays.

Daydream Island is one of many of Queensland’s most recognised offshore resorts that are in foreign hands including Lizard Island, Heron Island, Wilson Island, Hayman Island, Lindeman Island and South Molle Island.

CCIA bought Daydream Island in 2015 after then owner Vaughan Bullivant dropped his asking price from $65m to $30m.

They have spent least $100m refurbishing it, and industry sources say they are looking to sell the island for between $140m and $150m.

It is understood CCIA is preparing to formally take it to the market.

With Australians holidaying at home, many resorts are reporting above average occupancy rates.

CBRE Capital Markets, Hotels director Tom Gibson refused to comment on the future of Daydream Island however he said it was a “unique time” in the industry.

He said Queensland island resorts have a long history of attracting offshore investors given their raw beauty and appeal to international tourists.

“Australia has also always been regarded as an investment safe-haven given our macro-economic stability, though has been amplified more recently through our positive handling of COVID,” he said.

However, Mr Gibson said with the continued international border closures, the resort islands are being pursued by domestic investors seeking escape-style investments that are pandemic-resilient.

Last year hospitality Sydney-based baron empire-builder Justin Hemmes and Caledonia chairman Mark Nelson bought a large slice of the exclusive Haggerstone Island.

Sources say Sydney-based Oscars Hotel Group will pay close to $20m to purchase Long Island in the Whitsundays.

It is understood the sale of Dunk Island was nearing completion to an Australian buyer while the campaigns to sell Keppel Island and Pumpkin Island have largely caught the attention of locals.

Mr Gibson said there were record amounts of domestic and offshore capital looking to be invested, though there are limited hotel deals available to pursue as owners have been supported through government incentives such as JobKeeper and bank grace periods during the pandemic.

“The dislocation for deal availability has been attributed to owners reverting back to their core businesses — often non-hotel related,” he said.