BHP promises to reinforce safety culture following Luke O’Brien’s death at Saraji

Mining giant BHP has put its ‘Queensland tax’ at 62 per cent for the half year, making future investment ‘risky’ as it pledges to reinforce its own safety culture following the death of a miner crushed at its Saraji mine.

QLD Business

Don't miss out on the headlines from QLD Business. Followed categories will be added to My News.

Mining giant BHP has doubled down on threats it will not invest in further growth in Queensland labelling the state as “unattractive and risky” on the back of a 62 per cent tax rate at the half year.

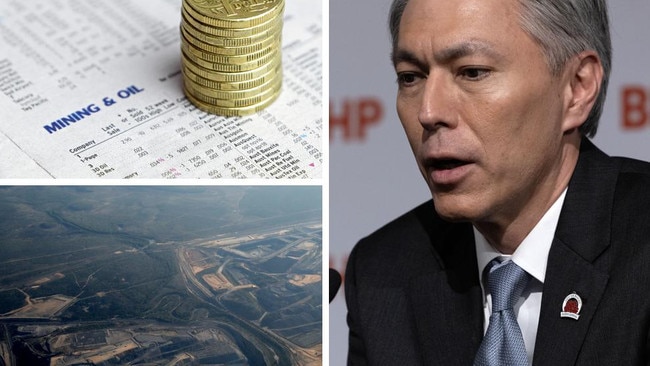

BHP chief executive Mike Henry said the company was also redoublings its efforts to reinforce safety culture following the death of Luke O’Brien, who was fatally crushed after he was pinned between a ute and B Double tanker at Saraji mine on January 15, 2024.

“We have an investigation under way into what went wrong,” Mr Henry said.

“Above all else it is simply not acceptable if anyone is being seriously injured or worse at work and we’re redoubling our efforts to reinforce our culture and controls when it comes to safety.”

BHP’s half year financial results, released to the Australian Stock Exchange on Tuesday, revealed the company’s underlying attributable profit as at December 2023 was $US6.6bn and had an interest dividend of 72 US cents per share.

However it was a tough first half of the year for its coal mining portfolio that was met with various challenges including more planned maintenance, extended longwall move at Broadmeadow, low inventory to start the year due to rain impacts in prior year, and heavy storms to end the half.

As a result production was down 17 per cent.

Mr Henry said the future lay in demand for higher-quality metallurgical coals, which he expected to be increasingly reflected in the price of coal.

“Over the past five years, the average price discount for hard coking coal, relative to premium hard coking coal was approximately 12 per cent,” he said.

Over the past few years BHP has moved to upgrade its coal portfolio to concentrate on higher quality coals culminating in October with the divestment of Blackwater and Daunia mines from its BMA joint venture for up to US$4.1 billion.

“Following completion, over 85 per cent of our metallurgical coal products will be premium hard coking coal – versus only half when we began this journey,” Mr Henry said.

“BMA is a leading global producer of these coals and our customer base is growing. More than 40 per cent of our met coal goes to India today, and the Indian government is targeting to more than double steel production capacity by 2030.

“Factoring in that BMA owns its own port, located a relatively short distance from its mines, its ability to blend coals and its proximity to customer markets we are well-positioned over the long term.”

However, Mr Henry said, Queensland extremely high royalties combined with income taxes – which equated to a tax rate of 62 per cent – made the state “so unattractive and risky compared to our other investment opportunities that we simply cannot allocate any growth capital to this state”.

“Given the negative impact on investment economics resulting from the change in coal royalty rates, and the increase in sovereign risk due to the decision to raise royalties without consultation, we will not be investing in any further growth in Queensland, however we will sustain and optimise our existing operations,” Mr Henry said.