Beston Global Food Company directors face public examination into $72m collapse

Directors of failed dairy firm Beston Global Food will face the music in court, with liquidators pushing ahead with a public examination into its $72m collapse.

QLD Business

Don't miss out on the headlines from QLD Business. Followed categories will be added to My News.

The directors of failed cheese and milk producer Beston Global Food Company will face the music in court in the coming weeks, with liquidators pushing ahead with a public examination into the company’s dealings leading up to it $72m collapse.

The latest report from liquidator Tim Mableson of KPMG reveals a public examination of Beston’s directors, and former directors and employees, will be held in the Federal Court in July or August, as part of an investigation into potential insolvent trading claims and unfair and uncommercial transactions that could be recovered for creditors.

According to the report, dairy farmers and unsecured creditors owed $18.8m will be relying on those recoveries for any repayment of the money they’re owed, given secured creditor NAB is facing a significant shortfall on its $52.6m claim over the company’s assets.

NAB has been repaid more than $11m from asset sales so far – or 21 cents in the dollar – but liquidators have warned the final dividend to the bank is only expected to rise to a maximum of 50 cents in the dollar

Remaining asset sales – including Beston’s dairy factory and rural landholdings near Tailem Bend – are expected to be finalised in the coming months.

“The proceeds from the sale of the companies’ assets will be insufficient to discharge the debt due to NAB in full,” the report says.

“As such, there will be no funds available to unsecured creditors from the realisation of the companies’ assets. A return to unsecured creditors of the companies depends on any liquidators’ recoveries that may be available and successful.

“These could take many months and even years to finalise from the liquidation date.”

Mr Mableson has previously told creditors that early investigations had identified potential unfair preference payments and other voidable transactions in excess of $7.4m, and that it was his opinion the company was likely insolvent “from at least April 4, 2024”.

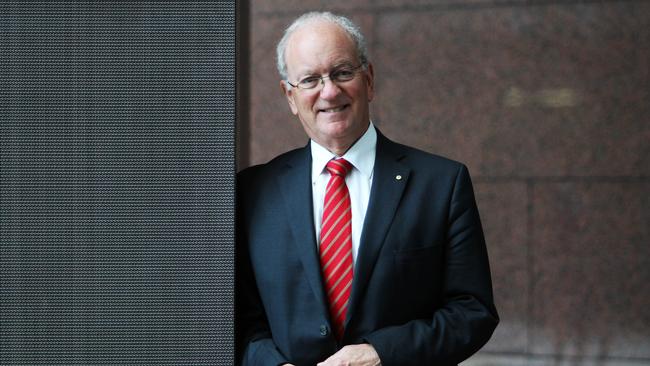

He has also flagged an investigation into director-related transactions relating to the company’s former structure, dismantled in 2021, under which directors Dr Roger Sexton and Stephen Gerlach managed the executive functions of Beston via a vehicle called BPAM which was paid a management fee.

Dr Sexton has previously said there was no credence to the suggestion the claim could successfully be pursued, saying the directors had always taken independent legal and financial advice, and the transactions with BPAM were set out in the prospectus and approved by shareholders.

A court examination will help the liquidators determine a date of insolvency and the merits of pursuing insolvent trading and voidable transaction recoveries.

“The liquidators will utilise the information obtained from the production of documents and public examination in order to further their investigations into the affairs of the companies,” Mr Mableson’s report says.

“This includes their investigations into voidable transactions and insolvent trading.”

Beston, which listed on the ASX in 2015, fell into liquidation in February, after former directors failed to mount a convincing rescue campaign for the business. It had struggled for years under the weight of high energy, transport and operating costs, and due to the poor operational performance of its main cheese and whey powder business.

The operations were wound down in early December with the loss of about 150 jobs, mainly in the dairy sector in South Australia.

Last month the state government announced a $3m fund to support dairy farmers affected by the collapse.

Originally published as Beston Global Food Company directors face public examination into $72m collapse